WELLPOINT,INC. Ticker: WLP

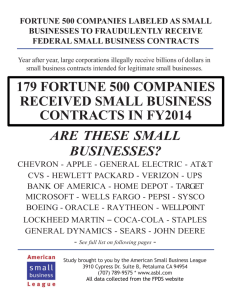

advertisement

WELLPOINT,INC. Current Price: $35.60 (as of 11/28/08) Ticker: WLP Target Price: $49.75 Recommendation: Buy Analyst Information: Name: Robert Lazarony Email:Lazarony.3@osu.edu Phone: (216)272-7421 Advisor: Chris Henneforth, CFA Fund: SIM (Bus-Fin 724) Recommendation Summary: • • • • • Stock Information: WellPoint is well positioned within the industry, holding the largest customer base of any managed care organization in the nation. Demographic trends show increases in both population age and obesity-this can be looked at as both a positive and a negative: o Increase in the amount of citizens who will need healthcare coverage o Significant cost restructuring could come as a result, as medical costs will increase due to complex treatments required The Managed care industry has not performed well during the past year due to premium mispricing and the economic slowdown. However, it appears that the stock has been oversold, and it should recover. Both DCF and Multiples valuation show significant upside potential (~40%) for WellPoint over the next year. Sector: Healthcare Industry: Managed Care Market Cap: 17.62 B 52 Wk High: 90.00 52 Wk Low: 27.50 Shares Outstanding: 509.04M Earnings per Share: 5.61 P/E Ratio: 6.17 Beta: 1.14 Comparable Returns: March falloff from premium mispricing FISHER COLLEGE OF BUSINESS Student Investment Management Last Update November 28, 2008 Student Investment Management: WellPoint, Inc. Page |2 Table of Contents Company Overview ........................................................................................................................ 3 Reportable Segments ...................................................................................................................... 3 Competitive Advantages ................................................................................................................. 4 Economic/Macro Analysis ............................................................................................................... 6 Sector/Industry Analysis ................................................................................................................. 9 Company Position within Industry ................................................................................................ 10 Growth Factors ............................................................................................................................. 11 New Product Offerings: ......................................................................................................... 11 Acquisitions: .......................................................................................................................... 12 Risk Factors ................................................................................................................................... 12 Economic Concerns: .............................................................................................................. 12 Competitive Forces: ............................................................................................................... 13 Regulation Uncertainty: ......................................................................................................... 14 Financials ....................................................................................................................................... 15 Income Statement: ................................................................................................................ 15 Balance Sheet: ....................................................................................................................... 15 Statement of Cash Flows: ...................................................................................................... 16 DCF Analysis: .......................................................................................................................... 16 Valuation Analysis ......................................................................................................................... 17 Absolute Valuation: ............................................................................................................... 17 Relative to S&P 500: .............................................................................................................. 18 Relative to Healthcare Sector: ............................................................................................... 19 Recommendation .......................................................................................................................... 19 DCF Spreadsheet ........................................................................................................................... 21 Consolidated Financial Statements for WellPoint, Inc. ................................................................ 22 Balance Sheet: ....................................................................................................................... 22 Income Statement: ................................................................................................................ 24 Endnotes: ...................................................................................................................................... 