Introduction & Time Value of Money

advertisement

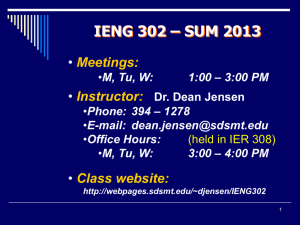

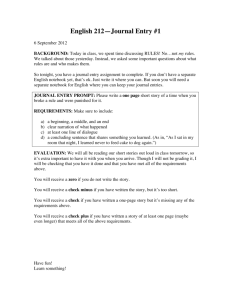

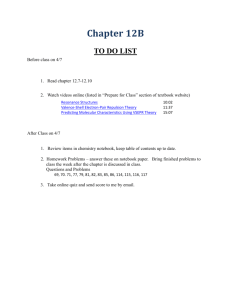

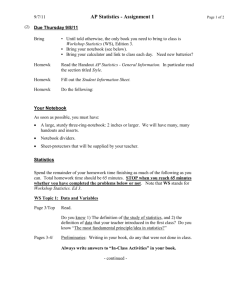

IENG 301/302 – Spring 2014 • Instructor: Paula Jensen •Phone: 394 – 1770 •E-mail: paula.jensen@sdsmt.edu •Office Hrs: MW 10-11 IER 307 T/TH 8:50-9:20 CB 329 T/TH 10:30-11:00 IER 307 • Class website: Http://pjensen.sdsmt.edu D2L: Content 1 Course Objectives 1. Solve problems in a manner expected on the Fundamentals of Engineering exam. 2. Evaluate personal finance choices. 2 Eshenbach, T. (2011). Engineering Economy (3rd ed.). New York NY: Oxford University Press. 591pp. ISBN 978-0-19976697-0 Engineering Notebook – 9-3/4" x 7-1/2", 5x5 quad-ruled, 80-100 pp. (approx.). Engineering Problems Paper – 8-1/2" x 11", three hole drilled, ruled five squares/division, 50 pp. (approx.). FE Supplied-Reference Tables for Eng. Econ. 3 http://library.sdsmt.edu/quicklink.html Click on Knovel Eshenbach, T. (2011). Engineering Economy (3rd ed.). New York NY: Oxford University Press. 591pp. ISBN 978-0-19-976697-0 4 Anything you can copy, cut, staple, paste, glue, or otherwise persuade to live permanently within the covers of your engineering notebook may be used on the exams … EXCEPT old exams and other’s notebook pages. MUST HAVE in your notebook by next class: FE Supplied-Reference Tables for Eng. Econ. 5 Go to www.ncees.org Exams Study Materials Fundamentals of Engineering FE Supplied-Reference Free Preview Read & Accept Terms FE Supplied-Reference Handbook as multiple PDF files Engineering Economics Save the file to your computer Print these out, cut & paste into your Eng. Notebook 6 Course Structure • Grading: Percentage • Weighting: •Assignments •Interaction •Exam I •Exam II •Exam III •Exam IV 302 15% 5% 20% 20% 20% 20% 301 20% 5% 25% 25% 25% -7 A 90-100 B 80-89 C 70-79 D 68-69 F <68 8 Policies • Out of Class Assignments: •Due at class (or earlier) •No late work – drop lowest scoring HW • Interaction Assignments •Due in class •Schedule to makeup if gone for sponsored activities ahead of time. 9 Assignment Structure • Format for most problems: •Find (objective) •Given (organize relevant data, only) •Cash Flow Diagram (rarely dropped) •Soln. (steps to solve): •Write equation in Table Factor Form •Convert to values (or equation forms) •Double underline answer to question • Turn in on EP Paper •Stapled w/ name! •Not graded if illegible! 10 If you are writing about issues relating to the class, make sure the subject line reads IENG 301 or 302: (subject info) so I can sort my emails and answer accordingly. Please be professional in your e-mails. (no texting lingo!) •Exams: •Open engineering notebook •Closed text, etc. •Put FE reference tables in notebook •Make-up Exams •Sponsored activities schedule ahead of time •Otherwise, add extra weight to next midterm •No make-up Final 12 Cheating: use or attempted use of unauthorized materials, information or study aids Tampering: altering or interfering with evaluation instruments and documents Fabrication: falsification or invention of any information Assisting: helping another commit an act of academic dishonesty Plagiarism: representing the words or ideas of another as one's own Assignment #0 Name Preferred name Your SDSM&T E-mail address Course ID Term / Year Your major and anticipated graduation date Your hometown Anything else the instructor should know about you 14 Students with special needs or requiring special accommodations should contact the instructor and/or the campus ADA coordinator, Jolie McCoy, at 394-1924 at the earliest opportunity. It evaluate the money side of engineering problems. It answers questions like: When should I buy this? How many payments should I make? Does this take into account all the stakeholders in the change? When does the cost benefit take place? Which project should we do? 16 Engineering Econ Process • Identify alternative uses