Session 9 - Cost Accounting 1613KB Oct 24 2012 02:04:54 PM

advertisement

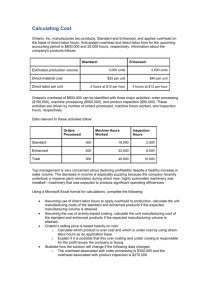

Session 9 Cost accounting Overview • Theory • Exercises – 4.36, 4.38, 4.44, 4.45, 4.46 Theory: Cost Driver – plausible explanation of the cost to run an activity. Example: Cost of “using a machine” is likely driven by how many hours it is run. Theory: Activities: Types • Unit level: Performed each time a unit is produced • Batch level: Performed each time a batch is produced • Product level: Performed to support production of different type of product • Customer Level: Performed to support servicing customers • Facility level:Residuary head Activities Drivers Unit Level Acquire and Use material for containers No. of Containers Acquire and Use material for baby-care products No. of products Batch Level Set up manually controlled machines Set up computer controlled machines No. of batches of contain No. of batches of B. Prod Product Level Design and manufacture moulds Use manually controlled machines Use conputer controlled machines No.of moulds required Product type (containers) Product type (B.Products Customer Level Consult customers Provide warehousing for customers No. of consultations No. of cubit feet Faciltiy Level Manage workers Salaries Activities Drivers Unit Level Acquire and Use material for containers No. of Containers Acquire and Use material for baby-care products No. of products Batch Level Set up manually controlled machines No. of batches of containers Set up computer controlled machines No. of batches of B. Produst Activity Cost Activity VolumeActivity Rate 40,000 80,000 1,000,000 8,000 0.04 10 3,000 12,000 10 20 300 600 5,000 15,000 40,000 5 1 1 1000 15000 40000 4,000 2,000 40 10,000 100 0.2 3,000 48,000 15,000 16,000 0.2 3 Product Level Design and manufacture moulds No.of moulds required Use manually controlled machines Product type (containers) Use conputer controlled machines Product type (B.Products) Customer Level Consult customers No. of consultations Provide warehousing for customers No. of cubit feet Faciltiy Level Manage workers Salaries Use main building Square feet Activities A. Rate A.Volume Containers Baby Product Unit Level Acquire and Use material for containers 0.04 1,200,000 48,000 Acquire and Use material for baby-care products 10 7,000 70000 Batch Level Set up manually controlled machines Set up computer controlled machines 300 600 12 16 3,600 1 4 1 1 1,000 9600 Product Level Design and manufacture moulds Use manually controlled machines Use conputer controlled machines 1000 15000 40000 4000 15,000 40000 Customer Level Consult customers Containers B.products Provide warehousing for customers Containers B.products Faciltiy Level Manage workers Containers B.products Use main building Containers B.products Total Cost 100 2 40 200 8,000 2,000 1,600 4,000 10,000 800 5,000 7,000 15,000 4000 0.2 400 0.2 2000 3 85,200 21000 151,000 Theory: Activity Based Costing - what activities cause indirect cost - Unit level, batch level, product level, facility level, - Find the cost driver rate - -assign to the product Exercise 4.36 a. Compute the amount of overhead to be allocated to each product under activity based costing. Exercise 4.36 4.36 a. (30 min) Limitations of traditional costing methods Rate Single Bulb Dual Bulb Production setup €2,150a €25,800d €38,700 Materials handling 565b 5,650e 11,300 Packaging and shipping 0.20c 10,000f 20,000 Total overhead €41,450 €70,000 _______________ a €2,150 per setup = €64,500 30 setups b €565 per part = €16,9500 30 parts €2,150 per setup = €64,500 30 setups c €0.20 per unit shipped = €30,000 150,000 units shipped €565 per=part = x€16,9500 d €25,800 €2,150 12 setups 30 parts e €5,650 €0.20 per= unit €565 xshipped 10 parts = €30,000 150,000 units shipped f €10,000 = €0.20 x 50,000 units shipped Total €64,500 16,950 30,000 €111,450 Production set up for Single Bulp = rate* number of set up for single bulp d e f €25,800 = €2,150 x 12 setups €5,650 = €565 x 10 parts €10,000 = €0.20 x 50,000 units shipped Exercise 4.36 b. Compute the amount of overhead to be allocated to each product using direct labor hours as the allocation base. Assume the following: Units Produced Direct labor hours per unit Single Bulb 50,000 units 0.5h Dual Bulb 100,000 units 1.0h Units Produced Direct labor hours per unit Single Bulb 50,000 units 0.5h Dual Bulb 100,000 units 1.0h 25,000 hours = 0.5 hours per unit x 50,000 units 100,000 = 1 hour x 100,000 units Exercise 4.36 b. Single Bulb 25,000a €22,290b Dual Bulb Total 100,000 125,000 €89,160c €111,450 Direct labour hours Overhead _______________ a 25,000 hours = 0.5 hours per unit x 50,000 units; 100,000 = 1 hour x 100,000 units b €22,290 = (€111,450 overhead / 125,000 hours) x 25,000 hours c €89,160 = (€111,450 overhead / 125,000 hours) x 100,000 hours Exercise 4.36 c. Should the company follow the controller’s recommendations? Is the total overhead cost affected by the choice of traditional or ABC methods for assigning overhead costs to products? Exercise 4.36 • c. The traditional costing method has appeared to allocate too little overhead to Single Bulb and too much overhead to Dual Bulb. Dual Bulb appears more costly (and therefore less profitable) than it should, which could affect a number of decisions such as whether to continue producing the product and the price at which to sell it. Activity-based costing provides a more detailed and accurate allocation of overhead costs. However, the more accurate method is also more expensive. The ABC system should be adopted if the benefits from improved information exceed the additional costs required to obtain the information. Exercise 4.38 a. 1.Compute a predetermined overhead rate for year 5 for each cost driver using the estimated costs and estimated cost-driver units prepared by the consultant. Also compute a predetermined overhead rate for year 5 using direct labor hours as allocation base. Exercise 4.38 a. Cost Activity Order processing Production setup Materials handling Machine deprec. & maint. Quality control Packing Estimated Driver Allocation Driver Costs Units Rate # of orders 42,000 Kč 200 210 Kč # of runs 130,000 50 2,600 kg. of mat. 90,000 75,000 1.20 mach. hrs. 88,000 8,000 11 # of insp. 20,000 50 400 # of units 50,000 250,000 0.2 420,000 Kč Predetermined rate = estimated overhead cost estimated allocation base activity level = 420,000 Kč estimated overhead cost 4,000 direct labour hours = 100 Kč per direct labour hour Exercise 4.38 b. Compute the production costs for each product using direct labor hours as the allocation base. (a.2) Exercise 4.38 b. Exercise 4.38 c. Compute the production costs for each product using the cost drivers recommended by the consultant.(a.1) Exercise 4.38 c. Exercise 4.38 d. How do you account for the discrepancy between the product costs using the two methods? Explain Exercise 4.38 d. The discrepancy between our product costs using direct-labor hours as the allocation base versus activity-based costing is found in the way overhead costs are allocated. Our traditional direct-labor cost method distorts our product costs because there is little correlation between our direct-labor costs and overhead. Activity-based costing is more accurate. It allocates the individual components of our overhead to our products based upon the product’s use of that overhead component. Exercise 4.44 a. Compute the cost-driver rate fir each cost-driver base. Exercise 4.44 a. Answer is in the last column labeled “Rate per Unit of Measure.” (A) Activity/Resource 1. Unit-Level 1.1 Sell goods on commission 2. Batch-Level 2.1 Process purchases 3. Product-Level 3.1 Provide product-level advertising 3.2 Provide product-inventory record-keeping 4. Customer-Level 4.1 Accept customer returns 5. Facility-Level 5.1 Supervise sales personnel 5.2 Use building (B) Activity Activity Cost Volume Unit of Measure €25,000 €250,000 sales dollars €8,000 €20,000 €2,000 €6,000 200 number of purchase orders 200 number of promotions 500 number of products 600 number of returns €4,000 €25,000 cost amount of activity 1.1 €28,000 8,000 square feet of shelf space (=A/B) Rate per Unit of Measure 10% €40.00 €100.00 €4.00 €10.00 16% €3.50 Exercise 4.44 b. Use ABC. Compute the cost of each product given the activity level for the month of June. Exercise 4.44 b. Product costs using activity-based costing Activity/Resource 1. Unit-Level 1.1 Sell goods on commission 2. Batch-Level 2.1 Process purchases Unit of Measure sales dollars number of purchase orders 3. Product-Level 3.1 Provide product-level advertising 3.2 Provide product-inventory record-keeping number of promotions number of products 4. Customer-Level 4.1 Accept customer returns number of returns 5. Facility-Level 5.1 Supervise sales personnel 5.2 Use building cost amount of activity 1.1 square feet of shelf space Total Cost Units of Product Cost per Unit (excluding Merchandise Cost) Tennis Racquets Rate per Actual Unit of Activity Measure Volume Fishing Rods Actual Tennis Fishing Activity Racquets Rods Volume Cost Cost 10% €2,000 €1,000 €200.00 €100.00 €40.00 2 3 €80.00 €120.00 €100.00 €4.00 2 1 2 1 €200.00 €4.00 €200.00 €4.00 €10.00 5 2 €50.00 €20.00 16% €3.50 €200 80 €100 60 €32.00 €280.00 €16.00 €210.00 €846.00 €670.00 20 10 €42.30 €67.00 Exercise 4.44 c. Assume that the company’s traditional costing system had assigned a cost of 9€ per unit sold to the batch, product, customer, and facility level. Compute both the total cost and unit cost for each product for the month of June. Exercise 4.44 c. Product