25 Student Investment Management: WellPoint, Inc. Page |3 Company Overview1 WellPoint, Inc. is the largest health benefits company in terms of commercial membership in the United States, serving 34.8 million medical members as of December 31, 2007. It is an independent licensee of the Blue Cross and Blue Shield Association, or BCBSA, an association of independent health benefit plans. WellPoint serves its members as the Blue Cross licensee for California and as the Blue Cross and Blue Shield, or BCBS, licensee for: Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri (excluding 30 counties in the Kansas City area), Nevada, New Hampshire, New York (as BCBS in 10 New York city metropolitan and surrounding counties, and as Blue Cross or BCBS in selected upstate counties only), Ohio, Virginia (excluding the Northern Virginia suburbs of Washington, D.C.), and Wisconsin. It also serves its members throughout the country as UniCare. It is licensed to conduct insurance operations in all 50 states through its subsidiaries. WellPoint offers a broad spectrum of network-based managed care plans to the large and small employer, individual, Medicaid and senior markets. Their managed care plans include preferred provider organizations, or PPOs; health maintenance organizations, or HMOs; pointof-service plans, or POS plans; traditional indemnity plans and other hybrid plans, including consumer-driven health plans, or CDHPs; hospital only and limited benefit products. In addition, WellPoint provides a broad array of managed care services to self-funded customers, including claims processing, underwriting, stop loss insurance, actuarial services, provider network access, medical cost management and other administrative services. The firm also provides an array of specialty and other products and services including life and disability insurance benefits, pharmacy benefit management, or PBM, specialty pharmacy, dental, vision, behavioral health benefit services, long-term care insurance and flexible spending accounts. Reportable Segments2 In the first quarter of 2008 WellPoint decided to reclassify their reportable segments. WellPoint seems to do this quite frequently. However, to avoid any confusion, and because the DCF analysis contained in this report uses 2007 segments, all segment information in this report will be based on the reportable segments listed in WellPoint’s 2007 Form 10-K. Through Student Investment Management: WellPoint, Inc. Page |4 December 31, 2007 WellPoint ran its business through three reportable segments: Consumer and Commercial Business (CCB); Specialty, Senior and State Sponsored Business (4SB); and Other. Consumer and Commercial Business: The CCB segment is comprised of a collection of business units which offer similar products and services, including commercial accounts and individual plans. The products offered include a diversified mix of managed care options including PPOs, HMOs, traditional indemnity benefits and POS plans. The segment also features some hybrid plans such as CDHPs, hospital only and limited benefit products and covers additional managed care services. Specialty, Senior and State Sponsored Business: The 4SB segment mainly consists of business providing various health and specialty products and services such as Medicare Part D, Medicare Advantage, Medicare Supplement, Medicaid, life and disability insurance benefits, PBM, specialty pharmacy, dental, vision, behavioral health benefit services and long-term care insurance. 4SB also offers some services to workers compensation carriers. Other: The Other segment includes WellPoint’s Federal Government Solutions (FGS) business as well as any other businesses that do not exceed the qualifications for a reportable segment according to Statement of Financial Accounting Standards No. 131. Additionally, intersegment sales and expense eliminations and corporate expenses not appearing in other segments are reported here. Competitive Advantages3 WellPoint has a number of sustainable competitive advantages that sets it apart from other managed care organizations (MCO’s): Enormous Customer Base: The sheer number of members that WellPoint has can definitely be classified as one of its greatest strengths. For a managed care organization to be successful, it must pool a large amount of premiums and organize these into an efficient operating structure. The more market penetration a firm has the easier it is for them to maintain this efficiency. With over 35 million Student Investment Management: WellPoint, Inc. Page |5 customers, WellPoint is the biggest managed care organization in the nation from a membership standpoint, and is well-positioned to offer a broad range of health benefits to its customers on a more cost effective basis than many of its smaller competitors. Blue Cross Blue Shield License: WellPoint believes that one of its greatest strength is its ability market products under the Blue Cross Blue Shield brand, the most recognized brand in the managed care industry. In addition to being the most renowned, BCBS brands are the oldest and largest organization of health benefits companies in the US. According to its website, about one in every three insured Americans is covered by a Blue plan. WellPoint is the licensee to the BCBS brand in 14 states, including California, New York, Ohio and Virginia. Obviously, being partnered with BCBS has enabled WellPoint to become a force in the managed care industry, as seen by its massive enrollment. If WellPoint continues to remain a licensee to the BCBS brand it will maintain its position as a one of the nation’s top providers. Broad Product Array: The importance of having various products available cannot be understated in the managed care industry. In order to tap into an exceedingly diverse market and adapt to different customer groups, managed care organizations must in turn create a diverse product offering. Currently, WellPoint offers one of the most comprehensive collections of managed healthcare products. Some of the offerings include Preferred Provider Organization (PPO) products, Consumber-Driven Health Plans (CDHP’s), traditional indemnity products, Health Maintenance Organization (HMO) products, Point-of Service (POS) plans, Blue Card, Senior