1426238504__capital_budgeting

advertisement

Capital expenditure Decisions

Session 1

Meaning

• Corporate finance is strategic in nature and can be viewed

from three angles

– How a firm finances its investments ( capital structure

decisions)

– How it manages short-term financial requirements (working

capital decisions)

– The allocation of funds (capital expenditure decisions)

Capital expenditure Decisions

•Is the process of making investment decisions in capital expenditure.

•It is long term planning for making and financing proposed capital outlays.

•It is concerned with the allocation of the firm’s scarce financial resources

among the available market opportunities

•These involve selecting the best from various mutually exclusive projects

that require current outlay of funds in the expectation of future stream of

benefits extending far into future

– Outlay means outflow or investment

– Benefits mean inflows or income generating out of the investment

Features

Require long term commitment of funds

Has long term effect on profitability

substantial outlays

Difficult and expensive to reverse

Difficulties of Investment decisions because

Decision extends to a series of years beyond the

current accounting period

Uncertainties of future

Higher degree of risk

Overall objective is to

• maximize the profitability of a firm or the return on

investment

(Either by increasing revenue or decreasing the costs)

Types

Examples

Mandatory investments

Replacement Projects

Expansion Projects

Diversification Projects

Research and

Development Projects

• Miscellaneous Projects

•

•

•

•

•

Grouping

• Accept/ Reject

• Mutually Exclusive

Project Decisions

• Capital Rationing

Decisions

Steps

• Identification of Potential Investment Opportunities

• Assembling of Investment Proposals

– Replacement, Expansion, New Product, Obligatory and welfare

•

•

•

•

Decision Making

Preparation of Capital Budget and Appropriations

Implementation

Performance Review

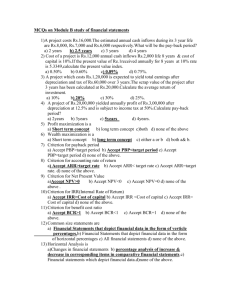

Project evaluation Techniques

Evaluation

Techniques

Tradition

al

Pay back

period

ARR

Modern

NPV

BCR

IRR

ACC

TRADITIONAL METHODS –

Pay Back period

• Pay back period means the length of time required to

recover the initial cash outlay on the project

• The shorter the payback period, the more desirable the

project is

• Seen under two situations

– Projects with EVEN CASH FLOWS

– Projects with UNEVEN CASH FLOWS

• Accept/reject criteria: accept the project with shorter

payback periods

• For even cash flows

Pay back period =

Cash Outlay

Annual cash inflows

• For uneven cash flows ( if the outlay is 1,00,000)

Y

Cash inflow of A

Cash inflow of B

1

50,000

20,000

2

30,000

20,000

3

20,000

20,000

4

10,000

40,000

5

10,000

50,000

6

-

60,000

Pay back period of A = 50+30+20 = 1 Lakh

= 3yrs

Pay back period of B = 20+20+20+40 = 1Lakh

= 4 yrs

Alternatively --• Determine the cumulative cash inflows

Year

A inflow

Cum

inflow

B inflow

Cum

inflow

1

50,000

50,000

20,000

20,000

2

30,000

80,000,

20,000

40,000

3

20,000

1,00,000

20,000

60,000

4

10,000

1,10,000

40,000

1,00,000

5

10,000

1,20,000

50,000

1,50,000

6

-

60,000

2,10,000

Locate the year against which 1,00,000 appears

That is the pay back period

The project with shorter pay back period is selected, here it is A

Example

2

A project cost Rs 5,00,000 and yields annually a profit of Rs 80,000 after

depreciation @ 12% p.a but before tax and depreciation if 50%. Calculate the pay

back period.

Profit before tax & Depreciation

Less Depreciation

Profit before tax

Less Tax @ 50%

Profit after tax

Add Depreciation @ 12%on 5,00,000

= 80,000

= 60,000

= 20,000

= 10,000

= 10,000

= 60,000

70,000

Pay back period = Cost of the project = 5,00,000 = 7.14 years

Annual Cash flow

70,000

• Advantages

– Simple

– Rough and ready method to

weed out risky projects the

cash inflows of which is more

after the pay back period

– Emphasis on cash inflows so

useful for firms with liquidity

crises

– Useful while evaluating a

single project.

