F-10 Share-based compensation - ASC 718-10-10

advertisement

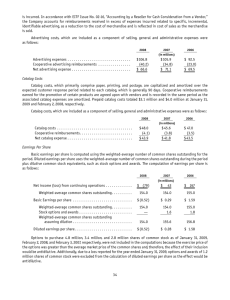

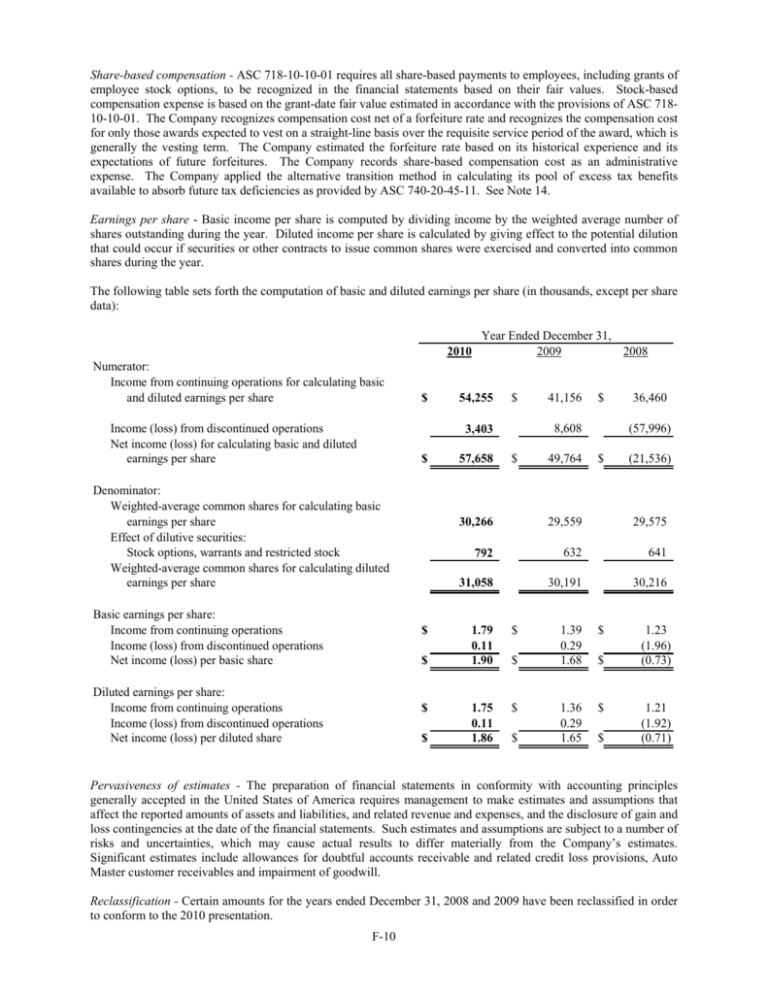

Share-based compensation - ASC 718-10-10-01 requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. Stock-based compensation expense is based on the grant-date fair value estimated in accordance with the provisions of ASC 71810-10-01. The Company recognizes compensation cost net of a forfeiture rate and recognizes the compensation cost for only those awards expected to vest on a straight-line basis over the requisite service period of the award, which is generally the vesting term. The Company estimated the forfeiture rate based on its historical experience and its expectations of future forfeitures. The Company records share-based compensation cost as an administrative expense. The Company applied the alternative transition method in calculating its pool of excess tax benefits available to absorb future tax deficiencies as provided by ASC 740-20-45-11. See Note 14. Earnings per share - Basic income per share is computed by dividing income by the weighted average number of shares outstanding during the year. Diluted income per share is calculated by giving effect to the potential dilution that could occur if securities or other contracts to issue common shares were exercised and converted into common shares during the year. The following table sets forth the computation of basic and diluted earnings per share (in thousands, except per share data): 2010 Numerator: Income from continuing operations for calculating basic and diluted earnings per share Income (loss) from discontinued operations Net income (loss) for calculating basic and diluted earnings per share $ Year Ended December 31, 2009 2008 54,255 $ Denominator: Weighted-average common shares for calculating basic earnings per share Effect of dilutive securities: Stock options, warrants and restricted stock Weighted-average common shares for calculating diluted earnings per share Basic earnings per share: Income from continuing operations Income (loss) from discontinued operations Net income (loss) per basic share $ $ Diluted earnings per share: Income from continuing operations Income (loss) from discontinued operations Net income (loss) per diluted share $ $ 57,658 $ 8,608 3,403 $ 41,156 $ 49,764 36,460 (57,996) $ (21,536) 30,266 29,559 29,575 792 632 641 31,058 30,191 30,216 1.79 0.11 1.90 1.75 0.11 1.86 $ $ $ $ 1.39 0.29 1.68 $ 1.36 0.29 1.65 $ $ $ 1.23 (1.96) (0.73) 1.21 (1.92) (0.71) Pervasiveness of estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and related revenue and expenses, and the disclosure of gain and loss contingencies at the date of the financial statements. Such estimates and assumptions are subject to a number of risks and uncertainties, which may cause actual results to differ materially from the Company’s estimates. Significant estimates include allowances for doubtful accounts receivable and related credit loss provisions, Auto Master customer receivables and impairment of goodwill. Reclassification - Certain amounts for the years ended December 31, 2008 and 2009 have been reclassified in order to conform to the 2010 presentation. F-10