Why Invest In Shares?

advertisement

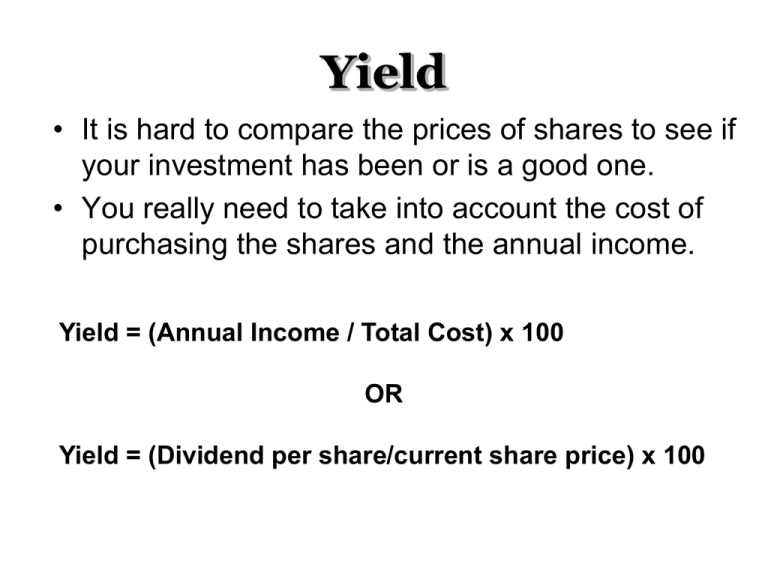

Yield • It is hard to compare the prices of shares to see if your investment has been or is a good one. • You really need to take into account the cost of purchasing the shares and the annual income. Yield = (Annual Income / Total Cost) x 100 OR Yield = (Dividend per share/current share price) x 100 • Depending on the information given you can choose either formula. • The first type of question means that you need to calculate the cost of buying AND the income you will get in the form of a dividend. • The shorter method – that does not take into account the fees that you pay when you buy shares. (less accurate) Price Earnings Ratio The price earnings ratio shows the number of times the share price covers the earnings per share. Eg if a P/E ratio is 14 for BHP shares this indicates that it will take 14 years for the earnings to cover the share price. Assuming the price and returns remain constant. • This ratio is commonly used to ascertain a stock’s relative value, and therefore whether it is over priced. Calculation of Price Earning Ratio • It is calculated daily by dividing the share price by the earnings per share, where earnings per share is the net profit, earned by the company, divided by the number of ordinary shares on issue for the company. The P/E ratio is calculated daily and can be listed in share tables and is calculated by dividing the market value of the company by it’s earning per share. P/E Ratio = Market price per shares / earnings per share The earnings per share are calculated by getting the previous year’s net profit for ordinary shareholders and dividing this by the number of ordinary shares. High P/E ratio may indicate that investors are expecting high growth in earnings in the future. You can really only compare companies from the same industry sector. Earnings Per Share = Net profit for ord shareholders/number of ord shares If the industry is stable then the P/E ratio may be low – like banks. But if there is speculation and a lot of movement then the P/E ratio may be high. • Market conditions will have a strong influence on relative P.E ratios – it does give a snap shot regarding the economic growth of the company.