Intermediate Finance – Exam II

advertisement

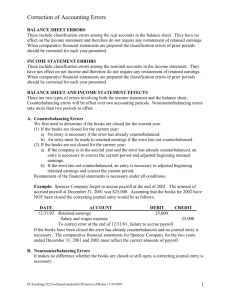

Intermediate Finance – Exam II Multiple choice (3 points each.) 1. How much would you be willing to pay for a share of ABC Corp. stock if it just paid an annual dividend of $2.00 per share and has a long-term growth rate of 5%? Your required rate of return on the stock is 15%. a. $20.00 b. $10.00 c. $10.50 d. $21.00 e. no solution 2. What is the return on equity of O&J Corp. if they just paid an annual dividend of $1.50, have a long-term growth rate of 10%, and their current stock price is $12. a. 23.75% b. 22.50% c. 21.60% d. 15.125% e. 10% 3. The investment opportunity schedule shows: a. the marginal cost of capital for every project in descending order b. the weighted cost of capital for every project in ascending order c. the weighted cost of capital at every breakpoint d. the IRR of every project in descending order e. the NPV profile of a project and its IRR 4. The retained earnings breakpoint shows: a. the point at which the NPV crosses the horizontal axis b. the amount of accumulated depreciation expensed on an old piece of equipment c. the amount of money that can be spent on capital projects before retained earnings are used up d. the total capital budget for a company with no retained earnings e. the capital expenditures at which a company’s cost of capital will decrease 5. Increased depreciation expense from a new piece of equipment results in a cash inflow because: a. the new equipment increases revenue b. the tax break from increased depreciation causes an inflow c. the new equipment’s depreciation is offset by the net operating cash flow d. depreciation doesn’t affect cash inflow only changes in revenues and operating expenses do e. increased depreciation expense doesn’t result in a cash inflow, it causes a cash outflow Problems. 1. (15 points) Comodo Industries can issue new bonds for 9%. Their earnings per share has been as follows: Year EPS 1995 $1.35 1996 1.50 1997 1.85 1998 2.05 1999 2.28 Their payout ratio is 30% and their common stock currently sells for $35. Comodo’s tax rate is 40%. Their capital structure is as follows: Debt Equity (100,000 shares) $750,000 250,000 $1,000,000 Calculate the company’s cost of capital. Show all work. (Remember when calculating g, the PV # goes into the calculator as negative.) Calculate the company’s retained earnings breakpoint. 2. (20 points) A project has the following cash flows: year 0 1 2 3 Cash Flow $- 43,000 19,000 20,000 12,000 The discount rate is 12%. Calculate the following (Show work for MIRR.) a. Payback = _____________________ b. NPV = _______________________ c. IRR = ________________________ d. MIRR = ________________________ 3. (Replacement problem – 35 points) Terry’s Hamburgers is considering replacing their old Frosty Ice Cream machine with a new Softee Ice Cream machine that can make five different flavors of softees. The old machine was purchased 3 years ago for $29,000 and has an expected life of 6 years and salvage value of $5,000. The old machine was depreciated using the straight-line method and has three years of depreciation left. The old machine could be sold today for $12,500. The new Softee Ice Cream machine has a purchase price of $45,000 and will cost $2,000 to install. It has an expected life of 3 years and will be depreciated using 5 year MACRs (20%, 32%, 19%, 12%, 11%, 6%). If the new machine is purchased, cleaning materials and spare parts totaling $1,400 will have to be purchased. At the end of 3 years, the machine has an expected salvage value of $10,000. The new machine is expected to increase revenues by $14,000 per year and decrease operating expenses by $5,600 per year. Terry’s current tax rate is 40%. The company’s cost of capital is 10%. Clearly show the incremental cash flows that result from purchasing the new machine. What is the NPV? Should Terry purchase the new Softee machine? 4. (15 points) When analyzing two mutually exclusive projects, the NPV and IRR methods can recommend different projects. Graphically show and explain how this can happen. In what cases is this likely to occur? If a conflict occurs, which method is preferable and why?