CH 15

advertisement

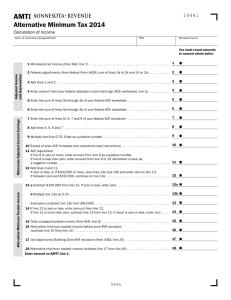

570 Notes, 15-1 Chapter 15 Alternative Minimum Tax I. General A. AMT is separate (alternative), but parallel income tax system B. AMT computation reconciles Taxable Income with Alternative Minimum Taxable Income (AMTI) through adjustments and preferences II. Computing AMT - the formula: Taxable Income +/- Adjustments + Preferences = AMTI Exemption = AMT tax base x AMT rate(s) = Tentative Minimum Tax (net of AMT Foreign Tax Credit) Regular income tax (net of Foreign Tax Credit) = AMT III. Adjustments and Preferences (in general) A. Adjustments 1. Can be positive or negative 2. Timing differences - reverse themselves 3. Example (from text): X incurs circulation expenses of $30,000 in 2010, which may be immediately expensed for regular tax purposes. For AMT purposes, the expenses must be amortized over 3 years. The reconciliation and adjustments for 2010-2012 are: Year 2010 Regular 2011 2012 B. Preferences 1. Positive only 2. Permanent - do not reverse themselves Adjustment AMT 570 Notes, 15-2 IV. Exemption Amounts Individual Taxpayers C Corporations Single Married, Joint Married, Sep. Initial Exemption Phaseout V. $46,700 $70,950 $35,475 $40,000 25% (AMTI > $112,500) 25% (AMTI > $150,000) 25% (AMTI > $75,000) 25% (AMTI > $150,000) AMT Rates Individual Taxpayers VI. 26% on 1st $175,000 ($87,500 MFS) of base 28% on excess C Corporations Flat 20% Taxpayers Affected by AMT A. Individuals - everyone B. C Corporations 1. Small corporations are exempt. a. “Small” is defined as average annual gross receipts of less than $7.5 million for the 3-year period preceding the tax year. ($5m in the 1st 3 years of corporate life) b. Corporations are automatically classified as small in the 1st year of existence. C. S Corporations? VII. AMT Credit A. Reason available is to prevent having to pay tax at the highest rates on the timing differences, i.e., when positive, the AMT applies, but when negative, the regular tax applies. B. Offsets regular income tax liability. C. Applies ONLY to adjustments that are timing differences D. See examples 26-28. 570 Notes, 15-3 VIII. Adjustments Applicable to All Taxpayers Item: Circulation Expenditures Treatment under: Regular Taxable Income AMT Expense immediately Amortize over 3 years Depreciation - Real Property 1987-1998 placed in service MACRS (S/L) over 27.5, 31.5, ADS (S/L) over 40 yrs. or 39 yrs. MACRS (S/L) over 27.5 or 39 yrs. Same as regular taxable income MACRS (200% DB), class lives ADS (150% DB), longer lives MACRS (200% DB) over class lives; §179; bonus ADS (150% DB) over class lives; §179 & bonus same Pollution Control Facilities 1987-1998 placed in service Amortize over 60 mo. ADS over appropriate AMT class lives MACRS Same as regular taxable income 10-yr. Write-offs: Mining Exploration & Development Costs; Research & & Experimental Expenditures Expensed as incurred Amortized over 10 yrs. Long-Term Contract Revenue Recognition Completed contract may be allowed Percentage of completion only Gain or loss on sale of asset SP - adjusted basis Same as regular tax, but using AMT methods NOLs Operating loss, CB 2, CF 20 Same as regular tax, but using AMT methods & 90% limit on offset Post-1998 placed in service Depreciation - Personalty 1987-1998 placed in service Post-1998 placed in service Post-1998 placed in service 570 Notes, 15-4 IX. Adjustments Applicable ONLY to Individuals Item: Incentive Stock Options (ISOs) Treatment under: Regular Taxable Income AMT No income at exercise Recognize income (FMV - cost) when forfeiture provision expires (or exercise if later). Basis is increased for income recognized. Passive Activity Losses Can use only to offset Passive Activity Income Same as regular tax, but using AMT methods Itemized Deductions medical > 7.5% AGI taxes interest casualty losses charitable contributions miscellaneous phaseout (3% AGI > certain amt.) Standard deduction Personal & dependency exemptions Other adjustments medical >10% AGI only IRD estate tax interest, but only home acquisition debt investment interest included in AMTI casualty losses charitable contributions only gambling losses phaseout does NOT apply Not allowed Not allowed 570 Notes, 15-5 X. Adjustments Applicable ONLY to Corporations A. The ACE (Adjusted Current Earnings) Adjustment: B. 1. ACE Adjustment = 75% x (ACE - AMTI before ACE) 2. ACE employs earnings & profits concepts 3. ACE adjustment can be + or -, but the negative adjustment is limited to the net of the positive adjustments for prior years. Impact of Various Transactions on ACE and E&P (for Ch. 19) Effect on Transaction Unadjusted AMTI in Arriving at ACE Tax-exempt income (net of expenses) Add Dividends received deduction (70% rule) Add Key employee insurance proceeds Add Intangible drilling costs deducted currently Add Deferred gain on installment sales Add Loss on sale between related parties Subtract Net buildup on life insurance policy Add LIFO recapture (LIFO > FIFO) Add Effect on Taxable Income in Arriving at E&P Add Add Add Add Add Subtract Add Add Exemption amount of $40,000 Federal income tax Dividends received deduction (80% & 100% rules) Excess capital losses Disallowed travel & entertainment expenses Penalties and fines Excess charitable contribution No effect No effect No effect No effect Subtract Add No effect No effect Subtract Subtract No effect No effect Subtract Subtract 570 Notes, 15-6 XI. Preferences - Applicable to All Taxpayers Item: Percentage Depletion Regular Taxable Income No aggregate limit on % depletion, so Accum. Depl. can exceed basis Intangible Drilling Costs (IDC) Expense as incurred. Private Activity Bond Interest Income Exempt Depreciation - Real Property and Leased Personal Property (PRE - 1987 placed in service) ACRS, class lives Preferences – Applicable to Individual Taxpayers Only § 1202 Stock 50% of Gain Excluded Treatment under: AMT % depletion cannot exceed basis. Add back any amounts exceeding basis. Preference for Excess IDC= IDC incurred this yr. - IDC / 10 yrs - 65% of net oil/gas income Taxable ADS (S/L), AMT lives (longer) 7% of the 50% excluded amount is preference XII. Example of the basis adjustment: Bob acquires an asset for $100,000 in 2010. Depreciation for regular tax is: 2010 = $33,000; 2011 = $25,000. Depreciation for AMT is: 2010 = $26,000; 2011 = $21,000. Bob sells the asset in 2012 for $50,000. Regular Tax 2010 2011 2012 Adjustment AMT