Transaction Analysis(February, 2009)

advertisement

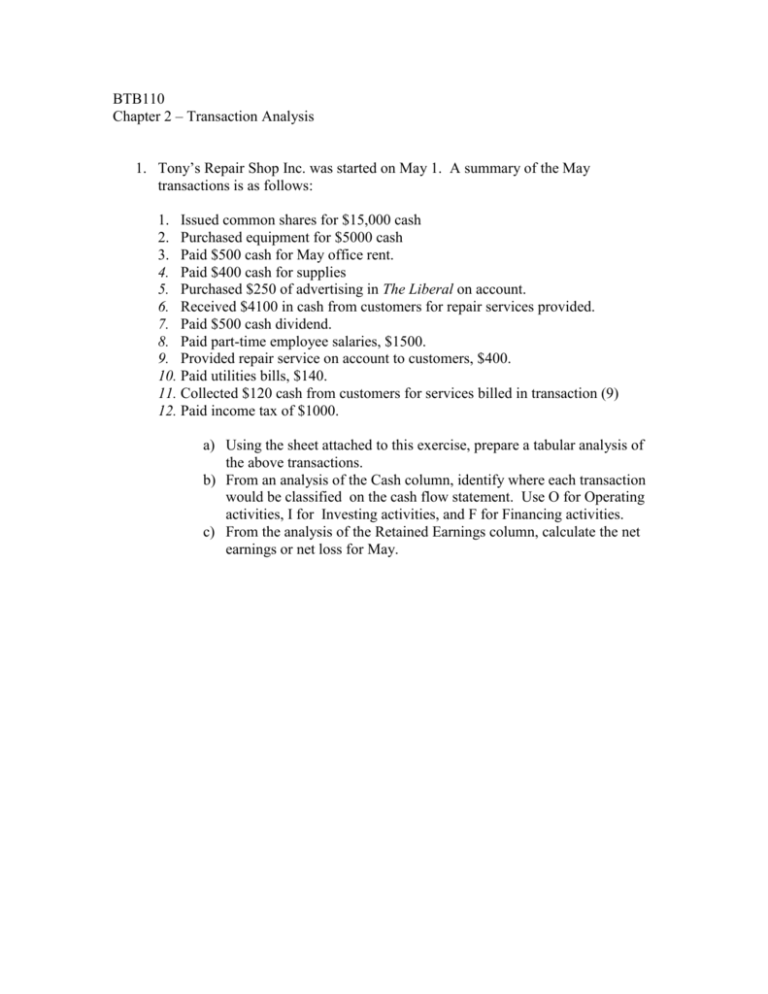

BTB110 Chapter 2 – Transaction Analysis 1. Tony’s Repair Shop Inc. was started on May 1. A summary of the May transactions is as follows: 1. Issued common shares for $15,000 cash 2. Purchased equipment for $5000 cash 3. Paid $500 cash for May office rent. 4. Paid $400 cash for supplies 5. Purchased $250 of advertising in The Liberal on account. 6. Received $4100 in cash from customers for repair services provided. 7. Paid $500 cash dividend. 8. Paid part-time employee salaries, $1500. 9. Provided repair service on account to customers, $400. 10. Paid utilities bills, $140. 11. Collected $120 cash from customers for services billed in transaction (9) 12. Paid income tax of $1000. a) Using the sheet attached to this exercise, prepare a tabular analysis of the above transactions. b) From an analysis of the Cash column, identify where each transaction would be classified on the cash flow statement. Use O for Operating activities, I for Investing activities, and F for Financing activities. c) From the analysis of the Retained Earnings column, calculate the net earnings or net loss for May. Cash Accounts Receivable Assets Supplies Equipment Liabilities Accounts Payable Shareholders’ Equity Common Retained Shares Earnings