EPS

advertisement

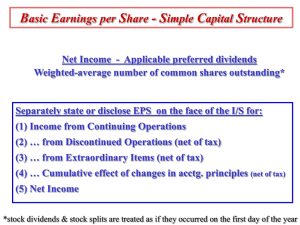

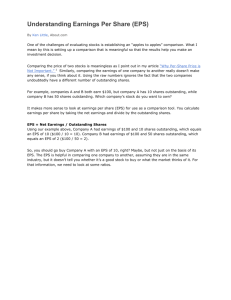

By: Megan Addison, Nicholas DeMario, Scott Heydle and Jenn Ritchie What is Earnings Per Share? Earnings Per Share (EPS) is the portion of a companies profit allocated to each outstanding share of common stock. Serves as an indicator of a companies profitability. EPS is required by FASB No. 128, which covers the computation, reporting, and disclosures. Under this, companies are required to present EPS on the face of the income statement. If an entity’s structure is simple– that is it has no potentially dilutive securities– only the basic EPS needs to be disclosed. If complex, presentation of both basic and diluted EPS is mandated “It is EPS and the related price to earnings ratio– not income, not assets, not equity, and not any other accounting magnitudes– that are the most widely reported numbers in investment services…” -- Dr. John W. Coughlan President at CPA school of Washington Looking Back at Accounting 101 When we first encountered calculating EPS in Accounting 101, we simply divided the net income by the total number of common stock. Net Income= 250,000 Common Stock= 35,000 EPS here, would be $7.14 This, however, is for limited situations such as: 1. The company has no common stock transactions during the period, so the same number of shares of stock were outstanding throughout the entire period. 2. The company has no preferred stock. 3. The company has no other financial securities or contingencies that could result in the issuance of additional shares of common stock. This method, however, is not used by companies in any other situation. …And as Dr. Kirch would say… This is Kindergarten stuff! Basic Earnings Per Share Basic EPS, also known as weighted average EPS, is intended to provide a historical view of a companies performance. GAAP requires that a weighted average number of common shares outstanding be used in computing EPS. To calculate the basic EPS, you must divide net income, less dividends paid to preferred stock holders, divided by the weighted average of stock outstanding. The weighted average number is determined by multiplying the number of shares issued for any time period by a fraction. Once you have that number, add it to your already outstanding shares of stock. Numerator: number of months shares have been outstanding. Denominator: number of months in the period. An Example: 10,000 shares were outstanding at 1/1/01 5,000 shares were issued on 7/1/01 Net Income was 55,000 5,000 dividends were paid to preferred stock holders. Diluted Earnings Per Share •FAS No. 128: Both Basic and Diluted EPS •Complex Capital Structures: •Convertible Securities •Common Stock Warrants and Options •Other Contingent Issuance Agreements • Diluted EPS Intended to… • Antidilution not to be reported If-Convertible Method •Convertible Securities (convertible preferred stock and convertible bonds) •Example… Treasury Stock Method •Common Stock Warrants or Options •Example… Controversy over Earnings Per Share •Problem: EPS is helpful in comparing one company to another, assuming they are in the same industry, but it doesn’t tell you whether it’s a good stock to buy or what the market thinks of it. •For that information, it is necessary to look at some ratios. Options & Warrants •Problem: The use of the treasury stock method for options and warrants assumes that proceeds from the exercise of options or warrants would be used to reacquire a company’s own stock. •However, the opinion APB No. 15 itself states that the treatment it prescribes isn’t based on the assumption that the funds provided by exercise would actually be used in this manner. Controversy Cont. •Problem: Using treasury stock method softens the potential dilution of EPS because only an incremental number of shares rather than all shares assumed exercised are used. (anti-diluted) •Further options and warrants are excluded from EPS calculations when current market prices determine whether options or warrants are ultimately exercised. •Different Methods that could be used: •In accordance with FAS 128, paragraph 101 and 104 1. Imputed Earnings Method 2. Treasury Stock Method with a Discounted Excess Price 3. Maximum Diluted Method 4. Graham-Dodd Method For each period an income statement is presented the following must be disclosed A reconciliation of the numerators and the denominators of the basic and diluted pershare computations for income from continuing operations. The reconciliation must display income and share mount that effects esecurities that affect earnings per share. Income (Numerator) Income before extraordinary item and accounting change Less: Preferred stock dividends Basic EPS Income available to common stockholders Effect of Dilutive Securities Warrants Convertible preferred stock 4% convertible debentures Diluted EPS Income available to common stockholders For the Year Ended 2001 Shares (Denominator) Per-Share Amount $ 7,500,000 (45,000) 7,455,000 3,991,666 45,000 60,000 30,768 308,333 50,000 $ 7,560,000 4,380,767 $1.87 $1.73 The effect that has been given to preferred dividends in arriving at income available to common stock holders in computing basic EPS Securities that could potentially dilute basic EPS in the future that were not included in the computation of diluted EPS because to do so would have been anti-dilutive for the period presented. For the latest period for which an income statement is presented, an entity shall provide a description of any transaction that occurs after the end of the most recent period but before issuance of the financial statements that would have changed materially the number of common shares or potential common shares outstanding at the end of the period if the transaction had occurred before the end of the period Examples of those transactions Issuance or acquisition of shares Issuance of warrants, options or convertible securities Resolution of a contingency pursuant to a contingent stock stock agreement Conversion or exercise of potential common shares outstanding at the end of the period into common shares. Practice Problem One Addison Co. issued 6,000 shares of common stock on March 31, 2007. They began the year with 12,000 shares of common stock outstanding. If their net income for the year was 85,000 and no preferred dividends were paid, what was the company’s basic earnings per share? Answer: $6.30 Practice Problem Two Still on Addison Co. assume that at the beginning of the year there was 3,000 convertible preferred stock outstanding, each share is convertible to 2 common shares of stock. Calculate the diluted earnings per share for Addison Co. Answer: $3.78