Plans, Individual Plans, Medicaid and other state sponsored programs, and Medicaid. WellPoint also offers numerous specialty and niche products such as Pharmacy, Disability, Dental, Vision, and Behavioral Health. WellPoint’s product development and marketing enables them to target all types of health insurance customers. Student Investment Management: WellPoint, Inc. Page |6 Economic/Macro Analysis There are several economic trends to monitor when analyzing a managed care organization: Demographics: Without question, looking at demographic trends across the country is a key to examining a company like WellPoint. The following population pyramids show the age distribution for the years 1980, 2007, and estimated in 2025: Student Investment Management: WellPoint, Inc. Page |7 In addition to getting larger, the U.S. population is also getting older. Life expectancy is increasing due to improvements in medical technologies. Obviously, it costs money to keep people alive longer, and typically the longer a person lives, the more likely they are to suffer from a chronic illness. The highlighted portions show one of the largest generations, the baby boomers, getting older. The result of these people reaching retirement age will have a material effect on managed care companies. According to the U.S. Department of Health and Human Services “the population age 65 and older is increasing at a rate faster than the total population.” These people are going to need care, and WellPoint, because of their already mentioned sustainable competitive advantages, is in a good spot to satisfy that need. Another demographic trend to watch is the percent of people who are overweight and obese. Obesity can lead to increased risk for a number of chronic medical problems that may require long term care including heart disease, endometrial, breast and colon cancers, diabetes, liver and gull bladder disease, and strokes. Being overweight can also result in high cholesterol and triglyceride levels. Necessary treatments for these types of conditions can be very complex and costly. Similar to the increasing percentage of elderly people, the past thirty years have seen an increase in obesity. The following exhibit gives a good picture of the rising obesity trend in the U.S. by state: Student Investment Management: WellPoint, Inc. Page |8 Obesity Trends* Among U.S. Adults BRFSS, 1990, 1998, 2007 (*BMI ≥30, or about 30 lbs. overweight for 5’4” person) 1998 1990 2007 No Data <10% 10%–14% 15%–19% 20%–24% 25%–29% ≥30% Source: CDC Behavioral Risk Factor Surveillance System. Today about thirty percent of the U.S. adult population over twenty is considered to be obese. This represents a startling increase of about 100% since 1980. Again WellPoint is positioned to provide the needed health insurance to people who may require long term managed care. Government Spending:4 It is important to examine federal budget projections for spending when looking at a managed care company because a significant amount of government spending goes into programs like Medicare and Medicaid. From years 2002 through the first half of 2008 the budget has been operating at a deficit. Standard & Poor’s believes that the full year deficit will be close to $400 billion in 2008, which represents its highest level since the record loss year of 2004. Estimates for 2009 are even less encouraging, with an anticipated deficit of $489 billion. Clearly, Congress must be worried about this and has explored ways to cut costs. In 2005 Congress passed the Deficit Reduction Act which was set a goal of reducing Medicare spending by $6.4 billion and $22.4 billion, and Medicaid spending by $4.8 billion and $26.1 billion, with the first target to be reached by 2010 and the second by 2015. Spending on Medicare, however, has not yet taken a hit due to the staggering deficit numbers; in fact it continues to rise. Just between 2006 and 2007 it rose from $374 billion to $436 billion, an increase of 16.6 percent. Still though, a cut in funding to either of these programs could affect WellPoint’s revenues since Student Investment Management: WellPoint, Inc. Page |9 it participates in both, deriving 4% of its 2007 membership base from Medicare enrollees and 6% from Medicaid enrollees. Sector/Industry Analysis As the general economy goes up and down, demand for healthcare remains largely unaffected. This relatively stable inelastic demand is why healthcare is traditionally classified as a defensive sector. Currently the sector has a beta of 0.7, also an indicator of its defensive nature. Because it is a defensive sector, healthcare tends to outperform the market during times of economic downturn. Since current conditions indicate that we are in the midst of a recession one would expect healthcare to be performing reasonably well. Year to date the healthcare sector is down about 25%, representing an outperformance of the S&P 500 by about 15%. Market conditions are not likely to improve in the next six months; as a result investors should see continued outperformance by the sector. One would expect that since managed care is part of a defensive sector, it would be relatively defensive as well. However, with an industry beta of 1.3, it does not appear to be as defensive as the sector overall, and may be subject to a myriad of risk factors that other industries in the sector do not face. Some examples of these factors include unemployment rates, projected premium rates for Medicare and Medicaid plans, and a company’s ability to accurately predict medical costs. Year to date the managed healthcare industry is down about 60 percent, an underperformance of the sector by 35 percent and of the S&P 500 by 20 percent. Trends in the industry are affected by various factors. With unemployment rising and government spending expected to expand