Chapter 3

Corporations: Special

Situations

Corporations, Partnerships,

Estates & Trusts

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

The Big Picture (slide 1 of 2)

Determining DPGR for the Domestic Production Activities

Deduction

• Mocha, Inc., produces and sells its ice cream to food stores

and restaurants.

– Mocha also operates snack shops next to its facilities where it sells ice

cream, coffee, and other snacks to the general public.

•

Mocha has gross receipts of $42 million from the wholesale

sale of its ice cream and $5 million from the operation of the

snack shops.

– What receipts are considered to be domestic production gross receipts

(DPGR) for the domestic production activities deduction (DPAD)?

• What planning tip might you give to Mocha?

– Read the chapter and formulate your response.

The Big Picture (slide 2 of 2)

Who Pays the alternative minimum tax (AMT)?

• Carmine, Inc., has a tentative minimum tax base of $7

million and average gross receipts for this year and

the prior 3 years of < $7.5 million.

• Taupe, Inc., has a tentative minimum tax base of $7.1

million and average gross receipts for this year and

the prior 3 years of < $7.5 million.

• Carmine is not subject to the AMT, but Taupe is.

• How can this happen?

– Read the chapter and formulate your response.

Domestic Production

Activities Deduction (slide 1 of 5)

• The American Jobs Creation Act of 2004 created a

new deduction, the domestic production activities

deduction (DPAD)

– Based on income from manufacturing activities

– Calculated using the following formula:

• 9% × Lesser of

– Qualified production activities income

– Taxable income (or modified AGI) or AMTI

– The deduction cannot exceed 50% of an employer’s W–2

wages properly allocable to domestic production gross

receipts

Domestic Production

Activities Deduction (slide 2 of 5)

• A phase-in provision increased the

applicable rate for the production activities

deduction as follows:

Rate

Years

3%

2005-2006

6%

2007-2009

9%

2010 and thereafter

Domestic Production

Activities Deduction (slide 3 of 5)

• Eligible taxpayers include:

– Individuals, partnerships, S corporations, C

corporations, cooperatives, estates, and trusts

• For a pass-through entity (e.g., partnerships, S

corporations), the deduction flows through to the

individual owners

• For sole proprietors, a deduction for AGI results

• For C corporations, the deduction is included with other

expenses in computing corporate taxable income

Domestic Production

Activities Deduction (slide 4 of 5)

• Qualified production activities income is the

excess of domestic production gross receipts

over:

– Cost of goods sold (CGS)

– Direct costs

– Allocable indirect costs

Domestic Production

Activities Deduction (slide 5 of 5)

• Domestic production gross receipts (DPGR) include

receipts from:

– Lease, rental, license, sale, exchange, or other disposition

of qualified production property (QPP) that was

manufactured, produced, grown, or extracted in the U.S.

– Qualified films largely created in the U.S.

– Production of electricity, natural gas, or potable water

– Construction performed in the U.S.

– Engineering and architectural services for domestic

construction

Disallowed Production ActivitiesPreparation of Food & Beverages

• DPGR does not include gross receipts

from the sale of food & beverages

prepared by a taxpayer at a retail

establishment

– There is a 5 percent de minimis safe harbor

The Big Picture – Example 20

DPGD – 5% De Minimis Rule

• Return to the facts of The Big Picture on p. 3–2.

• Suppose that Mocha has the following sales:

– $42 million from the wholesale sale of its ice cream, and

– Only $2 million from the snack shops next to its facilities

where it sells ice cream to the general public.

• The full $44 million is DPGR

– The $2 million falls under the de minimis safe-harbor

exception

– $2 million is less than 5% of $44 million ($42 million + $2

million).

Alternative Minimum Tax

(slide 1 of 3)

• Designed to ensure that corporations with

substantial economic income pay at least a

minimum amount of federal taxes

• Essentially, a separate tax system with a quasiflat tax rate applied to a corporation’s

economic income

Alternative Minimum Tax

(slide 2 of 3)

• If tentative alternative minimum tax > regular

corporate income tax, corporation must pay

regular tax plus the excess, the alternative

minimum tax (AMT)

Alternative Minimum Tax

(slide 3 of 3)

• For tax years beginning after 1997, many small

corporations are not subject to AMT

– A small corporation has average annual gross

receipts of $5 million or less for the preceding

three-year period

– Small corporation continues to qualify as long as

average gross receipts for the preceding three-year

period do not exceed $7.5 million

The Big Picture – Example 25

Small Corporation Exemption

• Return to the facts of The Big Picture on p. 3–2.

• Suppose that Carmine, Inc., had gross receipts

of $3.7 million, $4.8 million, and $4.6 million

for tax years 2008, 2009, and 2010,

respectively, for an average of $4.37 million.

– For 2011 AMT purposes, Carmine is considered to

be a small corporation.

