Introduction & Time Value of Money

advertisement

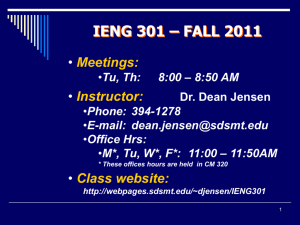

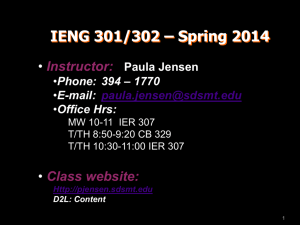

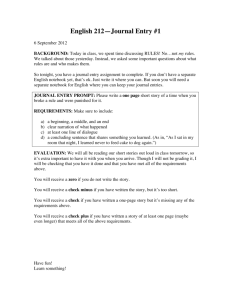

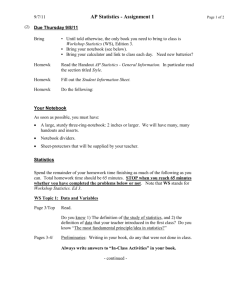

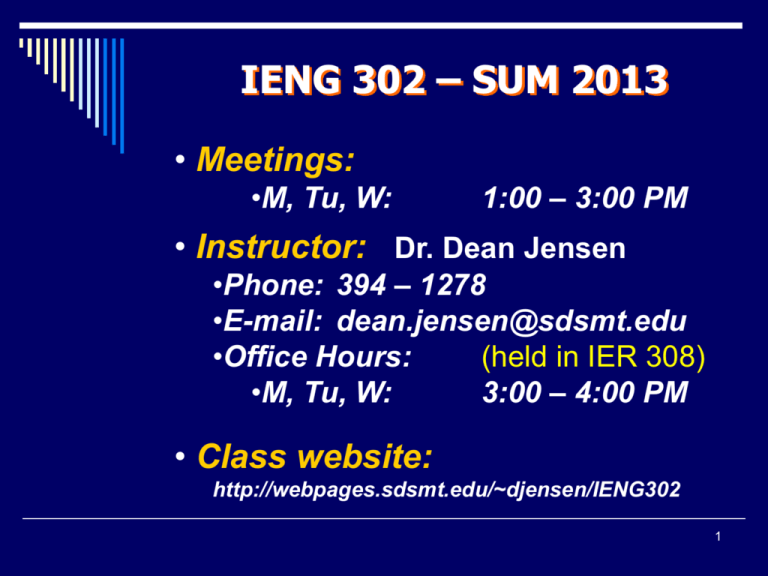

IENG 302 – SUM 2013 • Meetings: •M, Tu, W: 1:00 – 3:00 PM • Instructor: Dr. Dean Jensen •Phone: 394 – 1278 •E-mail: dean.jensen@sdsmt.edu •Office Hours: (held in IER 308) •M, Tu, W: 3:00 – 4:00 PM • Class website: http://webpages.sdsmt.edu/~djensen/IENG302 1 Other Course Objectives 1. Solve problems in a manner expected on the Fundamentals of Engineering exam. 2. Evaluate personal finance choices. 3. Become an Engineering Economics NINJA! 2 Suggested / Required Materials Blank, L. & Tarquin, A. (2005). Engineering Economy (6th ed.). New York NY: McGraw – Hill. 759pp. ISBN 0-07-320382-3. (or similar) Engineering Notebook – 9-3/4" x 7-1/2", 5x5 quad-ruled, 80-100 pp. (approx.). REQUIRED Engineering Problems Paper – 8-1/2" x 11", three hole drilled, ruled five squares/division, 50 pp. (approx.). FE Supplied-Reference Tables for Eng. Econ. 3 Engineering Notebook Anything you can copy, cut, staple, paste, glue, or otherwise persuade to live permanently within the covers of your engineering notebook may be used on the exams … EXCEPT old exams and other’s assignments. MUST HAVE in your notebook by next class: FE Supplied-Reference Tables for Eng. Econ. 4 FE Supplied-Reference Tables Go to www.ncees.org Exams Study Materials Download FE Supplied-Reference Handbook Enter e-mail address to receive a password Submit e-mail Enter a valid password to download … Submit password Click the click here to download … save to your desktop Open the Supplied-Reference PDF to Contents page Click Engineering Economics link (page 114) Print these pages out, cut & paste into your Engineering Notebook 5 Course Structure • Grading: • Weighting: •Assignments •Exam I •Exam II •Exam III •Exam IV Bonus Points Percentage 302 20% 20% 20% 20% 20% 5% 6 Policies • Assignments: •Due at class (or earlier), all equal wt. (%) •No late work – drop lowest scoring HW • Exams: •Open engineering notebook •Closed text, etc. •Put FE reference tables in notebook •Make-up Exams •Sponsored activities schedule ahead of time •Otherwise, add extra weight to next midterm •No make-up Final • Bonuses: – add 5%, but no make-ups 7 Assignment #0 Name Preferred name Your SDSM&T E-mail address Course ID Term / Year Your major and anticipated graduation date Your hometown Anything else the instructor should know about you 8 Assignment Structure • Format for most problems: •Find (objective) •Given (organize relevant data, only) •Cash Flow Diagram (rarely dropped) •Soln. (steps to solve): •Write equation in Table Factor Form •Convert to values (or equation forms) •Double underline answer to question • Turn in on EP Paper •Not graded if illegible! 9 Engineering Econ Process • Identify alternative uses for limited resources • Obtain needed data • Analyze data to determine preferred alternative: (usually provided in class) •Screening decisions (meets minimum acceptable?) •Preference decisions (Select from competing alternatives) 10 Typical Decisions • Cost reduction (e.g., equipment, tooling, facility layout) • Capacity expansion (e.g., to increase production, sales) • Equipment / Project selection • Lease or buy decisions • Make or buy decisions • Equipment replacement 11 Fundamental Concept: 12 Lets Get Started… • Would you rather have $10 000 today or $10 000 five years from now? • If you don’t need it right now, what could you do with it? • Would it be worth the same in five years? • Money changes value with time! 13 Risk • Because money changes value over time, it is risky to invest it. • If you need money to do something, you will need to convince someone to finance your project … they will want something in return: • Equity Financing … investor owns part of assets, gets part of the profit or gets (part) of their asset • Debt Financing … investor gets