at a slower rate, MCO’s are increasing their focus on offering specialized products that target people who are either uninsured or underinsured. Healthcare cost expansion, after a moderating trend through 2005 looks to be modestly picking up. Standard &Poor’s believes that health spending is likely to continue above GDP growth. Managed care organizations pay close attention to these numbers. They must be able to accurately predict what will happen in medical cost trends in order to price their products accordingly. As a whole, managed care is in the mature stage of the industry life cycle. Competition is extremely fierce, and compared to other industries managed care is relatively concentrated. The concentration is expected to continue to grow. According to Standard & Poor’s in 2007 Student Investment Management: WellPoint, Inc. P a g e | 10 about 56% of the insured population was handled by the top ten insurance companies. They expect this figure rise to 70-80% by 2015. 5 The larger companies are increasingly expanding their reach nationally, and as a result pushing smaller competitors out. Many of these companies are being be scooped up in mergers and acquisitions by the bigger organizations. Company Position within Industry As previously mentioned WellPoint is the largest managed care organization on a membership basis. Because of this, the firm is able to take advantage of significant economies of scale which are tremendously important in the industry. In comparison to its nearest competitors, WellPoint has preformed inline. The following figure shows comparable returns year to date for WellPoint, UnitedHealth, Aetna, Humana and Cigna, all members of the S&P 500 healthcare sector: Obviously these firms have taken quite a beating. Of the five WellPoint has preformed the best, but only marginally so. The weakening economy seems to be the chief reason for their poor performance, although some if it may be due to an inability to accurately predict medical cost trends. The following table shows the company’s current (as of November 29th) market capitalization and 2007 revenues: Company Market Capitalization (in 2007 Revenues (in millions) billions) WellPoint 18.12 61,134.30 UnitedHealth 25.38 75,431.00 Student Investment Management: WellPoint, Inc. P a g e | 11 Aetna 10.06 27,599.60 Humana 5.10 25,289.99 Cigna 3.29 17,623.00 As can be seen WellPoint is one of the biggest managed care firms on a revenue and market capitalization basis as well. Net income growth from the second half of 2007 to 2008 was rather discouraging. WellPoint experienced a -17.3% change, but was better off than competitors Cigna and UnitedHealth who both suffered greater than -30% changes. As already mentioned, WellPoint is currently the BCBS licensee in 14 states. Recently, some smaller not-for-profit Blue Cross Blue Shield plans have been considering merging and changing their status to for-profit. It would not be surprising if WellPoint, which has consistently expanded its reach through acquisitions, made offers on some of these plans. WellPoint does have a very cash rich position and would be further served by adding more regions to its already extensive BCBS coverage. Growth Factors The most promising growth factors that are the biggest catalysts for WellPoint are new product offerings and further acquisitions. New Product Offerings: WellPoint’s product offering is expanding in order to provide more customer friendly products. Tapping into markets of people who were previously uninsured or underinsured, or other niche groups is one of the best ways for an MCO to increase its market penetration. Over the past few years, this has meant getting into the public healthcare business in programs like Medicare and Medicaid. Even though these products are usually lower margin, enrollment rates are higher in these programs than in most managed care’s private commercial plans. WellPoint has done a good job in bringing these businesses into their operations. The most recent trend in reaching underinsured markets is a focus on consumerism, which can be summed up as an effort to educate the consumer, allowing them to make more informed decisions about their healthcare. The resulting product of this focus was the consumer driven health plan (CDHP); a generally lower premium plan that requires more out-of-pocket Student Investment Management: WellPoint, Inc. P a g e | 12 expenses from the participant. Because the customer will be required to pay more out-of-pocket, they become more conscious about decisions they make regarding healthcare. While it may sound somewhat controversial, and they have received some criticism, CDHP’s have allowed countless companies that previously could not offer healthcare to employers to do so at affordable rates. WellPoint currently offers consumer driven health plans to all private customers and has done well to make these products affordable to previously uninsured customers. Acquisitions: In expanding its business, WellPoint has made significant acquisitions, including the gigantic purchase of WellChoice, Inc in 2005. So far they have been able to integrate the many acquisitions into a highly successful managed care juggernaut. As mentioned before, I believe that WellPoint will have the opportunity to invest in further acquisitions in the coming months. With several not-for-profit MCO’s considering merging and changing to for-profit status, most of which already have the BCBS license, WellPoint could become an even greater force in the industry if it were to successfully acquire some of these. Expanding the extent of their BCBS coverage would be frightening to competitors who do not enjoy the benefits that go along with marketing products with the industry’s strongest brand. Risk Factors WellPoint is subject to many risks that may have a