Chapter 3

advertisement

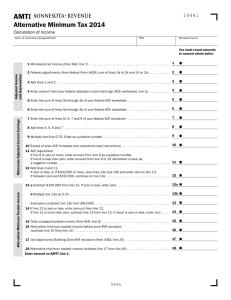

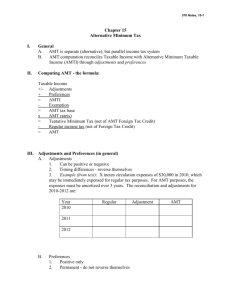

Chapter 3 Corporations: Special Situations We cover only alternative minimum tax – L.O. 6 through L.O. 9 Alternative Minimum Tax (AMT) General information AMT makes it more likely that corporations will pay some income tax. "Regular" taxable income (base) and tax liability (using rate schedule and then credits) are calculated first. AMT rules expand the base and apply a single rate, 20% and then allow fewer credits. The taxpayer pays whichever is higher. Example: regular tax liability = 250,000 tentative minimum tax = 270,000 How much tax is owed? What is the AMT amount? After 1997, small corporations are exempt from the AMT, and therefore, do not need to go through all the AMT calculations. “Small” is based on average annual gross receipts. Calculating AMT (AMT formula Figure 6-1) Regular taxable income before any NOL carryover that was deducted Plus preferences Plus or minus adjustments = AMTI before ACE adjustment and before NOL Plus or minus ACE adjustment (ACE is adjusted current earnings) = AMTI before AMT NOL deduction Minus AMT NOL (limited to 90% of previous line) = AMTI (Alternative Minimum Taxable Income) Minus exemption (subject to phase out) = Tentative minimum tax base x 20 % = Tentative minimum tax before credits Minus allowable foreign tax credit (90% of tentative minimum tax before credits) = Tentative minimum tax Compare tentative minimum tax with regular tax after regular tax FTC and pay whichever is higher Handout #1, Handout #2 HW 17, 19 1 Preferences (add) Preferences generally include some kind of income that was excluded for regular tax purposes. Examples: tax-exempt interest from private activity bonds, percentage depletion in excess of the adjusted basis of the property Adjustments (add or subtract) Adjustments arise from timing differences between AMT rules and regular tax rules. Examples: Depreciation, amortization, and depletion. These amounts are calculated for AMT purposes using rules that are different from rules for regular tax calculations. Note, gains and losses on the sale of these assets will then be different for AMT and regular tax because the accumulated depreciation/amortization/depletion amounts are different. Long-term contract accounting. Completed contract method can be used for regular tax for some construction, but percentage of completion is required for AMT purposes. Installment method for dealers (i.e., the property sold is inventory). The full amount of income/gain is reported for AMT when realized. Production activities deduction. These rules have the overall effect that deductions take longer for AMT and income is reported sooner. Handout #3 to #6 HW 43 Adjustment for Adjusted Current Earnings (plus or minus) The ACE adjustment is made for some taxable income items that are not already part of the AMT calculation (i.e., not a preference item or adjustment item above). "Adjusted current earnings" (ACE) is calculated and compared to AMTI after preferences and after all the other adjustments ("pre-adjustment AMTI" or the subtotal = AMTI before ACE adjustment). If ACE is higher than pre-adjustment AMTI, a positive adjustment will be made (the AMT tax base will be increased). If ACE is lower than pre-adjustment AMTI, a negative adjustment might be made (the AMT tax base will be decreased). The adjustment amount is 75% of the difference between the two amounts. Negative adjustments can only be made to the extent there are net prior period positive adjustments. 44 HW 20 2 The ACE calculation requires a reconciliation from AMTI thus far calculated to arrive at ACE. There are some references to earnings and profits (E&P) for these calculations, but you don't really have to know what E&P is. ACE calculation => Pre-adjustment AMTI Plus or minus ACE depreciation adjustment (AMT depreciation - ACE depreciation) Plus inclusion of certain types of income Tax-exempt interest that’s not a preference (net of interest expense incurred to generate the income), key person life insurance proceeds, increase in cash surrender value of life insurance Plus disallowance of certain deduction items DRD for 20% or less ownership (i.e., 70% DRD) Plus or minus other items Organization cost amortization (not allowed for ACE), non-inventory installment sales (installment method not allowed for ACE), LIFO reserve adjustments (LIFO not allowed for ACE), key person life insurance expense (allowed for ACE) = ACE Then: compare pre-adjustment AMTI to ACE to determine the ACE adjustment. 45 (solution manual should say “Increase in LIFO recapture amount” for the inventory addition amount) AMT NOL The AMT NOL is limited to 90% of the AMTI before the AMT NOL deduction. The corporation will have a regular tax NOL carryforward and an AMT NOL carryforward. Exemption Base amount = $40,000 Phase-out of exemption: 25% of the amount by which AMTI exceeds $150,000. The phase out range ends at $310,000 (310,000 = 150,000 + 40,000/.25). 46 Brandt in class HW 46 Tern and Snipe, 21 Minimum Tax Credit If AMT is paid, the AMT carries forward as a credit to be used to offset the corporation's regular tax liability when the regular tax liability is greater than AMT. Handout #7 Handout #8 (comprehensive) HW 24 3