a specified amount of money for their risk within a specified time • Angel Financing … investor gets a token they value The expectation is: Higher Risk Higher Return 14 Rate of Return • (ROR) is the rate of change in value earned over a specific period of time – expressed as a percentage of the original amount ROR = Period Ending Amount – Period Starting Amount x 100% Period Starting Amount • The Rate of Return is a measure of how much risk there is in an investment Higher Risk Higher ROR 15 Rate of Return and Interest • The Interest Rate (i) is the percentage change in value earned over a specific period of time. • For simple interest, a return is earned only on the original amount (principal, p) each period. • If the principal is invested for n periods: Total Interest Earned = (p)(n)(i) Total Money Returned = p + (p)(n)(i) 16 Compound vs Simple Interest • For simple interest, a return is earned only on the original principal each period. • For compound interest, a return is earned on the entire amount (principal + total interest already earned) invested at the beginning of the current period. • • Effectively, you are also earning interest on your interest (and on your investment principal)! Unless explicitly stated otherwise, this course uses compound interest. (And so does the rest of the world!) 17 • • • • Using Compound Interest to Make Economic Decisions … Paid $100,000 for it - 3 years ago Don’t need it now Option 1 – Sell it for $50,000 Option 2 – Lease it for $15,000 for 3 years. Sell it for $10,000 at the end of the lease. Note: Leases typically pay at the beginning of a time period. Loans typically pay at the end of a time period. 18 Questions? • What about the $100,000? •The $100 K is irrelevant - it is a sunk cost, and makes no difference in the decision at this point in time. • How do we select between the options? •We need to know under which conditions we would be economically indifferent (equivalent) - have the same amount of money at the same time - and then if the conditions are better for one option, we will select that option. • Any other factors? •Since we need to account for the time value of money - we need to know the interest rate and the compounding period. 19 Cash Flow Diagrams OPTION 1: $50 k n= 0 1 2 3 YRS F3? OPTION 2: $15 k n= 0 $15 k 1 $15 k 2 $10 k 3 YRS F3? 20 The Question • Under what conditions would I be indifferent between Options 1 & 2? • Indifferent means Economically Equivalent: – Have the same amount of money at same point in time, after accounting for all of the cash flows. – In this case, 3 years from now. • Interest Rates… – Percentage – Compounding annually 21 Future Value in 3 years… I% 2.5% 5.0% 7.5% 10% Option 1 $53,844 $57,881 $62,115 $66,550 Option 2 $57,288 $59,652 $62,094 $64,615 At what interest rate, am I indifferent between the two options? • They are economically equivalent at an interest rate just a little less than 7.5% 22 Option 1 50,000 now i = 10% compounded annually F1 = 50,000 + 50,000 (.10) = 55,000 F2 = 55,000 + 55,000 (.10) = 50,000 (1 + .10)2 = 60,500 F3 = 60,500 + 60,500 (.10) = 50,000 (1 + .10)3 = 66,550 23 Generalizing … P = Present value at the beginning of first period. Fn = Future value at end of n periods in the future. Fn = P (1 + i)n = P (F/P,i,n) so … (F/P,i,n) = (1+i)n 24 Standard Factors Used to Solve ECON Problems ( F / P, i, n) ( P / F, i, n) ( F / A, i, n) ( A / F, i, n) ( P / A, i, n) ( A / P, i, n) ( P / G, i, n) ( A / G, i, n) ( F / G, i, n) Find F Given P Find P Given F Find F Given A Find A Given F Find P Given A Find A Given P Find P Given G Find A Given G Find F Given G 25 Tables… 26 Tables… 27 … or Formulas … 28 … or Formulas … 29 Future Given Present P is the present value at Time 0 F is the future value at Time n (n compounding periods in the future) i is the effective interest rate F? 0 1 2 3 n P F = P(F/P,i,n) 30 Tables… =i F3 = 50 000(F/P,10%,3) = 50 000(1.3310) = $66 550 31 Formulas… F3 = 50 000(F/P, 10%,3) = 50 000(1+.10)3 = 50 000(1.3310) = $66 550 32