for limited resources • Obtain needed data • Analyze data to determine preferred alternative: (not this class) •Screening decisions (meets minimum acceptable?) •Preference decisions (Select from competing alternatives) 17 Typical Decisions • Cost reduction (e.g., equipment, tooling, facility layout) • Capacity expansion (e.g., to increase production, sales) • Equipment / Project selection • Lease or buy decisions • Make or buy decisions • Equipment replacement 18 Lets Get Started… • Would you rather have $10 000 today or $10 000 five years from now? • If you don’t need it right now, what could you do with it? • Would it be worth the same in five years? • Money changes value with time! 19 Rate of Return • (ROR) is the rate of change in value earned over a specific period of time – expressed as a percentage of the original amount ROR = Period Ending Amount – Period Starting Amount Period Starting Amount • x 100% The Rate of Return is a measure of how much risk there is in an investment Higher Risk Higher ROR 20 Rate of Return and Interest • The Interest Rate (i) is the percentage change in value earned over a specific period of time. • For simple interest, a return is earned only on the original amount (principal, p) each period. • If the principal is invested for n periods: Total Interest Earned = (p)(n)(i) Total Money Returned = p + (p)(n)(i) 21 Compound vs Simple Interest • For simple interest, a return is earned only on the original principal each period. • For compound interest, a return is earned on the entire amount (principal + total interest already earned) invested at the beginning of the current period. • • Effectively, you are also earning interest on your interest (and on your investment principal)! Unless explicitly stated otherwise, this course uses compound interest. (And so does the rest of the world!) 22 • • • • Using Compound Interest to Make Economic Decisions … Paid $100,000 for it - 3 years ago Don’t need it now Option 1 – Sell it for $50,000 Option 2 – Lease it for $15,000 for 3 years. Sell it for $10,000 at the end of the lease. Note: Leases typically pay at the beginning of a time period. Loans typically pay at the end of a time period. 23 Cash Flow Diagrams OPTION 1: $50 k n= 0 1 2 3 YRS F3? OPTION 2: $15 k n= 0 $15 k 1 $15 k 2 $10 k 3 YRS F3? 24 The Question • Under what conditions would I be indifferent between Options 1 & 2? • Indifferent means Economically Equivalent: – Have the same amount of money at same point in time, after accounting for all of the cash flows. – In this case, 3 years from now. • Interest Rates… – Percentage – Compounding annually 25 Future Value in 3 years… I% 2.5% 5.0% 7.5% 10% Option 1 $53,844 $57,881 $62,115 $66,550 Option 2 $57,288 $59,652 $62,094 $64,615 At what interest rate, am I indifferent between the two options? • They are economically equivalent at an interest rate just a little less than 7.5% 26 Option 1 50,000 now i = 10% compounded annually F1 = 50,000 + 50,000 (.10) = 55,000 F2 = 55,000 + 55,000 (.10) = 50,000 (1 + .10)2 = 60,500 F3 = 60,500 + 60,500 (.10) = 50,000 (1 + .10)3 = 66,550 27 Generalizing … P = Present value at the beginning of first period. Fn = Future value at end of n periods in the future. Fn = P (1 + i)n = P (F/P,i,n) so … (F/P,i,n) = (1+i)n 28 Standard Factors Used to Solve ECON Problems ( F / P, i, n) ( P / F, i, n) ( F / A, i, n) ( A / F, i, n) ( P / A, i, n) ( A / P, i, n) ( P / G, i, n) ( A / G, i, n) ( F / G, i, n) Find F Given P Find P Given F Find F Given A Find A Given F Find P Given A Find A Given P Find P Given G Find A Given G Find F Given G 29 Tables… 30 Tables… 31 … or Formulas … 32 … or Formulas … 33 P is the present value at Time 0 F is the future value at Time n (n compounding periods in the future) i is the effective interest rate i=? 0 1 2 F? 3 n P F = P(F/P,i,n) 34 Tables… =i F3 = 50 000(F/P,10%,3) = 50 000(1.3310) = $66 550 35 Formulas… F3 = 50 000(F/P, 10%,3) = 50 000(1+.10)3 = 50 000(1.3310) = $66 550 36