01 Error Correction answer key

advertisement

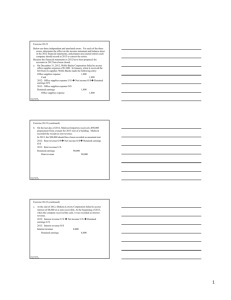

ERROR CORRECTION MULTIPLE-CHOICE ANSWERS 1. a __ __ 4. b __ __ 7. b __ __ 10. c __ __ 2. c __ __ 5. a __ __ 8. b __ __ 11. d __ __ 3. b __ __ 6. c __ __ 9. d __ __ MULTIPLE-CHOICE ANSWER EXPLANATIONS B. Error Correction 1. (a) The correct amount of 2010 interest expense is 2,040, as computed below. 11/1/2009 note Interest from 1/1/2010 to 10/31/2010 (5,000 x 12% x 10/12) 500 2/1/2010 note Interest from 2/1/2010 to 7/31/2010 (15,000 x 12% x 6/12) 900 5/1/2010 note Interest from 5/1/2010 to 12/31/2010 (8,000 x 12% x 8/12) 640 Total 2010 interest 2,040 Since interest expense of 1,500 was recorded, 2010 interest expense was understated by 540 (2,040 – 1,500). 2. (c) The error in understating the 2008 ending inventory would have reversed by 1/1/2010 (2008 income understated by 60,000; 2009 income overstated by 60,000). The error in overstating the 2009 ending inventory would not have been reversed by 1/1/2010. This error overstates both 2009 income and the 1/1/2010 retained earnings balance by 75,000. 3. (b) A correction of an error is treated as a prior period adjustment, recorded in the year the error is discovered, and is reported in the financial statements as an adjustment to the beginning balance of retained earnings. The adjustment is reported net of the related tax effect. In this case the net-of-tax effect is 28,000 [40,000 – (30% x 40,000)]. This should increase beginning retained earnings because the understatement of 12/31/2009 inventory would have resulted in an overstatement of cost of goods sold and therefore an understatement of retained earnings. Thus, the adjustment 1/1/2010 retained earnings is 178,000 (150,000 + 28,000). Tack’s journal entry to record the adjustment is Inventory 40,000 Retained earnings 28,000 Taxes payable 12,000 4. (b) A correction of an error is treated as a prior period adjustment and is reported in the financial statements as an adjustment to the beginning balance of retained earnings in the year the error is discovered. The adjustment is reported net of the related tax effect. In 2009, insurance expense of 60,000 was recorded. The correct 2009 insurance expense was 20,000 ($60,000 x 1/3). Therefore, before taxes, 1/1/2010 retained earnings is understated by 40,000. The net of tax effect is 28,000 [40,000 – (30% x 40,000)], so the adjusted beginning retained earnings is 428,000 (400,000 + 28,000). 5. (a) A change in accounting principle is a change from one generally accepted principle to another generally accepted principle. A correction of an error is the correction of a mathematical mistake, a mistake in the application of an accounting principle, an oversight or misuse of existing facts, or a change from an unacceptable principle to a generally accepted one. Therefore, a switch from the cash basis (unacceptable) to the accrual basis (acceptable) is a correction of an error reported as a prior period adjustment. 6. (c) The requirement is to determine the effect of inventory errors on cost of goods sold. The effect of the errors on Bren’s 2010 cost of goods sold (CGS) is illustrated below. BI +P – 26,000 CGS understated 26,000 CGAS – EI (+ 52,000) CGS understated 52,000 CGS CGS understated 78,000 Beginning inventory is the starting point for the CGS computation, so BI errors have a direct effect on CGS. The understatement of BI (26,000) causes an understatement of goods available for sale (CGAS) and thus of CGS. Ending inventory is subtracted in the CGS computation, so EI errors have an inverse effect on CGS. The overstatement of EI (52,000) means that too much was subtracted in the CGS computation, causing another understatement of CGS. Therefore, CGS is understated by a total of 78,000. 7. (b) The failure to record the 300,000 of deferred compensation expense in 2009 is considered an error. The profession requires that the correction of an error be treated as a prior period adjustment. Thus, the requirement is to determine the retroactive adjustment that should be made to the beginning balance of the retained earnings for 2010 (including any income tax effect). The net adjustment to beginning retained earnings would be a debit for 230,000 (300,000 less the income tax benefit of 70,000). 8. (b) The depreciable base used to compute depreciation expense under both the straight-line and production methods is equal to the cost less estimated salvage value of the asset. Depreciation expense is overstated and net income is, therefore, understated when the estimated salvage value is excluded from the depreciation computation under both of these methods. 9. (d) The entry Ritzcar should have made to accrue sales commissions earned but unpaid at the end of its 2009 fiscal year is Commission expense xxx Commissions payable xxx Since Commissions payable is a current liability, the 2009 ending working capital is overstated due to Ritzcar’s failure to record this entry. Since this error was not repeated at the end of Ritzcar’s 2010 fiscal year, the income impact of the 2009 error “self-corrected” during 2010, when Ritzcar recorded both the earned but unpaid 2009 commissions plus the 2010 earned commissions. Therefore, the 2010 ending retained earnings would not be impacted by the error. 10. (c) A liability is accrued when an obligation to pay or perform services has been incurred. This is the case even if the liability will not be satisfied until a future date. Therefore, accrued liabilities will be understated on the December 31, 2010 balance sheet because the special insurance costs were not recorded. However, there will be no effect on the December 31, 2010, balance of retained earnings because these costs relate to work in process, and work in process does not affect net income currently. Please note that if the special insurance costs related to goods that were sold, cost of goods sold would have been understated that would have caused both net income and retained earnings to be overstated. 11. (d) The classification of holiday pay expense for administrative employees as manufacturing overhead would result in the capitalization of some or all of these costs as a component of ending inventory, while these costs should be expensed as incurred. This error could overstate ending inventory, a current asset. The overstatement of ending inventory also understates the cost of goods sold (Beginning inventories + Net purchases – Ending inventories = Cost of goods sold), and overstates net income and stockholders’ equity. The understatement of accrued sales expenses would not affect current assets. The misclassification of the noncurrent note receivable principal as a current asset would have no impact on stockholders’ equity. The understatement of depreciation on manufacturing machinery would understate the overhead added to inventories, a current asset. Simulation Problem is in page 260