Chapter 7: Equity Markets and Stock Valuation

Equity Markets and

Stock Valuation

Chapter 7

Common Stock Valuation

Cash flows from owning a share of stock come in the form of future dividends (vs. coupon pmts on a bond)

P

0

= D

1

/ (1 + R) 1 + D

2

/ (1 + R) 2 + . . .

Common Stock Valuation

In Certain special cases it’s possible to calculate the present value of all the future dividends to determine the value for the stock

Table 7.1, Pg 190

Constant $ Dividend

–

Zero Growth

Steady Dividend Growth

–

Dividend grows at a steady rate

– Known as the Dividend Growth Model

Required Return

Dividend Yield

Common Stock Valuation

Constant $ Dividend - Zero Growth

P

0

= D/R

Example: Not in Book

Suppose Smith, Inc. has just issued a dividend of

$2.90 per share. Subsequent dividends will remain at $2.90 indefinitely. Returns on the stock of firms like Smith, Inc. are currently running

15%. What is the value of one share of stock?

P

0

= $2.90 / .15

P

0

= $19.33

Common Stock Valuation

Steady Dividend Growth

P

0

= D

1

/ (

R

–

g

)

Example: Problem 4, Page 203

Motorheadache Corporation will pay a $4.00 per share dividend next year. The company pledges to increase its dividend by 4% per year indefinitely.

If you require a 13 percent return on your investment, how much will you pay for the company’s stock today?

P

P

P

0

0

0

= 4.00 / (.13 - .04)

= 4.00 / .09

= 44.44

Common Stock Valuation

Required Return

R

= D

1

/P

0

+

g

Where: D

1

/ P0 = is the dividend yield

And: g = the capital gains yield

– The same as the growth rate in dividends for the steady growth case

Example: Problem 2, Page 203

The next dividend payment by BJG, Inc., will be $2 per share. The dividends are anticipated to maintain a 6 percent growth rate, forever. If BJG stock currently sells for $35.00 per share, what is the required return?

R = 2 / 35 + .06

R = .0571 + .06

R = .1171 or 11.71%

– Also work Problem 8, Page 203

Common Stock Valuation

Required Return

R

= D

1

/P

0

Example: Not in Book

+

g

The current price of XYZ stock is $50.00

Dividends are expected to grow at 7% indefinitely and the most recent dividend was $1. What is the required rate of return on XYZ stock?

R = (1 x 1.07) / 50 + .07

R = 1.07 / 50 + .07

R = .0214 + .07

R = .091 or 9.1%

Common Stock Valuation

Dividend Yield

= D

1

/P

0

Example: Not in Book

Wilson Corporation Stock pays a constant dividend of $2.50 forever and currently sells for

$20.00. What is the required rate of return.

Remember: Required Return R = D

1

/P

0

+

– Where: D

1

/ P0 = is the dividend yield g

Here we are excluding the g rate

R = D

R

R

1

/P

0

= $2.50 / 20

= .1250 or 12.50%

Common Stock Features

Shareholder Rights

Shareholders

– Hold

Common Stock: Equity w/o priority for dividends or in bankruptcy

Directors

– Elected by a vote at the annual shareholders’ meeting

– Hire Management

Common Stock Features

Shareholder Rights

Straight Voting: A procedure in which a shareholder may cast all votes for each member of the board of directors.

Cumulative Voting: A procedure in which a shareholder may cast all votes for one member of the board of directors.

Common Stock Features

Shareholder Rights – Straight Voting

50 percent plus one share = control

Straight Voting:

Directors are elected one at a time

# of Votes a Shareholder may cast:

• # of shares (owned or controlled)

Shareholders may cast all votes for each member of the board of directors

• If Smith has 20 votes and Jones has 80 votes, Jones will be able to elect all the directors

• 50 percent plus one share = control

Can “freeze out” minority shareholders

Common Stock Features

Shareholder Rights – Cumulative Voting

Cumulative Voting:

Directors are elected all at once

# of Votes a Shareholder may cast is:

• # of shares (owned or controlled) x # of directors to be elect

• 20 shares x 4 directors = 80 votes

Shareholders can distribute votes as they wish

The shareholder may cast all votes for one member of the board of directors

Permits minority participation

Mandatory in some states

Common Stock Features

Shareholder Rights – Cumulative Voting

1 / (

N

+ 1) % of stock plus one share

In general:

1 / (N + 1) % of stock plus one share where N = the number of directors up for election

Will guarantee a seat

Example: If four directors are up for election, what % of the shares (plus one share), will guarantee election?

– 1 /( 4 +1)

– 1 / 5 = .20 or 20%

Common Stock Features

Shareholder Rights

Example: Problem 9, Page 203

After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of Huckaba Enterprises.

Unfortunately, you will be the only individual voting for you.

– If Huckaba has 100,000 shares outstanding and the stock currently sells for $60, how much will it cost you to buy a seat if the company uses straight voting ?