negative impact on future profitability. It is important to discuss some of the most pressing concerns. Economic Concerns: The larger general economic issues have thus far not been kind to WellPoint. As already discussed, year to date the stock is down about 60 percent. If conditions get worse before they get better the next six months could see even more losses. Because most customers at WellPoint are enrolled in programs through their employers, a significant change in the employment rate could affect WellPoint’s profitability. The employment rate has risen over the past two years from 4.5% in the last quarter of 2006 to 6.5% in the third quarter of 2008. Weakening employment numbers means fewer new enrollees for companies like WellPoint. In addition, managed care organizations usually feel the effects of increasing unemployment again on a lag. Student Investment Management: WellPoint, Inc. P a g e | 13 When employees lose their jobs they usually get some severance which often includes some health coverage. If and when these plans run out, however, the MCO takes a hit again, as reenrollment is not going to be likely if current market conditions last.6 Also since WellPoint does most of its business in the 14 states it has the BCBS license, if economic conditions here are worse than the nation overall, WellPoint will be at a disadvantage compared to its competitors.7 The following table shows the unemployment rate in the aforementioned states:8 Unemployment Rate State State (Oct 2008) Unemployment Rate (Oct 2008) California 8.2 Missouri 6.5 Colorado 5.7 Nevada 7.6 Connecticut 6.5 New Hampshire 4.1 Georgia 7.0 New York 5.7 Indiana 6.4 Ohio 7.3 Kentucky 6.8 Virginia 4.4 Maine 5.7 Wisconsin 5.1 On and adjusted basis for population, the average unemployment in these states is approximately 6.75, which is significantly higher than the national unemployment number. Increasing unemployment is not the only economic problem that WellPoint is facing. Due to the recent credit crunch, market conditions have made the availability of liquid funds very scarce. In order to pay for capital expenditures, operating costs, and debts, WellPoint needs access to liquid assets. The firm had been relying on a $2.5 billion commercial paper program to achieve some liquidity. However, in response to increased volatility in that market, WellPoint decided to scale back its utilization to about $1.3 billion by the end of September. If getting credit continues to be difficult, WellPoint could run into problems in meeting its liquidity needs from internal sources, and long term this could result in unfavorable credit terms which might be WellPoint’s only option.9 Competitive Forces: Competition within the managed care industry is extremely fierce. As concentration in the industry increases I believe that competition will increase as well. In several of the markets in Student Investment Management: WellPoint, Inc. P a g e | 14 which WellPoint does business, it must win customers from various local plans as well as bigger national ones. Different customer groups require different products, and for the most part WellPoint has the plan diversity required. However, as new products become available by competitors, there is no guarantee that WellPoint will be able to adapt accordingly. In addition to battling over customers, the firm also must fight for the services of independent agents and brokers whom they use to market their products. Mostly, these agents are prevalent in their individual, senior and smaller commercial business plans. These agents typically do not only sell WellPoint products though and can be just as difficult to win over as customers. Intense competition also exists in attracting and retaining employees. Regulation Uncertainty:10 The federal and state governments in which WellPoint operates have enacted extensive regulations regarding the managed care industry. Often these regulations can vary greatly from state to state. Also, Congress at any time can reform regulations, forcing WellPoint to make changes in its policies. Healthcare has been a hot topic this year with regard to the November presidential election. During the race, President-elect Barack Obama set forth a plan for universal or near- universal health coverage which would be modeled after Medicare. Under increased regulation, private insurers would possibly be forced to accept all applicants. Clearly, this could present a problem for a company like WellPoint. Typically people who were not insured or were underinsured are going to take advantage of the new coverage by increasing the rate of plan utilization. A person who would normally not receive care for a minor injury or illness, or put that care off, because it would come out of pocket, might make a hospital visit when home healthcare would suffice. The overall effect would be harder to predict medical costs trends and lower margins from increased public healthcare products. However, it is debatable whether or not we will see the promised healthcare reforms in the near future. It is more likely that it will happen on the state level, as numerous proposals are currently either already enacted or on the table in several of the states in which WellPoint conducts business, including California, Colorado, Connecticut, Maine, New York, and Wisconsin. It is uncertain what kind of effect the new regulations will have on business, but they likely will make it more difficult to maintain margins. Student Investment Management: WellPoint, Inc. P a g e | 15 Financials Pouring over a firm’s financial statements is an important part of valuing a company. This section goes over the WellPoint’s income statement, balance sheet and statement of cash flows, all three of which have been attached to the end of this report. I have also prepared a careful