principles of accounting acct 101 assignment 1

advertisement

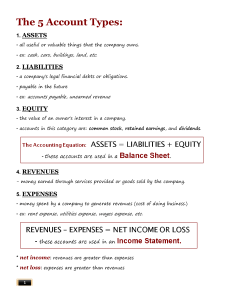

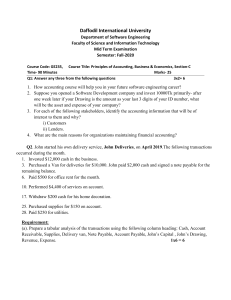

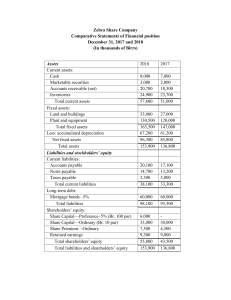

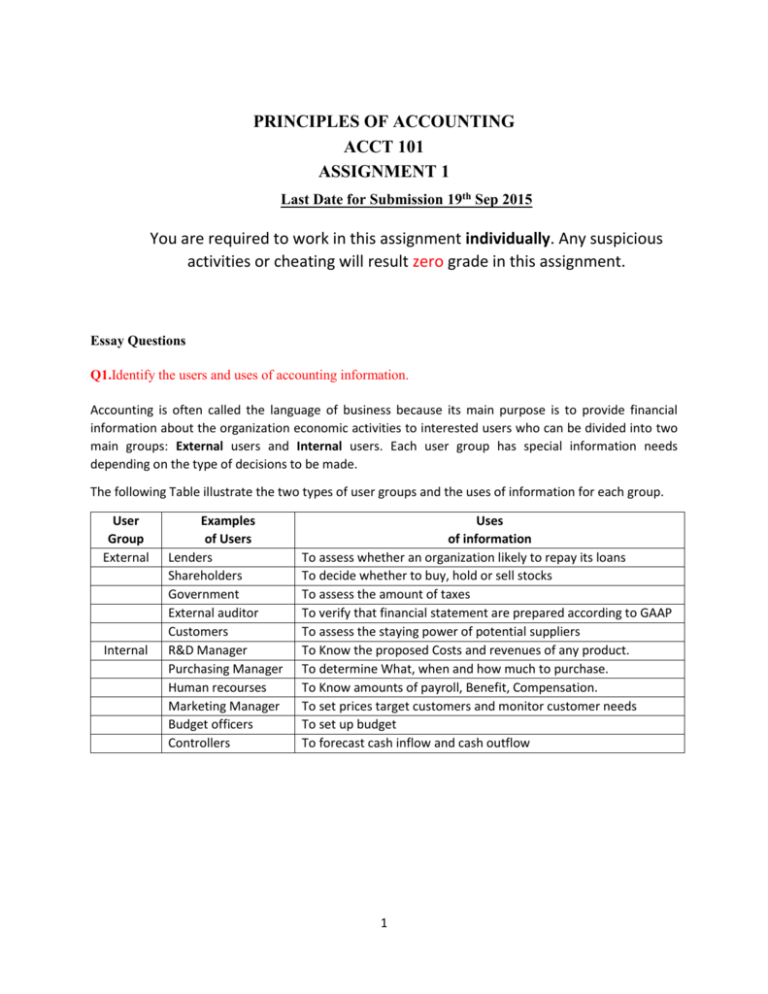

PRINCIPLES OF ACCOUNTING ACCT 101 ASSIGNMENT 1 Last Date for Submission 19th Sep 2015 You are required to work in this assignment individually. Any suspicious activities or cheating will result zero grade in this assignment. Essay Questions Q1.Identify the users and uses of accounting information. Accounting is often called the language of business because its main purpose is to provide financial information about the organization economic activities to interested users who can be divided into two main groups: External users and Internal users. Each user group has special information needs depending on the type of decisions to be made. The following Table illustrate the two types of user groups and the uses of information for each group. User Group External Internal Examples of Users Lenders Shareholders Government External auditor Customers R&D Manager Purchasing Manager Human recourses Marketing Manager Budget officers Controllers Uses of information To assess whether an organization likely to repay its loans To decide whether to buy, hold or sell stocks To assess the amount of taxes To verify that financial statement are prepared according to GAAP To assess the staying power of potential suppliers To Know the proposed Costs and revenues of any product. To determine What, when and how much to purchase. To Know amounts of payroll, Benefit, Compensation. To set prices target customers and monitor customer needs To set up budget To forecast cash inflow and cash outflow 1 Q2.Identify the two main groups involved in establishing generally accepted accounting principles in the U.S. In the united states the securities and exchange commission (SEC) has the legal authority to set generally accepted accounting principles. The SEC has largely delegated the task of setting U.S GAAP to the financial Accounting Standard board (FASB), Which is a private sector group that sets both board and specific principles. Q3.Identify and describe the four basic financial statements. The four basic financial statement and their purpose are 1. Income statement: Describes a company’s revenues and expenses along with the resulting net income or loss over a period of time due to earnings activities. 2. Statement of Retained Earnings Explains changes in retained earnings from net income or loss and from any dividends over a period of time. 3. Balance sheet. Describe a company’s financial position at point in time which includes assets, liabilities and equity. 4. Statement of Cash flow Identifies cash inflow and cash outflow over a period of time. Q4.A company purchased $7,000 of supplies and testing equipment on credit. Enter the appropriate amounts that reflect this transaction into the accounting equation format shown below. Assets = Liabilities + + $7,000 + $7,000 2 Equity Q5. Flora Accounting Services completed these transactions in February: a. Purchased office supplies on account, $300 b. Completed work for a client on credit, $500 c. Paid cash for the office supplies purchased in (a) d. Completed work for a client and received $800 cash e. Received $500 cash for the work described in (b). Prepare journal entries to record the above transactions. Date A B C D E Explanation Dr. $300 Supplies Accounts Payable Accounts Receivable Services Revenue Accounts Payable Cash Cash Services Revenue Cash Accounts Receivable Cr. $300 500 500 300 300 800 800 500 500 3