AMT Formula for Corporations

AMT Adjustments (slide 1 of 2)

• The starting point for computing AMTI is taxable

income before any NOL deduction

– Certain adjustments must be made to this amount

• Tax preference items are always additions to taxable

income

• AMT adjustments may either positive or negative

– Positive adjustments result from timing differences

• Added to taxable income in computing AMTI

– When AMT adjustments reverse, they are

deducted from taxable income to arrive at AMTI

AMT Adjustments (slide 2 of 2)

• AMT adjustments may either increase or

decrease taxable income

– e.g., The deduction for domestic manufacturing

activities (DPAD) is available for AMT purposes

• DPAD for AMT is limited to the smaller of qualified

production income as determined for the regular income

tax or for AMTI before the manufacturing deduction

Adjustments for AMT (slide 1 of 2)

• A portion of depreciation on property placed in

service after 1986

• Difference between gain (loss) on sale of

property for regular tax and AMT purposes

• Passive activity losses of certain closely held

corporations and personal service corporations

• Mining exploration and development costs in

excess of allowed AMT 10 year amortization

Adjustments for AMT (slide 2 of 2)

• Difference between percentage of completion

and completed contract income

• Amortization claimed on certified pollution

control facilities

• Difference between installment gain and total

gain on certain dealer sales

• A portion of the difference between “ACE”

and unadjusted AMTI

Tax Preference Items

• Accelerated depreciation on real property in excess of

straight-line for property placed in service before

1987

• Tax-exempt interest on “private activity bonds”

– Interest on such bonds issued in 2009 and 2010 is not

treated as a tax preference

• Percentage depletion in excess of the adjusted basis

of property

• Certain intangible drilling costs for “integrated oil

companies”

ACE Adjustment

(slide 1 of 3)

• Ace adjustment = 75% of difference between

unadjusted AMTI and ACE

– Can be positive or negative

– Negative adjustment is limited to aggregate

positive adjustments less previous negative

adjustments

ACE Adjustment

(slide 2 of 3)

• Starting point for determining ACE is AMTI

– AMTI is defined as regular taxable income after

AMT adjustments and tax preferences (other than

the NOL and ACE adjustments)

ACE Adjustment

(slide 3 of 3)

• AMTI is adjusted to arrive at ACE

– These adjustments include:

• Exclusion items—Income items that will never be

included in regular taxable income or AMTI

• Disallowed items – e.g., dividends received deduction

of 70% (less than 20% ownership)

• Other adjustments items including, for example,

intangible drilling costs, circulation expenditures,

organization expense amortization, LIFO inventory

adjustments, installment sales, other items

Impact of Certain

Transactions on ACE

Transaction

Effect on

Unadjusted

AMTI in Arriving

at ACE

Tax exempt income (less expenes)

Add

Federal income tax

Dividends received deduction (70%)

No Effect

Add

DRD (80% and 100%)

No Effect

Exemption ( up to $40,000)

No Effect

Key employee insurance proceeds

Add

Exemption

• Exemption amount for a corp = $40,000

– Reduced by 25% of excess of AMTI over

$150,000

– Exemption is totally phased-out when AMTI

reaches $310,000

Minimum Tax Credit (slide 1 of 2)

• AMT paid in one year can be used as a credit

against future regular tax liability that exceeds

its tentative minimum tax

– Indefinite carryforward

– Cannot be carried back

– Cannot offset any future minimum tax liability

Minimum Tax Credit (slide 2 of 2)

• Small corporations (no longer subject to AMT)

with unused minimum tax credits after 1997

may use them against regular tax liability

• Limit = regular tax – [25% × (regular tax –

$25,000)]

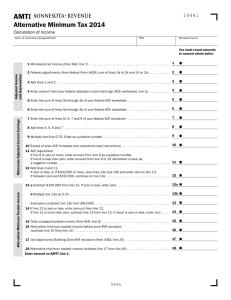

AMT Example (slide 1 of 4)

Moreland Co. has the following income, etc. in 2011:

Taxable income

$100,000

Depreciation adjustment

18,000

Installment gain (not on inventory sale)

80,000

Federal income tax provision on

financial stmts.

75,000

Penalties and fines

2,000

Private activity bond interest income

(issued 2008)

25,000

Other tax-exempt interest

20,000

– The depreciation adjustment is an AMT adjustment and the private

activity bond interest is a tax preference for AMTI.