discounted cash flow model. Income Statement11: Given that WellPoint is a managed care organization, the predominant form of revenues received come from premiums. The remainder comes from administrative fees, and income earned on investments that the company has made. Because premium revenue accounts for about 93% of total revenue from operations, it is the primary driver of earnings growth. Keeping operating expenses contained is also a key. The medical loss ratio (MLR) gauges how well management has been able to do this. Medical Loss Ratio It is calculated by dividing a 83.0% company’s total amount of medical 82.0% costs by premium revenues. As has 81.0% Medical Loss Ratio 80.0% been mentioned several times, pricing products based on projected medical 79.0% 2007 2006 2005 2004 2003 costs is crucial for maintaining margins in this business. The figure at the left shows the MLR for WellPoint over the last five years. In 2007, it was at its highest point, reaching 82.4%. Average MLR across the industry is around 80% for a company that is considered to be managing its customer base well according to Standard and Poor’s, so WellPoint is relatively in-line.12 The foremost reason for the inflated MCR is a higher cost of Medicare and Medicaid on a per patient basis compared to privately funded plans. Balance Sheet: The main thing analysts look for when examining a MCO’s balance sheet is stability of the organization’s cash balance. Companies like WellPoint need cash to keep their bigger commercial customers feeling safe. If a client does not believe WellPoint will be able to maintain enough liquidity to keep their employees covered, even during times of financial crisis, they will take their business elsewhere. WellPoint has done a solid job in keeping the cash on Student Investment Management: WellPoint, Inc. P a g e | 16 hand consistent over the past 3 years; and even during the credit crunch they have performed admirably. The cash and cash equivalents balance as of December 31, 2007 was 2.77 billion, and at the end of 2008’s third quarter it was still at 2.27 billion. Statement of Cash Flows: The main source of operating cash flow for WellPoint is through premiums. The biggest source of investing cash flow, both inflows and outflows, is from purchasing and selling fixed maturity securities. Taking a look at financing activities, during the financial years 2006 and 2007 and earlier this year WellPoint repurchased and retired significant portions of stock. The end result has been a trend for lots of outflows from financing activities. DCF Analysis: In order to come up with a target value for the price of WellPoint, I have constructed a discounted cash flow analysis which is attached at the end of this report. In building this model most of the information gathered was derived from the companies various financial statements. Assuming a 13% terminal discount rate and a 1% terminal free cash flow growth, I arrived at a target price of $49.73, which represents an upside of 39.87 percent. A sensitivity analysis was also preformed, varying the discount rate from 10-13 percent and the terminal FCF growth rate from 1-3 percent. The decision to go with 1% FCF growth was based on the fact that it looks like growth is slowing for WellPoint, and I expect it to grow slower than GDP in the future. A 13% discount rate was chosen to be best on the basis that it is slightly less than the expected industry growth rate of 13.37 percent. Assumptions used in the DCF are listed below: Segment Analysis: • Net Sales Growth- Commercial and Consumer- growth expected to slow unless WellPoint completes aforementioned acquisitions • Net Sales Growth- Specialty Senior and State Sponsored- biggest growth will come from this segment • Net Sales Growth-Other- small constant growth • Operating Margins- Assumed constant for next three years, although overall margins might shrink slightly because of increased public health insurance Income Statement, Balance Sheet Analysis, and Cash Flow Analysis: • Interest Expense- expected to remain constant as a percent of sales • Amortization of Other Intangible Assets- expected to remain constant as a percent of sales Student Investment Management: WellPoint, Inc. • • • • • • • P a g e | 17 Income Tax- assumed to continue at 36.4% Cash and Equivalents- assumed to stay at $2,767.9 million Accounts Receivable- increase at short term average of 4.70% per year Inventory- none Accounts Payable- increase at short term average of 5.68% per year Capital Expenditures- assumed to remain at a constant 0.48% of sales Depreciation and Amortization- assumed to remain at a constant 0.93% of sales Valuation Analysis Valuations were made on an absolute basis, relative to the S&P 500, and relative to the healthcare sector. Absolute Valuation: The absolute valuation, while not necessarily the best way to estimate a target price, does give some gauge against which to measure the DCF. Listed below is the analysis: Absolute Valuation P/Forward E P/S High Low Mean Target Multiple 6.1 8 Current Target X/Share 6.42 18.2 5.2 13.9 1.14 0.26 0.73 0.31 0.45 120.1 3.6 0.7 2 0.8 1.3 44.5 P/EBITDA 1.12 3.2 8.5 3.8 5.5 9.36 P/CF 17.6 4.7 14.2 5.6 8.5 6.35 Target Price 51.36 54.05 P/B 57.85 51.53 54.04 P/E/G Ratio ROE 1.2 0.4 0.9 0.5 0.7 71.2 49.84 17.60% 10.20% 13.00% 14.00% 13.00% 254.28 33.06 Average 50.24 Currently these measures were very near their all time lows for WellPoint. The major assumption used in this valuation was that the values would at least get somewhat closer to their historical averages. In order to compare this method with the already discussed DCF analysis, a mean Student Investment Management: WellPoint, Inc. P a g e | 18 value was calculated resulting in a target price is $50.49, which represents an upside of 41.38 percent. This value is