6. The Accounting Period Concept

advertisement

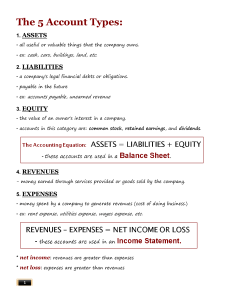

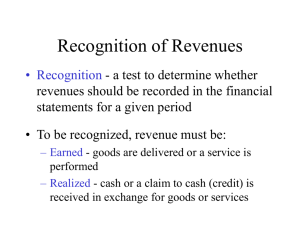

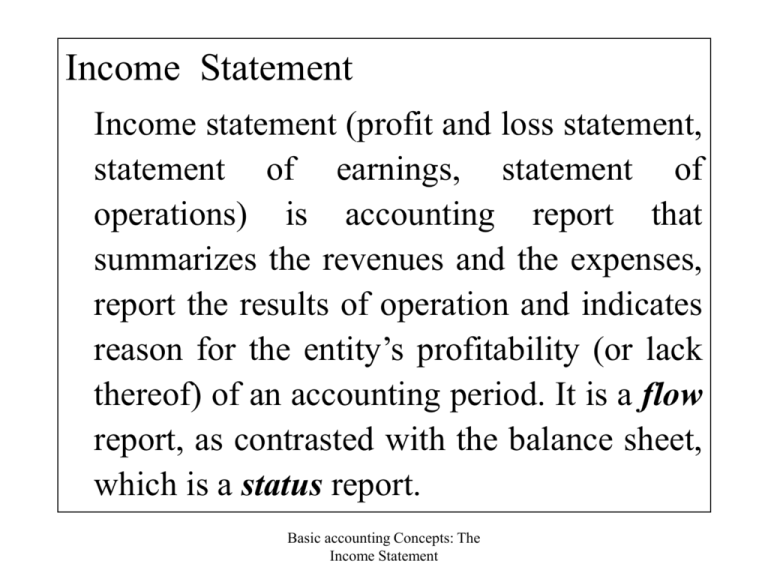

Income Statement Income statement (profit and loss statement, statement of earnings, statement of operations) is accounting report that summarizes the revenues and the expenses, report the results of operation and indicates reason for the entity’s profitability (or lack thereof) of an accounting period. It is a flow report, as contrasted with the balance sheet, which is a status report. Basic accounting Concepts: The Income Statement Basic Business Financial Flows Cash Purchasing or production activities Collection activities Accounts receivable Inventories Earnings activities Basic accounting Concepts: The Income Statement 6. The Accounting Period Concept Accounting measures activities for a specified interval of time, called the accounting period. 7. The Conservatism Concept This concept suggests the period when revenue and expense should be recognized. – Recognize revenues (increases in retained earnings) only when they are reasonably certain. – Recognize expenses (decreases in retained earnings) as soon as they are reasonably possible. Basic accounting Concepts: The Income Statement 8. The Realization Concept This Concept indicates the amount of revenue that should be recognized from given sale, refers to inflows of cash or claim to cash arising from sale of goods or services. ... That the amount recognized as revenue is the amount that is reasonably certain to be realized. 9. The Matching Concept When a given event affect both revenues and expenses, the effect on each should be recognized in the same accounting period. Basic accounting Concepts: The Income Statement 10.The Consistency Concept This concept states that once an entity has decided on one accounting method it should use the same method for all subsequent events of the same character unless it has a sound reason to change methods. 11.The Materiality Concept The Accountant does not attempt to record events so insignificant that the work of recording them is not justified by the usefulness of the results. Basic accounting Concepts: The Income Statement GARSDEN CORPORATION Income Statement For the Year Ended December 31, 2000 Net sales Cost of sales Gross margin Research and development expense Selling, general, and administrative expenses Operating income Other revenues (expenses): Interest expense Interest and divident revenues Royalty revenues Income before income taxes Provision for income taxes Net income Earning per share of common stock 75,478,221 52,227,004 23,251,217 2,158,677 8,726,696 (363,000) 43,533 420,010 10,885,373 12,365,844 100,543 12,466,387 4,986,555 7,479,832 6.82 STATEMENT OF RETAINED EARNINGS Retained earning at geginning of year Add: Net income Deduct: Dividents ($4 per common share) Reatained earning at end of year Basic accounting Concepts: The Income Statement 16,027,144 7,479,832 (4,390,000) 19,116,976