AMT Example (slide 2 of 4)

Calculation of AMTI before ACE:

Taxable income

Plus: private activity bond income

Plus: depreciation adjustment

AMTI

$100,000

25,000

18,000

$143,000

AMT Example (slide 3 of 4)

Calculation of ACE Adjustment:

AMTI before ACE

Plus: deferred installment gain

Plus: other tax-exempt income

Adjusted current earnings

Less: AMTI

Base amount for Ace Adjustment

Times rate:

ACE Adjustment (positive)

$143,000

80,000

20,000

$243,000

143,000

$100,000

75%

$75,000

AMT Example (slide 4 of 4)

Calculation of AMT:

AMTI before ACE

Plus: ACE Adjustment

AMTI

Less: Exemption

Tentative minimum tax base

20% rate

Tentative minimum tax

Less: regular tax

AMT(TMT-Regular tax)

$143,000

75,000

$218,000

23,000

$195,000

× 20%

$ 39,000

(22,250)

$ 16,750

Total cash paid = Regular tax + AMT = $ 39,000

Accumulated Earnings Tax

(slide 1 of 5)

• Penalty tax designed to discourage the

retention of corporate earnings unrelated to the

business needs of the company

Accumulated Earnings Tax

(slide 2 of 5)

• Tax of 15% is imposed on accumulated taxable

income (ATI), determined as follows:

• ATI = Taxable income ± Adjustments - Dividends

paid - Accumulated earnings credit

• Adjustments to taxable income generally pertain to a

corporation’s ability to pay a dividend

– Thus, deductions include the corporate income tax and

excess charitable contributions, while additions include the

NOL and dividends received deductions

Accumulated Earnings Tax

(slide 3 of 5)

• An accumulated earnings credit is allowed

even when accumulations are beyond

reasonable business needs

Accumulated Earnings Tax

(slide 4 of 5)

• The accumulated earnings credit is the greater

of:

– Current E&P needed to meet “reasonable needs”

of the business, or

– Amount by which $250,000 ($150,000 for service

companies) exceeds Accumulated E&P as of close

of preceding tax year (the minimum credit)

Accumulated Earnings Tax -Reasonable Needs

Of The Business (slide 5 of 5)

• Legitimate reasons

–

–

–

–

–

Business expansion

Capital asset replacement

Working capital needs

Product liability loss

Loans to suppliers or

customers

• Invalid Reasons

– Loans to shareholders

– Unrealistic contingencies

– Investment in unrelated

business assets

Personal Holding Company Tax

• Personal Holding Company (PHC) tax is

designed to discourage sheltering of certain

types of passive income in corporations

– Like the accumulated earnings tax, the purpose is

to force the distribution of corporate earnings to

shareholders

Definition of PHC

• A company is a PHC if:

– More than 50% of the value of stock is owned by 5 or

fewer individuals during the last half of the year

• Broad constructive ownership rules apply in determining stock

ownership

– 60% or more of gross income (as adjusted) must consist of

personal holding company income (PHCI)

• Examples are dividends, interest, rents, royalties, and certain

personal service income

• Rents or royalties may be excluded if they are significant in amount

(i.e., comprise more than 50% of the adjusted gross income)

Calculation of PHC Tax

• Once classified as a PHC, the tax base must be

calculated

– Penalty tax rate = 15%

– Tax base is undistributed Personal Holding

Company income (UPHC income)

• Amount is taxable income plus or minus certain

adjustments, minus the dividends paid deduction

Dividends Paid

• Dividend payments reduce both ATI and

undistributed PHCI

– As these are the bases on which the § 531 tax or

the § 541 tax is imposed, either tax can be

completely avoided by paying sufficient dividends

Refocus On The Big Picture (slide 1 of 4)

• Determining DPGR for the DPAD

• The $42 million gross receipts from the

wholesale sale of Mocha’s ice cream are

considered DPGR.

– However, the de minimis safe-harbor 5%

exception does not apply to include the gross

receipts from the snack shops

• $5 million ÷ $47 million = 10.6%.

Refocus On The Big Picture (slide 2 of 4)

• The sales from the snack shops could qualify as

DPGR if Mocha were to restrict snack shop sales.

– For example, keeping snack sales at around $2.2 million

would satisfy the 5 % exception.

• Thus, Mocha will have to decide whether the 9 %

DPAD is worth forgoing the profit on the snack sales.

• Keep in mind that the DPAD is allowed for the AMT.

Refocus On The Big Picture (slide 3 of 4)

• Who Pays the AMT?

• Carmine, Inc., has met several gross receipts

tests, including initially qualifying as a ‘‘small

corporation.’’

• To qualify as a ‘‘small corporation,’’ the

business must have had average gross receipts

of $5 million or less in the preceding 3 years.

Refocus On The Big Picture (slide 4 of 4)

• Once qualified as a ‘‘small corporation’’ it will

continue to be exempt from the AMT as long

as its average gross receipts for the 3 preceding

taxable years do not exceed $7.5 million.

• Unfortunately, Taupe, Inc., did not meet the

initial $5 million test, so it does not fall within

the $7.5 million exemption.

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr @oneonta.edu

SUNY Oneonta

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

45