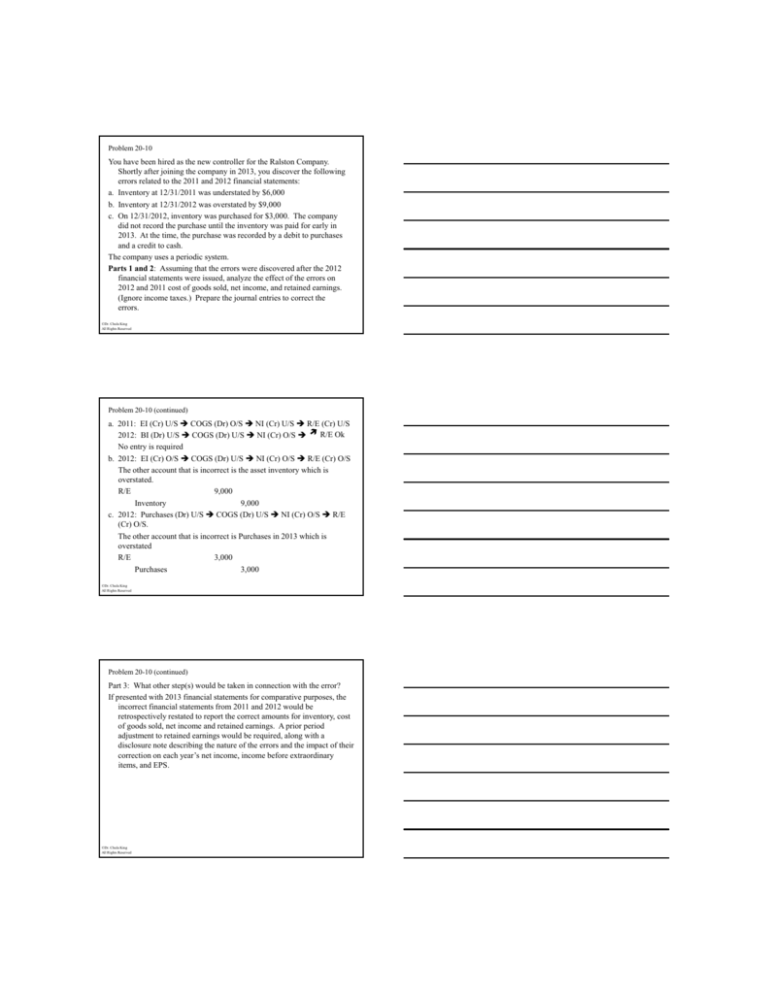

Problem 20-10

You have been hired as the new controller for the Ralston Company.

Shortly after joining the company in 2013, you discover the following

errors related to the 2011 and 2012 financial statements:

a. Inventory at 12/31/2011 was understated by $6,000

b. Inventory at 12/31/2012 was overstated by $9,000

c. On 12/31/2012, inventory was purchased for $3,000. The company

did not record the purchase until the inventory was paid for early in

2013 At the time,

2013.

time the purchase was recorded by a debit to purchases

and a credit to cash.

The company uses a periodic system.

Parts 1 and 2: Assuming that the errors were discovered after the 2012

financial statements were issued, analyze the effect of the errors on

2012 and 2011 cost of goods sold, net income, and retained earnings.

(Ignore income taxes.) Prepare the journal entries to correct the

errors.

©Dr. Chula King

All Rights Reserved

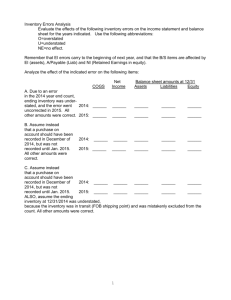

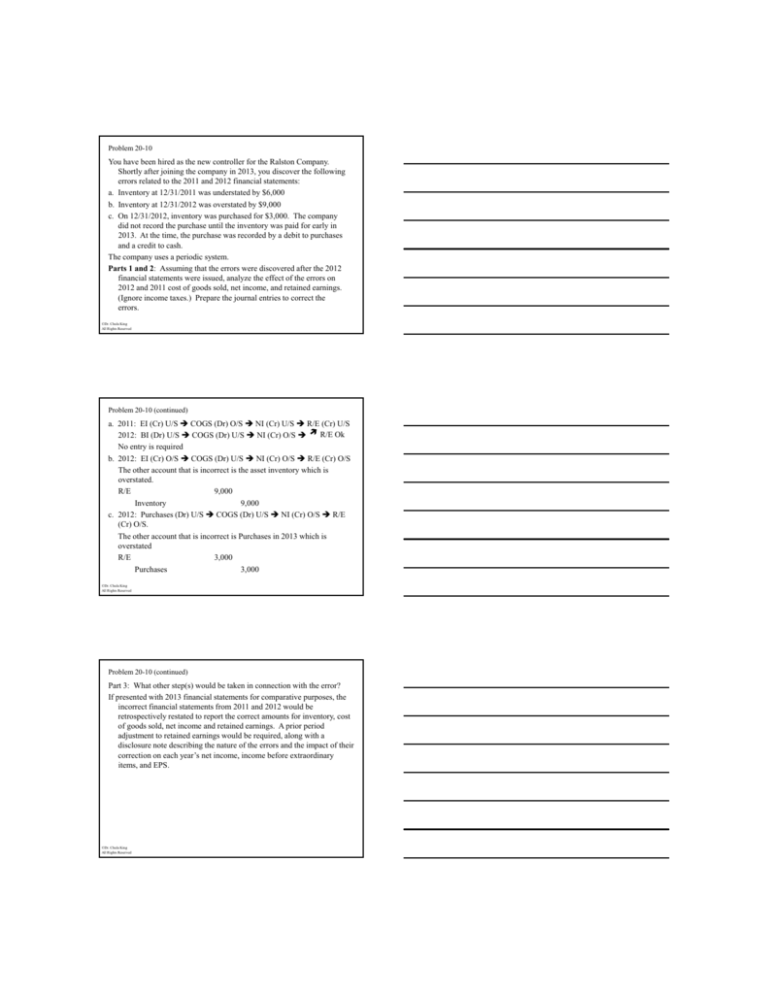

Problem 20-10 (continued)

a. 2011: EI (Cr) U/S COGS (Dr) O/S NI (Cr) U/S R/E (Cr) U/S

R/E Ok

2012: BI (Dr) U/S COGS (Dr) U/S NI (Cr) O/S

No entry is required

b. 2012: EI (Cr) O/S COGS (Dr) U/S NI (Cr) O/S R/E (Cr) O/S

The other account that is incorrect is the asset inventory which is

overstated.

R/E

9,000

Inventory

9,000

c. 2012: Purchases (Dr) U/S COGS (Dr) U/S NI (Cr) O/S R/E

(Cr) O/S.

The other account that is incorrect is Purchases in 2013 which is

overstated

R/E

3,000

Purchases

3,000

©Dr. Chula King

All Rights Reserved

Problem 20-10 (continued)

Part 3: What other step(s) would be taken in connection with the error?

If presented with 2013 financial statements for comparative purposes, the

incorrect financial statements from 2011 and 2012 would be

retrospectively restated to report the correct amounts for inventory, cost

of goods sold, net income and retained earnings. A prior period

adjustment to retained earnings would be required, along with a

disclosure note describing the nature of the errors and the impact of their

correction on each yyear’s net income,, income before extraordinary

y

items, and EPS.

©Dr. Chula King

All Rights Reserved