• (a) 50 percent plus one share = control

100,000 x .50 + 1 share = 50,001 x $60 =

$3,000,000

Common Stock Features

Shareholder Rights

Example: Problem 9, Page 203 continued

– Assume that Huckaba uses cumulative voting and there are four seats in the current election; how much will it cost you to buy a seat now?

• 1 / (

N + 1) % of stock plus one share

1 / (4 + 1) % of stock plus one share

.20 x 100,000 + 1 = 20,001 x $60 =

$1,200,000

Common Stock Features

Proxy Voting

Shareholders can vote in person or transfer their right to vote via Proxy

Proxy

– A grant of authority by a shareholder allowing another individual to vote that shareholder’s shares

– Large Corporations - convenience

Proxies are solicited by “Existing Management”

Proxy Fight

– Outside group of shareholders solicit proxies to replace current management

Common Stock Features

Classes of Stock

Some firms have more than one class of common stock

– Different acquisitions – norm

•

At one time GM had its:GM Classic, Class E (GME) – EDS acquisition, Class H (GMH) Hughes Aircraft

– Unequal voting rights – exception

• Example: Ford Class B Common Stock

– Not publicly traded

– Held by Ford family interests and trusts

– Has about 40% of the voting power

– Even though it represents les than 10% of the total number of the shares outstanding

Common Stock Features

Other Rights

In addition to the right to vote for directors, shareholders usually have the following rights:

1. The right to share proportionally in dividends paid.

2. The right to share proportionally in assets remaining after liabilities have been paid in a liquidation.

3. The right to vote on stockholder matters of great importance, such as a merger. Voting is usually done at the annual meeting or a special meeting.

Common Stock Features

Other Rights

Shareholders sometimes have Preemptive

Right: The right to share proportionally in any new stock sold

– If the company wishes to sell stock it must first offer it to the existing stockholders before offering it to the general public.

– Gives stockholders the opportunity to protect their proportionate ownership in the corporation.

Common Stock Features

Dividends

Dividends: Payments by a corporation to shareholders, made in either cash or stock.

Represent a return on shareholder investment

Issued at the discretion of the board of directors

–

Not a liability until declared

–

Once dividends are declared, they are a liability of the corporation until paid.

Common Stock Features

Dividends

Dividends received by individuals are considered ordinary income and fully taxable.

Payment of dividends by the corporation is not a business expense.

–

Not deductible for corporate tax purposes

– Paid from after-tax profits

Corporations that own stock in other corporations are permitted to exclude 70% of the dividend amounts they receive and are taxed only on the remaining 30%.

Preferred Stock Features

Preferred Stock: Stock with dividend priority over common stock, normally with a fixed dividend rate, sometimes without voting rights.

Preferred Stock Features

Form of Equity – but a lot like debt

May carry a credit rating much like a bond

May be callable and convertible into common stock

May have a related sinking fund – final maturity

Preferred Dividends: normally pay a fixed dividend rate

– Paid at the discretion of the Board of director

– Cumulative Preferred Dividends – Unpaid stock dividends carried forward in arrearage until paid

• Preference over “common” stock holders

– Non-cumulative

Preferred Stock Features

Does not have voting rights

Preference in the distribution of corporate assets, over common stock holders, in the event of liquidation

Preferred Shareholders are only entitled to the stated value of shares in liquidation

Preferred Dividends are not tax deductible by the issuing corporation

The Stock Markets

Primary Market: The market in which new securities are originally sold to investors.

– Shares of stock are first brought to the market and sold to investors

– Companies sell securities to raise money

Secondary Market: The market in which previously issued securities are traded among investors

– Existing shares are traded among investors

The Stock Markets

Dealers and Brokers

Dealer: An agent who buys and sells securities from inventory

– maintains an inventory and stands ready to buy and sell at any time

• Like a car dealer

– Bid price – price dealer is willing to pay

–

Ask price

– price at which a dealer will sell

– Spread – difference between the Bid and Ask price

• Dealer Profit

The Stock Markets

Dealers and Brokers

Broker: An agent who arranges security transactions among investors

– brings securities buyers and sellers together, but does not maintain an inventory

• Like a real estate broker

– Do not buy or sell securities for their own accounts

The Stock Markets

Organization of the

NYSE

NYSE is located on Wall Street (New York)

Largest stock market in the world

– In terms of $ volume of activity and total value of shares listed

Member: Owner of a

“seat” on the NYSE

– Collectively the members of the exchange are its owners

– Buy and sell securities on the exchange floor w/o paying commissions.