• Disadvantages

– Fails to consider TMV

– Does not consider projects

which generate inflows

substantially after the pay

back period

– It treats each asset/project

in isolation

– Does not measure the true

profitability as the period

considered is very short, but

the life of the asset/project

is very long

– Does not take cost of capital

into consideration

Improved pay back period methods

• Post Pay-back profitability method

• Pay-back Reciprocal method

• Post-Pay back period method

• Discounted Pay-Back method

• Post Pay-back profitability method

Step 1 Calculate Post Pay back profitability

= Annual cash inflow ( Estimated life – Pay back period)

Step 2 Calculate Post Pay back Profitability Index

= (PPP / initial investment)*100

• Pay-back reciprocal method

= Annual Cash inflow / total investment

This is used to estimate the internal rate of return generated by a

project

• Post pay back period

The project with greatest post pay-back period is accepted

because it continues to generate revenue to the firm

Illustration

Calculate the discounted pay-back period method from

the following information

Cost of the project

Life of the project

Annual Cash Inflow

Cut off rate 10 %

= Rs 6,00,000

= 5 years

= 2,00,000

Discounted Payback method

Year

Cash

flow

Discounting

factor

Present value Cumulative discounted

Net cash flow

1

2,00,000 0.909

1,81,800

1,81,800

2

2,00,000 0.826

1,65,200

3,47,000

3

2,00,000 0.751

1,50,200

4,97,200

4

2,00,000 0.683

1,36,600

6,33,800

5

2,00,000 0.621

1,24,200

7,58,000

The outlay of Rs 6,00,000 will be recovered between the

3rd and the 4th years

Precisely = 3 years + 1,02,800

1,36,600

= 3 ¾ years

Average/Accounting Rate of Return

•

•

•

It is the average profit after tax divided by the average book value of the

investment over the life of the project

ARR =

Average annual Profit after Tax

Net Average Investment

In order to calculate profit after tax

From profit, deduct

1.

2.

3.

4.

Depreciation

Interest

Tax

Add depreciation ( As depreciation is a non-cash item )

Accept/reject Criteria: Accept Project with higher ARR

Illustration:

A project requires an investment of Rs 5,00,000 and has a scrap value of Rs

20,000 after five years. It is expected to yield profits after depreciation and

taxes during the five years amounting to Rs. 40,000, Rs. 60,000, Rs.70,000,

Rs.50,000 and Rs. 20,000. Calculate the average rate of return on the

investment.

• Total Profit = 40000+60000+70000+50000+20000 =

2,40,000

• Average profit = 2,40,000 = Rs. 48,000

5

• Net investment = Rs 5,00,000 – 20,000 = Rs. 4,80,000

• ARR = 48,000 * 100

4,80,000

= 10%

X Ltd is considering the purchase of machine. Two machines are available E

and F. The cost of machine is Rs.6,00,000. Each machine has an expected life

of 5 years. Net profits before tax and after depreciation during the expected

life of the machines are given below

Year

Machine E

Machine F

1

15,000

5,000

2

20,000

15,000

3

25,000

20,000

4

15,000

30,000

5

10,000

20,000

Total

85,000

90,000

Assume the tax rate to be 50%

Statement of Profitability

Machine E

Year

Machine F

PBT

TAX

PAT

PBT

TAX

PAT

1

15,000

7500

7500

5,000

2500

2500

2

20,000

10000

10000

15,000

5000

5000

3

25,000

12500

12500

20,000

10000

10000

4

15,000

15000

15000

30,000

15000

15000

5

10,000

5000

5000

20,000

10000

10000

42,500

90,000

85,000

Av. PAT

Av. Invt

ARR

42500/5 = 8500

60,000/2 = 30,000

(8500/30000)*100 = 28.33%

45000

45000/5 = 9000

60,000/2 = 30,000

(9000/30000)*100 = 30%

Machine F is more profitable than Machine E as the ARR is greater

Advantages

• Simple

• Based on accounting

information available

• considers the entire

life of the project

• Takes the average of

the best estimate of

profits

• Disadvantages

• Based on accounting

profit and not cash

flows

• Does not take TMV

• Does not provide any

guidance on what

target rate of return

should be

Modern methods

- Net Present Value

• Refers to the sum of the present values of all the cash

flow positive as well as negative

• That are expected to occur over the life of the project

• Since it discounts the cash flows, it is considered

better than the traditional methods

• The firms discount the cash flows at the cost of capital

estimated previously for the components of capital

involved in the project

Steps

• Compute the cut-off rate, which is the cost of

capital/minimum required rate of return for the

providers of funds

• Compute the present value of the total investment

outlay

• Compute the present value of the inflows at the cut-off

rate ( cash inflows after depreciation and taxes)

• Calculate the NPV which is PV of outflows – PV of

inflows

• accept /reject criteria: That project/asset which

generates maximum positive NPV

Illustration

If suppose a project has a life of 5 years and it requires an initial outlay of Rs 35000.

