The US Health Care System is too expensive, wildly variable, with

advertisement

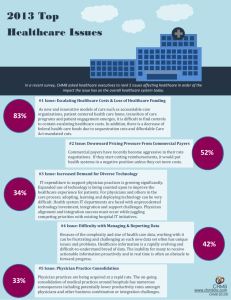

The Changing Market Over the past 6-8 months, there has been significant movement in the healthcare market, both nationally and locally • Supreme Court upholds the Affordable Care Act • Medicare Shared Savings Program launches, increasing proliferation of ACOs nationally and in North Carolina • Market consolidation across providers, payers, and enablement companies continues to move forward Summary of the Supreme Court Ruling on PPACA • The individual mandate is unconstitutional • The associated penalty for not buying insurance is constitutional • The expansion of Medicaid is constitutional, but the threat to terminate existing Medicaid is not The Supreme Court’s decision to uphold the ACA reinforces strategic activities underway across sectors of health care Continued shift to retail and consumerism • Public exchanges set to open in 2014 • Private exchanges are taking root • Employers will look to defined contribution models Continued migration to value based models • CMS funding and reimbursement reforms will continue to stimulate the shift to Fee for Value (FFV) • The value-based trend has developed independent momentum with commercial insurers and employers • Budgetary pressures will force governments to find innovative ways to control healthcare spending Continued transformation of healthcare to an information business • PPACA (along with the earlier 2009 stimulus bill) have already funneled billions into EMRs; adoption rates are past a tipping point • New business models built around information enablement services are emerging, and will fundamentally change the healthcare ecosystem Through MSSP and private sector activity, the shift to Accountable Care arrangements is now in progress across the country U.S. Primary Care Markets with Access to ACOs Legend Public Private Both Over 40% of the US population lives in markets with at least one ACO arrangement Within the North Carolina market, there are several organizations beginning the move to value Simultaneously, market consolidation among providers, payers, and enablement companies has continued Consolidation is a rampant trend across the healthcare marketplace • Reports of hospital acquisition of physicians come out almost daily • Hospital consolidation is also a growing trend • Payers and enablement companies are also becoming increasingly more involved in these transactions • DaVita, a leading provider of kidney care services, acquired HealthCare Partners for $4.42B. 1MM patients under management • WellPoint acquired CareMore, a senior care provider group, for ~$800MM • Highmark acquired West Penn Allegheny Health System for ~$400MM • Independence Blue Cross, Highmark, Horizon, and Lumeris acquired NaviNet, the country’s largest real-time communication network for physicians, hospitals, and health insurers, for an undisclosed amount • Carolinas HealthCare System took over management of Moses Cone Health System for in a deal with undisclosed terms • WellPoint acquired Amerigroup Corp, a provider group focused on the Medicaid population, for $4.46B • BCBS Michigan, WellPoint, and HCSC invested in Bloom Health to create a national private exchange The U.S. Health Care System is too expensive, wildly variable, with lower than desired quality and outcomes. Here is where we are headed: • There will be continued downward pressure on health care providers to control costs while improving quality of care provided. High Quality Low Cost VALUE • Fee-for-service reimbursement will be continually subject to reductions in fees, external efforts to control utilization, and scrutiny of care provided. • Favorable reimbursement will be shifted to those providers able to demonstrate value through providing high quality care at the lowest cost. The healthcare delivery system model will change across several key dimensions Volume Based Value Based FFS/DRGs No payment for readmits, never events, etc. Outcomes & Quality based Global payments Organizational model Departmental Populations Conditions Focused factories Value drivers Volume Efficiency (on a procedure level) Quality and low variability Efficiency (on a population level) Profit pools Visits Surgery / Procedures Outpatient ancillary Wellness and prevention Population management Chronic condition management Investments Capacity Revenue-producing assets Patient referrals Health IT Clinical integration Commercialization Reimbursement