– Seat

• Valuable asset

• Regularly bought and sold

• Well over $2 million in recent years

The Stock Markets

Organization of the NYSE

Commission Brokers: NYSE members who execute customer orders to buy and sell stock transmitted to the exchange floor

– Responsible to customers to get the best possible prices for their orders

– Usually about 500 NYSE members are commission brokers

– NYSE Commission Brokers are typically employees of brokerage companies such as

Merrill Lynch

The Stock Markets

Organization of the NYSE

Specialist: an NYSE member acting as a dealer in a small number of securities on the exchange floor; often called a market maker

– Each security is assigned to a single specialist

– Obligated to maintain a fair, orderly market for the securities assigned to them

– Post bid and ask prices

– Specialist’s post – a fixed place on the exchange floor where the specialist operates

The Stock Markets

Organization of the NYSE

Floor Brokers: NYSE members who execute orders for commission brokers

(who are too busy to handle certain orders themselves) on a fee basis (sometimes called $2 brokers)

The Stock Markets

Organization of the NYSE

In recent years, floor brokers have become less important on the exchange floor because of the efficient SuperDOT System:

– an electronic

NYSE system allowing orders to be transmitted directly to the specialist

– DOT stands for: D esignated O rder T urnaround

– Accounts for a substantial percentage of all trading on the NYSE, particularly on smaller orders

The Stock Markets

Organization of the NYSE

A small number of NYSE members are

Floor Traders : NYSE members who independently trade for their own accounts trying to anticipate price fluctuations

– Profit from buying low and selling high

– # of Floor Traders has declined in recent decade

• Suggesting that is has become increasingly difficult to profit from short-term trading on the exchange floor.

The Stock Markets

Organization of the NYSE

The business of the NYSE is to attract and process Order Flow: The flow of customer orders to buy and sell securities.

– The customers of the NYSE are the individual and institutional investors who place their orders to buy and sell shares in NYSE-listed companies.

The Stock Markets

Organization of the NYSE

Floor Activity:

On the floor of the exchange are a number of stations – figure-eight shape

Specialist’s Post:

A fixed place on the exchange floor where the specialist operates.

Commission brokers receive telephoned customers orders and move to the specialists’ posts where the orders can be executed and return to telephones to confirm order executions and receive new customer orders.

The Stock Markets

Organization of the NYSE

Floor Activity Con’t:

Commission Brokers are obligated to get the best possible price and must

“work” the order.

– Look for another broker at the specialist post where that particular stock trades, who represents a customer that wants to buy the particular stock they’re selling.

– For a very actively traded stock, there may be many buyers and sellers around the specialist’s post , and most of the trading will be done directly between brokers: called trading in the “crowd”.

–

The specialist’s responsibility is to maintain order

•

Functions as a referee

• Make sure that all buyers and sellers receive a fair price

The Stock Markets

Organization of the NYSE

Floor Activity Con’t:

If the Commission Broker is unable to quickly find another broker in the crowd with a matching offsetting order, he must sell to the specialist at the posted bid price

– The specialist provides the liquidity necessary to allow immediate order execution.

The colored coats worn by many people on the floor indicates the person’s job or position.

– Clerks, runners, visitors, exchange officials, etc.

The Stock Markets

NASDAQ

Operations

NASDAQ Computer network of securities dealers who disseminate timely security price quotes to Nasdaq subscribers

– N ational A ssociation of S ecurities D ealers A utomated

Q uotations system

– Dealers – act as market makers for securities listed on

NASDAQ and post bid and asked prices at which they accept orders along with the number of stock shares that they obligate themselves to trade at their quoted prices.

–

Nasdaq is a computer network and has no physical location where trading takes place

– All trading is done through dealers (vs. NYSE specialist system )

The Stock Markets

NASDAQ

Operations

NASDAQ requires that there be multiple market makers for actively traded stock ( vs. the NYSE specialist system )

Level 2 access – connects market makers with brokers and other dealers allowing subscribers to view price quotes from all Nasdaq market makers

Level 2 allows access to Inside Quotes: The highest bid quotes and the lowest ask quotes for a security

– Necessary to get the best prices for member firm customers.

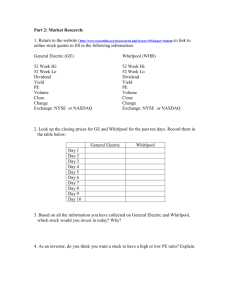

The Stock Markets

Stock Market Reporting

The Wall Street Journal

– Page 199

Internet

CNBC

Bloomberg

Chapter 7

Suggested Homework

Know chapter theories, concepts, and definitions

– Re-read the chapter and review the Power Point Slides

–

Suggested Homework:

• The Chapter Review and Self-Test Problems: Page 201

–

7.1 (first question only) and 7.2 (first question only)

•

Answers are provided in the book just after the problems

• Critical Thinking and Concepts Review: Page 202

–

Review questions 1 through 11

• Answers are provided in the solutions manual

•

Questions and Problems: Page 203

– 1 (first question only), 2, 4, 5, 8, 9, and 12

• Refer to the Solutions Manual to confirm your answers