relatively in line with the target price determined in the DCF model, further increasing the validity of both methods. Relative to S&P 500: WELLPOINT INCORPORATED NEW (WLP) Price 35.60 2001 2002 2003 2004 2005 2006 2007 StockVal ® 2008 2009 1.2 HI LO ME CU 1.0 0.8 1.17 0.45 0.75 0.55 0.6 11-23-2001 11-28-2008 0.4 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd 0.8 HI LO ME CU 0.6 0.76 0.26 0.47 0.38 0.4 11-23-2001 11-28-2008 0.2 PRICE / SALES RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd 1.2 HI LO ME CU 0.9 1.14 0.39 0.66 0.48 0.6 11-23-2001 11-28-2008 0.3 PRICE / BOOK VALUE RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd 1.4 HI LO ME CU 1.2 1.0 1.38 • 0.62 1.15 0.79 0.8 01-06-2006 11-28-2008 0.6 PRICE / EBITDA RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd Most of these multiples are below their historical mean, which indicates that the stock may be relatively undervalued. If these values do revert to the mean, or even get somewhat closer to it, the stock’s price will likely go up. Student Investment Management: WellPoint, Inc. P a g e | 19 Relative to Healthcare Sector: WELLPOINT INCORPORATED NEW (WLP) Price 35.60 2001 2002 2003 2004 2005 2006 2007 StockVal ® 2008 2009 1.2 HI LO ME CU 1.0 0.8 1.03 0.42 0.71 0.60 0.6 0.4 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd 0.6 11-23-2001 11-28-2008 HI LO ME CU 0.4 0.58 0.14 0.33 0.28 0.2 11-23-2001 11-28-2008 0.0 PRICE / SALES RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd 0.6 HI LO ME CU 0.5 0.4 0.60 0.25 0.46 0.36 0.3 11-23-2001 11-28-2008 0.2 PRICE / BOOK VALUE RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd 0.9 HI LO ME CU 0.7 0.5 0.90 • 0.38 0.67 0.47 0.4 01-06-2006 11-28-2008 0.3 PRICE / EBITDA RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd These measures also show that WellPoint may be trading at a discount compared to the healthcare sector as a whole. All current values are below historical averages. Recommendation Based on the analysis presented here, and on the various valuation techniques used, I would recommend buying WellPoint. The DCF analysis provided a target price of $49.75, a potential upside of 39.74%, while the multiples analysis determined an average target of $50.24, or 41.12% upside potential. Further, if these two measures are averaged, the resulting target price is $49.99, or 40.43% upside. With that having been said, this upside puts the stock above the threshold for a buy. At its current price WellPoint is undervalued, and it has some room to grow. A summary of the pros and cons of the recommendation follow: Student Investment Management: WellPoint, Inc. Pros • • • • WellPoint is the market leader on a membership basis and is the licensee for the highly reputable BCBS brand in its most important states Demographic trends are showing an increase in obesity and an aging population- the result more people who will need extensive healthcare coverage Very good opportunity for expansion from an acquisitions standpoint Both DCF and multiples valuation showed significant potential upside P a g e | 20 Cons • • • Competition in the managed care industry is extremely fierce Recessionary times have not proved well for WellPoint stock as it has lost 59% ytd. If slumping economy continues, very real threat of WellPoint underperforming Pricing trends may become increasingly harder to predict, putting strain on WellPoint to maintain its margins- increase in chronic illnesses (from higher levels of obesity and older pop.) require more complex and costly treatments WellPoint really fell off after a miscalculation of medical trends in the first quarter of 2008, resulting in an abnormally high medical loss ratio. The stock quickly plunged from a price of $72 to $44 in less than a month; the biggest drop was between March 10 and 11 when it went from $67 to $48. Largely this type of miscalculation was industry wide, and problems were further compounded when the world economy moved into a recessionary period; the stock got beaten down to levels that have not been seen since the Anthem-WellPoint merger in 2005. However, it seems likely that WellPoint has been oversold. The stock may take some time to recover, but both the DCF and multiples showed a 12-month target price around $50, leading to the final recommendation of a BUY. Student Investment Management: WellPoint, Inc. P a g e | 21 DCF Spreadsheet DCF Valuation 10/20/2008 Ticker: WLP Bobby Lazarony Terminal Discount Rate= Terminal FCF Growth= 13.0% 1.0% Forecast Year 2008E 2009E Terminal 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 64,528 4.57% 67,538 4.66% 70,239 4.00% 72,698 3.50% 74,879 3.00% 76,750 2.50% 78,285 2.00% 79,460 1.50% 80,254 1.00% 1.00% 61,705 Operating Income Operating Margin 5,215 8.45% 5,302 8.22% 5,429 8.04% 5,549 7.90% 5,743 7.90% 5,915 7.90% 5,987 7.80% 6,106 7.80% 6,118 7.70% 6,180 7.70% 7.60% Interest - net Interest % of Sales 457 0.74% 478 0.74% 500 0.74% 500 0.71% 500 0.69% 500 0.67% 500 0.65% 500 0.64% 500 0.63% 500 0.62% 0.62% 6,160 500 Amortization of other intangible assets As a % of sales 309 323 338 351 363 374 384 391 397 401 405 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% Taxes Tax Rate 1,620 36.4% 1,639 36.4% 1,671 36.4% 1,710 36.4% 1,776 36.4% 1,835 36.4% 1,857 36.4% 1,898 36.4% 1,901 36.4% 1,921 36.4% 36.4% - - - - - - - - - - 2,830 2,863 1.16% 2,920 2.00% 2,988 2.32% 3,104 3.87% 3,206 3.31% 3,246 1.23% 3,317 2.20% 3,321 0.12% 3,357 1.10% Minority Interest Net Income % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow YOY growth 1,913 3,342 -0.44% 574 600 628 653 676 696 714 728 739 746 754 0.93% 0.93% 0.93% 0.93% 0.93% 0.93% 0.93% 0.93% 0.93% 0.93% 0.93% (307) (313) (318) (321) 0.40% 368 0.48% 0.40% 376 0.48% 0.40% 381 0.48% 0.40% 385 0.48% (623) (296) (312) (281) (291) (300) -1.01% -0.46% -0.46% -0.40% -0.40% -0.40% 