Module 4

advertisement

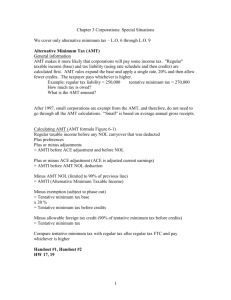

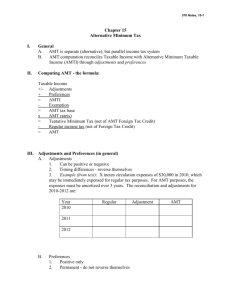

Module 16 AMT and Other Special Corporate Taxes Module Topics Corporate alternative minimum tax Personal holding company tax Accumulated earnings tax The Corporate Alternative Minimum Tax Key Learning Objectives Understand the parallel income tax system of corporate taxation Know how to minimize the alternative minimum tax liability AMT Background Policy reason History of individual and corporate provisions Compliance burden AMT Concepts Parallel tax system AMT is a separate tax system Differences will exist between regular taxable income and AMTI Prepayment system AMT accelerates income and defers deductions Minimum tax credit available for future years Corporate AMT Formula Taxable income Plus NOL deduction Plus tax preferences Plus/minus adjustments Tentative AMTI Plus/minus 75% ACE adjustment Minus ATMNOL (90% limit) AMTI Minus exemption AMT base (continued) Corporate AMT Formula ATM Base x 20% Tentative minimum tax before FTC Minus AMT FTC (90% limit) Tentative minimum tax Minus regular tax (after FTC) AMT (if positive) AMT Relief for Small Business C Corporations The Taxpayer Relief Act of 1997 Beginning in 1998 Small business C corporations do NOT need to compute the AMT AMT Relief for Small Business C Corporations Requirements for exemption Average gross receipts of less than $5,000,000 for the prior three years. If a new entity not a continuation of a prior business automatically exempt for its initial year Common Tax Preferences Tax-exempt interest on private activity bonds Excess accelerated depreciation on pre-87 realty Excess percentage depletion Excess intangible drilling costs Common ± Adjustments Post-86 realty 40-year straight line Post-86 personality 150% on regular recovery period Property transaction gains and losses Long-term contracts Compliance Query: AMT Depreciation Adjustments ABC Corporation purchased $30,000 of office furniture in June. It elected to expense $20,000 under §179. The furniture is 7-year property 200% declining balance for MACRS 150% declining balance for ADS prior to 1998, ADS was generally also a longer recovery period What is the AMT depreciation adjustment? Solution--Compliance Query: AMT Depreciation Adjustments Cost Sec. 179 expense Depreciable basis 30,000 20,000* 10,000 *allowed for both regular tax and AMT MACRS: 10,000 x .1429 = 1,429 ADS: 10,000 x .1071 = 1,071 AMT adjustment (+) 358 75% ACE Adjustment ACE is another parallel tax system Adjustment can be positive or negative Limit on negative adjustment ACE is a hybrid between AMTI and E&P Complex calculation rules apply Depreciation adjustments E&P adjustments Exclusion adjustments Compliance Query: Calculating the ACE Adjustment Tentative AMTI = 300,000 (1) ACE = 360,000 (2) ACE = 260,000 Prior years’ net positive adjustment: 22,000 What is the ACE adjustment for (1) and (2)? Solution--Compliance Query: Calculating the ACE Adjustment (1) ACE AMTI Difference Positive ACE adjustment 360,000 300,000 60,000 x 75% 45,000 Solution--Compliance Query: Calculating the ACE Adjustment (2) ACE AMTI Difference 260,000 300,000 <40,000> x 75% Computed ACE adjustment <30,000> Limited to <22,000> AMT Exemption $40,000 Reduced by .25 x (AMTI - $150,000) Compliance Query: Calculating the AMT Exemption XYZ Corporation has AMTI of $270,000 What is the statutory exemption and AMT base? Solution--Compliance Query: Calculating the AMT Exemption Exemption: 40,000 - .25(270,000-150,000) = 10,000 AMTI Exemption AMT Base 270,000 10,000 260,000 Personal Holding Company Tax Key Learning Objectives Recognize the conditions in which the personal holding company tax applies Know the components of the tax computation Explore opportunities for avoiding the tax PHC Tax--Overview Penalty tax on “incorporated pocketbooks” 39.6% rate applied to undistributed PHCI Tax can be avoided by making sufficient dividend distributions PHC Definition C Corps are PHCs if they meet: • Stock ownership test, and • Passive income test Stock Ownership Test 5 or fewer individual shareholders... Own > 50% in value of the stock… Sec. 544 stock attribution rules apply At any time during last half of year Passive Income Test PHCI ÷ AOGI 60 Common PHCI items: Dividends; interest; annuities; rents; royalties; certain personal service contracts AOGI typically consists of: Ordinary gross income Less certain rent and royalty related expenses Compliance Query: Z Corporation has 5 shareholders and the following income for the year: Gross merchandising income Capital gains Interest income Dividend income Adjusted income from rents Is Z corporation a PHC? 80,000 40,000 45,000 35,000 30,000 Solution--Compliance Query: PHCI = 110,000 (45,000 + 35,000 + 30,000) AOGI = 190,000 (80,000 + 110,000) PHCI AOGI = .579 Z Corporation is not a PHC Exclusions From PHCI for Adjusted Income From Rents Rent is excluded from PHCI if: AIR 50% of AOGI and Dividends paid (non-rental PHCI - 10% of OGI) Computing the Personal Holding Company Tax Taxable income Plus positive adjustments Minus negative adjustments Adjusted taxable income Minus dividends paid deduction Undistributed PHCI x .396 PHC tax Common Adjustments Positive Dividend received deduction NOL deduction from other than preceding year Charitable deduction carryover Negative Federal income taxes Charitable contributions > 10% limit Net capital gain (net of tax) The Dividends Paid Deduction Current-year dividends Grace period dividends 2.5 month and 20% rules Consent dividends Liquidating dividends Dividend carryovers Deficiency dividends Avoiding the PHC Tax Pay dividends! Monitor rent so that it does not fall below 50% of AOGI Do not lag when liquidating a corporation Monitor passive income sources Disperse stock ownership Accumulated Earnings Tax Key Learning Objectives Recognize the conditions in which the accumulated earnings tax applies Know the components of the tax computation Explore opportunities for avoiding the tax Accumulated Earnings Tax Overview Penalty tax on unreasonably accumulated income 39.6% rate applied to accumulated taxable income Tax can be avoided by making sufficient dividend distributions Motivations to Accumulate Earnings Low marginal tax rates (15%; 25%) on first $75,000 of income Retained funds invested in corporate stock eligible for 70% or 80% dividend received deduction Shareholders can hold, then sale their shares and get capital gain treatment Establishing a Tax Avoidance Purpose Tax applies if tax avoidance is one of the purposes of accumulating income It need not be the dominant or controlling purpose “Preponderance of Evidence” and Reasonable Business Needs If a corporation has accumulated its earnings beyond the reasonable needs of the business... It must prove by the preponderance of the evidence that the accumulation was not to avoid tax Reasonable Business Needs “Good” Reasons To provide for bona fide expansion of business or replacement of plant To acquire a business enterprise through purchasing stock or assets To provide for the retirement of bona fide indebtedness created in connection with the trade or business Reasonable Business Needs More “Good” Reasons To provide necessary working capital for the business Bardahl formula To provide for investments or loans to suppliers or customers if necessary To provide for the payment of reasonably anticipated product liability losses Key Factors Plans to use accumulated earnings must be Specific Definite Feasible Research Query Does the tax law specify any “bad” reasons for accumulating earnings? “Bad” Reasons to Accumulate Reg. § 1.537-2(c) Loans to shareholders, relatives, or friends Corporate funds used for personal benefit Investments in properties or securities unrelated to corporation’s business activities Protection against unrealistic hazards Determining the Accumulated Earnings Tax Taxable income Plus positive adjustments Minus negative adjustments Adjusted taxable income Minus dividends paid deduction Minus accumulated earnings credit Accumulated taxable income x .396 Accumulated earnings tax Common Adjustments Positive adjustments Capital loss carryovers and carrybacks Dividends received deduction Net operating loss deduction Charitable deduction carryovers Negative adjustments Federal income taxes Charitable contributions > 10% limit Net capital gains (net of tax) The Dividends Paid Deduction Current-year dividends Grace period dividends No 20% rule Consent dividends Liquidating dividends The Accumulated Earnings Tax Credit Safe harbor minimum $250,000 (less accumulated earnings at end of last year) Use $150,000 for certain service companies Maximum credit Earnings needed to meet reasonable business needs (less accumulated earnings at end of last year)