Name: __________________________ Problem chapter 16

advertisement

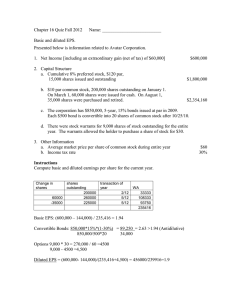

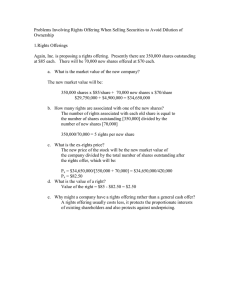

Name: __________________________ Problem chapter 16 1. Basic and diluted EPS. The following information was taken from the books and records of Teller, Inc.: Net Income $800,000 Capital Structure: Convertible bonds 6% $30,000 worth. Each $500 bond can be converted into 40 shares of common stock. The common stock $10 par started the year with 60,000 shares outstanding (issued 5 years ago). On April 1 there was a repurchase of 4,000 shares. On July 1, reissued 6,000 shares of treasury stock. On November 1 there was a 2 for 1 split. At the end of the year there were stock warrants outstanding (for the whole year) to purchase 25,000 shares of stock for $20 per share. The average market price for the stock is $40. The corporate income tax rate averages 40%. Instructions Compute basic and diluted earnings per share. Change in shares 1-Jan 1-Apr 1-Jul 1-Nov shares outstanding 60,000 56,000 62,000 124,000 -4,000 6,000 1/2 split transaction of year 3/12 3/12 4/12 2/12 Basic EPS = NI/WA = 800,000/120,000 = 6.67 Warrants 25,000*20/40 = 12,500 25,000-12,500= 12,500 Diluted EPS 800,000 + 30,000*0.06*(1-0.4) = 801,080/134,900 = 5.94 120,000 +12,500 + 30,000/500*40 6.04 > 0.45 split 2 2 2 WA 30000 28000 41333 20667 120000