296 0.48% 310 0.48% 324 0.48% 337 0.48% 349 0.48% 359 0.48% 2,485 (324) -0.40% 389 0.48% 2,858 2,911 3,023 3,140 3,244 3,284 3,356 3,360 3,397 3,383 14.98% 1.89% 3.83% 3.87% 3.30% 1.24% 2.19% 0.14% 1.09% -0.42% Terminal Terminal Value NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield Shares Outstanding 28,473 16,986 67% EV/EBITDA 8,388 33% Free Cash Yield 25,373 509.0 Current Price $ 35.60 Implied equity value/share $ 49.75 Upside/(Downside) to DCF Cash Debt P/E 9.79% 39.74% 2,768 9,024 Value 81,057 Revenue % Growth 28,472.5 8.5 5.02 11.88% Student Investment Management: WellPoint, Inc. Sensitivity Analysis (Implied Equity Value/share) Terminal FCF Growth Terminal Discount Rate 10.00% 10.50% 11.00% 11.50% 12.00% 12.50% 13.00% 66.61 63.06 59.87 56.97 54.35 51.95 49.75 68.45 66.64 61.23 55.38 52.86 50.55 70.53 66.41 62.75 59.48 56.53 53.85 51.42 72.88 68.40 64.45 60.93 57.79 54.95 52.38 75.56 70.66 66.36 62.57 59.19 56.16 53.44 Terminal FCF Growth 1.00% 10.00% 87.11% 10.50% 77.13% 11.00% 68.17% 11.50% 60.03% 12.00% 52.67% 12.50% 45.93% 13.00% 39.75% 1.50% 92.28% 87.19% 71.99% 63.37% 55.56% 48.48% 41.99% 2.00% 98.12% 86.54% 76.26% 67.08% 58.79% 51.26% 44.44% 2.50% 104.72% 92.13% 81.04% 71.15% 62.33% 54.35% 47.13% 3.00% 112.25% 98.48% 86.40% 75.76% 66.26% 57.75% 50.11% 1.00% 1.50% 2.00% 2.50% 3.00% 58.16 Terminal Discount Rate Consolidated Financial Statements for WellPoint, Inc. Balance Sheet: P a g e | 22 Student Investment Management: WellPoint, Inc. P a g e | 23 (In millions, except share data) Assets Current assets: Cash and cash equivalents Investments available-for-sale, at fair value: Fixed maturity securities (amortized cost of $1,814.5 and $481.5) Equity securities (cost of $1,732.7 and $1,669.7) Other invested assets, current Accrued investment income Premium and self-funded receivables Other receivables Income tax receivable Securities lending collateral Deferred tax assets, net Other current assets Total current assets Long-term investments available-for-sale, at fair value: Fixed maturity securities (amortized cost of $13,832.6 and $15,004.6) Equity securities (cost of $43.4 and $82.7) Other invested assets, long-term Property and equipment, net Goodwill Other intangible assets Other noncurrent assets Total assets Liabilities and shareholders’ equity Liabilities Current liabilities: Policy liabilities: Medical claims payable Reserves for future policy benefits Other policyholder liabilities Total policy liabilities Unearned income Accounts payable and accrued expenses Income taxes payable Security trades pending payable Securities lending payable Current portion of long-term debt Other current liabilities Total current liabilities Long-term debt, less current portion Reserves for future policy benefits, noncurrent Deferred tax liability, net Other noncurrent liabilities Total liabilities Commitments and contingencies—Note 18 Shareholders’ equity Preferred stock, without par value, shares authorized—100,000,000; shares issued and outstanding—none Common stock, par value $0.01, shares authorized—900,000,000;shares issued and outstanding: 556,212,039 and 615,500,865 Additional paid-in capital Retained earnings Accumulated other comprehensive income Total shareholders’ equity Total liabilities and shareholders’ equity December 31 2007 2006 $ $ $ $ 2,767.9 $ 2,602.1 1,832.6 1,893.7 40.3 165.8 2,870.1 996.4 0.9 854.1 559.6 1,050.4 13,031.8 465.4 1,984.5 72.8 157.2 2,335.3 1,172.7 — 904.7 642.6 1,284.5 11,621.8 13,917.3 45.1 752.9 995.9 13,435.4 9,220.8 660.8 52,060.0 14,972.4 86.2 628.8 988.6 13,383.5 9,396.2 497.4 51,574.9 5,788.0 63.7 1,832.2 7,683.9 1,114.6 2,909.6 — 50.6 854.1 20.4 1,755.0 14,388.2 9,023.5 661.9 3,004.4 1,991.6 29,069.6 — 5.6 18,441.1 4,387.6 156.1 22,990.4 52,060.0 $ $ $ 5,290.3 76.3 2,055.7 7,422.3 987.9 3,242.2 538.2 124.8 904.7 521.0 1,397.4 15,138.5 6,493.2 646.9 3,350.2 1,370.3 26,999.1 — 6.1 19,863.5 4,656.1 50.1 24,575.8 51,574.9 Student Investment Management: WellPoint, Inc. P a g e | 24 Income Statement: (In millions, except per share data) Revenues Premiums Administrative fees Other revenue Total operating revenue Net investment income Net realized gains (losses) on investments Total revenues Expenses Benefit expense Selling, general and administrative expense: Selling expense General and administrative expense Total selling, general and administrative expense Cost of drugs Interest expense Amortization of other intangible assets Total expenses Income before income tax expense Income tax expense Net income Net income per share Basic Diluted 2007 Years ended December 31 2006 2005 $ 55,865.0 3,674.6 582.4 60,122.0 1,001.1 11.2 61,134.3 $ 51,971.9 3,595.4 593.1 56,160.4 878.7 (0.3) 57,038.8 $ 40,680.0 2,792.0 519.2 43,991.2 633.1 (10.2) 44,614.1 46,036.1 42,191.4 32,598.8 1,716.8 6,984.7 8,701.5 400.2 447.9 290.7 55,876.4 5,257.9 1,912.5 $ 3,345.4 1,654.5 7,163.2 8,817.7 414.4 403.5 297.4 52,124.4 4,914.4 1,819.5 $ 3,094.9 1,474.2 5,798.5 7,272.7 387.2 226.2 238.9 40,723.8 3,890.3 1,426.5 $ 2,463.8 $ $ $ $ $ $ 5.64 5.56 4.93 4.82 4.03 3.94 Student Investment Management: WellPoint, Inc. P a g e | 25 Endnotes: 1 WellPoint, Inc. 2007 Form 10-K 2 10-K Form 3 10-K Form 4 Seligman, Phillip M .Standard &Poor’s Industry Surveys: Healthcare: Managed Care. October 16, 2008. 5 Seligman, Phillip M .Standard &Poor’s Industry Surveys: Healthcare: Managed Care. October 16, 2008. 6 Seligman, Phillip M .Standard &Poor’s Industry Surveys: Healthcare: Managed Care. October 16, 2008. 7 10-K 8 Bureau of Labor Statistics: www.bls.gov 9 WellPoint, Inc. Quarterly Report for Third Quarter 2008. 10 Seligman, Phillip M .Standard &Poor’s Industry Surveys: Healthcare: Managed Care. October 16, 2008. 11 10-K 12 Seligman, Phillip M .Standard &Poor’s Industry Surveys: Healthcare: Managed Care. October 16, 2008.