Chapter 21

advertisement

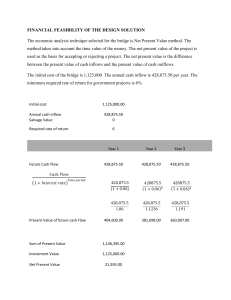

AMIS 525 Pop Quiz – Chapter 21 1. Three potential investment projects (A, B, and C) at Nit Corporation all require the same initial investment, have the same useful life (3 years), and have no expected salvage value. Expected net cash inflows from these three projects each year is as follows: A B C Year 1 ........ $1,000 $2,000 $3,000 Year 2 ........ $2,000 $2,000 $2,000 Year 3 ........ $3,000 $2,000 $1,000 What can be determined from the information provided above? A) B) C) D) the net present value of project C will be the highest. the internal rate of return of projects A and C cannot be computed. the net present value and the internal rate of return will be the same for all three projects. both A and B above. 2. (Ignore income taxes in this problem.) Given the following data: Cost of equipment ............. Annual cash inflows .......... Internal rate of return ........ $55,750 $10,000 16% The life of the equipment must be: A) B) C) D) it is impossible to determine from the data given 15 years 12.5 years 5.75 years 3. (Ignore income taxes in this problem.) Heap Company is considering an investment in a project that will have a two year life. The project will provide a 10% internal rate of return, and is expected to have a $40,000 cash inflow the first year and a $50,000 cash inflow in the second year. What investment is required in the project? A) B) C) D) $74,340 $77,660 $81,810 $90,000 1 Use the following to answer questions 4-5: (Ignore income taxes in this problem.) Vandezande Inc. is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are: Year 1 ...... Year 2 ...... Year 3 ...... Year 4 ...... Year 5 ...... Incremental net operating income Incremental net cash flows $54,000 $128,000 $31,000 $105,000 $52,000 $126,000 $49,000 $123,000 $48,000 $122,000 4. If the discount rate is 10%, the net present value of the investment is closest to: A) B) C) D) $370,000 $457,479 $234,000 $87,479 5. The payback period of this investment, rounded off to the nearest tenth of a year, is closest to: A) B) C) D) 2.9 years 4.9 years 3.1 years 5.0 years 6. Dunn Construction, Inc., has a large crane that cost $35,000 when purchased ten years ago. Depreciation taken to date totals $25,000. The crane can be sold now for $6,000. Assuming a tax rate of 40%, if the crane is sold the total after-tax cash inflow for capital budgeting purposes will be: A) B) C) D) $8,400 $12,000 $7,600 $10,000 2 7. Hawkeye Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $60,000. The new machine will cost $200,000 and an additional cash investment in working capital of $60,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $50,000 in additional cash inflows during the year of acquisition and $150,000 each additional year of use. The new machine has a threeyear life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life. What is the net present value of the investment, assuming the required rate of return is 10%? Would the company want to purchase the new machine? a. b. c. d. 8. $82,000; yes $50,000; no $(50,000); yes $(82,000); no The Alpha Beta Corporation disposes a capital asset with an original cost of $85,000 and accumulated depreciation of $54,500 for $25,000. Alpha Beta's tax rate is 40%. Calculate the after-tax cash inflow from the disposal of the capital asset. a. b. c. d. $2,200 ($2,200) $27,200 $31,500 3