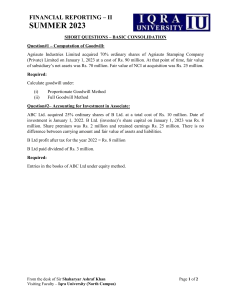

SHORT QUESTIONS – BASIC CONSOLIDATION Question#1 – Computation of Goodwill: Agriauto Industries Limited acquired 70% ordinary shares of Agriauto Stamping Company (Private) Limited on January 1, 2023 at a cost of Rs. 90 million. At that point of time, fair value of subsidiary’s net assets was Rs. 70 million. Fair value of NCI at acquisition was Rs. 25 million. Required: Calculate goodwill under: (i) (ii) Proportionate Goodwill Method Full Goodwill Method Question#2– Accounting for Investment in Associate: ABC Ltd. acquired 25% ordinary shares of B Ltd. at a total cost of Rs. 10 million. Date of investment is January 1, 2022. B Ltd. (investee)’s share capital on January 1, 2023 was Rs. 8 million. Share premium was Rs. 2 million and retained earnings Rs. 25 million. There is no difference between carrying amount and fair value of assets and liabilities. B Ltd profit after tax for the year 2022 = Rs. 8 million B Ltd paid dividend of Rs. 3 million. Required: Entries in the books of ABC Ltd under equity method. Question#3– Purchase Consideration: P purchased 60% of the shares of S on January 1, 2013. At the acquisition date, S had share capital of Rs. 10,000 and retained earnings of Rs. 190,000. The purchase consideration transferred by P in exchange for the shares in S was follows: Cash paid of Rs. 300,000 Cash to be paid in one year’s time of Rs. 200,000 10,000 shares in P. These had a nominal value of Rs. 1 and a fair value at January 1, 2013 of Rs. 3 each. Rs. 250,000 to be paid in one year’s time if S makes a profit before tax of more than Rs. 2 million. There is a 50% chance of this happening. The fair value of this contingent consideration can be measured as the present value of the expected value. Legal fees associated with the acquisition were Rs. 10,000. Where required, a discount rate of 10% should be used. Required: Per IFRS 3, what is the fair value of the consideration transferred to acquire control of S?