Calculate its Net Present Value. Also find whether the project is worth investing.

Year

Cash inflows

Discount factor

@10%

Discounted cash

flows

1

10000

0.909

9900

2

12000

0.826

9912

3

12000

0.751

9012

4

14000

0.683

9562

5

15000

0.621

9315

The sum of present values = 9900+9912+9012+9562+9315 = Rs 47701.

Since it is more than the initial outlay of Rs 35,000, it is worth investing in the project.

Advantages

• It recognizes the time value of

money and is suitable to be

applied in a situation with

uniform cash outflows and

uneven cash inflows or cash

flows at different periods of time.

• Takes into account the earnings

over the entire life of

asset/project

• Takes into consideration the

objective of maximum

profitability

Disadvantages

• More difficult to understand and

operate

• May not give good results while

comparing projects with unequal

lives as the project having net

present value but realized

Internal rate of return (IRR)

• It is that rate of interest at which the net present value

of a project is equal to zero

• Or it is the rate which equates the present value of

cash inflows with that of the outflows

• In NPV, the cost of capital becomes the discount rate,

in IRR, the discount rates which makes the NPV 0 has to

be worked out

• This is done usually with trial and error method

Steps to determine IRR

• Find the average annual net cash flow from the given cash flows

• Divide the initial outlay by the average annual net cash flow, the

answer is the PVIFA factor

• Look out for the interest rate against which the factor appears

for the given life of the project

• Multiply each of the cash flows by the PV values under the

interest factor found earlier, through the life of the project

• That factor for which the difference between the initial outlay and

the sum of the discounted cash flows is zero is the IRR.

• Accept/Reject criteria: Accept the project with IRR< k(

WACC)

A company has the following pattern of cash flows

Year Cash flows

( in lakhs)

0

(10)

1

5

2

5

3

3.08

4

1.20

Calculate the IRR

PVIFA =

Initial outlay

average annual cash flow

10

3.57 {(5+5+3.08+1.20)/4}

2.801

• From the PVIFA table, the interest factor corresponding to four years is

nearly 15%

• Taking the base interest as 15%, we start trial and error method

• At 15%, (-10 +(5*0.870)+(5*0.756)+(3.08*0.658)+(1.2*0.572) = 0.84

• At 16%, (-10+(5*0.862)+(5*0.743)+(3.08*0.641)+(1.2*0.552) = 0.66

• At18%, (-10+(5*0.848)+(5*0.719)+(3.08*0.609)+(1.2*0.516) = 0.33

• At 20% (-10 +(5*0.833)+(5*0.694)+(3.08*0.579)+(1.2*0.482) = 0

• So IRR is 20%

Benefit – Cost Ratio

•

•

•

•

•

•

It is also referred to as Profitability Index

BCR = PV /I

PV stands for Present value of Future cash flows

I stands for Initial investment

NCBR = BCR -1

Accept/Reject criteria : BCR>1 or NCBR>0, Accept

BCR<1 or NCBR<0, Reject

Evaluation

• The method is useful to rank • It provides no means for

a set of projects in the order

aggregating several smaller

of decreasingly efficient use

projects into a package than

of capital

can be compared with a

large project

• When the investment outlay

is spread over more than

one period, this criterion

cannot be applied.

Zeta Ltd is considering the following projects

PROJECTS

INITIAL

OUTLAY

CASH

INFLOWS

PROJEC

TS

Cf

NPV

A

20

7.5

A

7.5

(7.5*3.433)-20 =5.75

B

4.5

1.5

B

1.5

(1..5*3.433)-4.5=0.65

C

7

2.5

C

2.5

(2.5*3.433) -7 = 1.58

D

8

3.5

D

3.5

(3.5*3.433)-8=4.02

PROJECT

S

BCR

A

25.75/20

1.27

B

5.15/4.5

1.14

C

8.58/7

1.23

D

12.02/8

1.50

Annual Capital Charge

• Used for evaluating mutually exclusive projects or

alternatives which provide similar service

• Steps

•First determine the PV of the initial investment and operating costs

using the cost of capital (k) as the discount rate

•Then, determine PVIFA using (k,n) in the table

•Divide the PV of the cash flows by the PVIFA, the answer is annual

capital charge

•Accept/Reject criteria: Accept the project/asset

with lesser Annual Capital Charge

Illustration