costs using traditional costing Activity/Resource 1. Unit-Level 1.1 Sell goods on commission Unit of Measure sales dollars All Other Levels allocated based on: Number of Sales units sold Total Cost Units of Product Cost per Unit (total cost / units of product) Rate per Unit of Measure Tennis Racquets Actual Activity Volume Fishing Rods Actual Activity Volume 10% €2,000 €1,000 €9.00 20 10 Tennis Fishing Racquets Rods Cost Cost €200 €100 €180 €90 €380 €190 20 10 €19.00 €19.00 Exercise 4.44 d. Compare your findings under ABC and the traditional costing system. Explain Exercise 4.44 • d. Comparing the bottom line in requirement b with the bottom line in requirement c, one sees a significant difference in product costs. If we think about a sporting goods store that has 500 different products, as Omni Athletic does, then many of the products have a lower value than tennis racquets and fishing rods. In many cases, companies average the batch through facility-level costs over the products. This averaging process understates the cost of relatively high value products such as fishing rods and tennis racquets and overstates the cost of relatively low value products (such as tennis balls and fishing line). That could explain the difference in product costs between the traditional and ABC methods. Exercise 4.45 a. Compute cost-driver rates for each activity/resource. What is the cost per unit of the these manufacturing activities for the week? Exercise 4.45 Cost driver rates (A) Activity/Resource 1. Unit-Level 1.1 Materials - board A 1.2 Materials - board B 1.3 Labour to produce boards 1.4 Packaging and shipping 2. Batch-Level 2.1 Setup labour - board A 2.2 Setup labour - board B 2.3 Setup materials 3. Facility-Level 3.1 Equipment 3.2 Custodial and security service Activity Cost (B) Activity Volume Cost Driver Base €32,000 4,000 €32,000 2,000 €16,000 160,000* €30,000 6,000 €1,000 €1,200 €2,800 5 2 7 €20,000 €5,000 n/a n/a number of board A produced & shipped number of board B produced & shipped number of parts number of boards produced & shipped batches of board A run batches of board B run batches run Equip usage: 60% board A; 40% board B Building usage: 50% board A; 50% board B * 160,000 manually assembled parts = (20 parts x 4,000 units of A) + (40 parts x 2,000 units of B) (=A/B) Predetermined Cost Driver Rate €8.00 €16.00 €0.10 €5.00 €200.00 €600.00 €400.00 n/a n/a Exercise 4.45 Total and per-unit costs Activity/Resource 1. Unit-Level 1.1 Materials - board A 1.2 Materials - board B 1.3 Labour to produce boards 1.4 Packaging and shipping 2. Batch-Level 2.1 Setup labour - board A 2.2 Setup labour - board B 2.3 Setup materials 4. Facility-Level 4.1 Equipment 4.2 Custodial and security service Total Cost Units Produced Cost per Unit (total cost / units produced) Unit of Measure number of board A produced & shipped number of board B produced & shipped number of parts number of boards produced & shipped batches of board A run batches of board B run batches run Equip usage: 60% board A; 40% board B Building usage: 50% board A; 50% board B Rate per Unit of Measure €8.00 €16.00 €0.10 €5.00 Board A Actual Activity Volume Board B Actual Activity Board A Board B Volume Cost Cost €32,000 4,000 80,000 4,000 2,000 80,000 2,000 €8,000 €20,000 €32,000 €8,000 €10,000 €200.00 €600.00 €400.00 5 €1,000 5 2 2 €2,000 €1,200 €800 n/a n/a n/a n/a n/a n/a €12,000 €2,500 €8,000 €2,500 €77,500 4,000 €62,500 2,000 €19.375 €31.25 Exercise 4.46 Intellig receives a sales price of 25€ each for board A and 30 € for board B. Compute the profits for each type of board. Should Intellig discontinue either product? Exercise 4.46 Board A Revenues Board A (€25 x 4,000 units) Board B (€30 x 2,000 units) Total revenue Costs traced to products Unit level costs Batch level costs Facility level costs Total costs traced to products Operating income Board B €100,000 €60,000 3,000 14,500 €77,500 €22,500 Total €60,000 €100,000 60,000 €160,000 €50,000 2,000 10,500 €62,500 (€2,500) €110,000 5,000 25,000 €140,000 €20,000 Exercise 4.46 Should Intellig discontinue either product? • The argument could be made that Intellig should eliminate the Board B product since it shows a loss of €2,500. However, it is unclear (and probably unlikely) that the facility costs will be eliminated upon eliminating Board B. Instead, the facility costs might simply be allocated to Board A. • A better approach for the company is to review the process required to produce Board B to find areas where future cost savings might exist. Board B costs significantly more to produce than Board A, but is priced the same as Board A. Intellig should also review its pricing structure for Board B to see if the market will pay more than the current €30 per unit price. ARE YOU READYYY? See you next week!