Corporate Development

advertisement

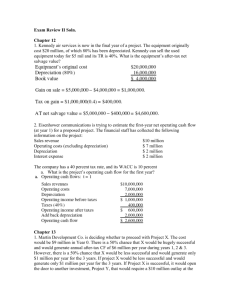

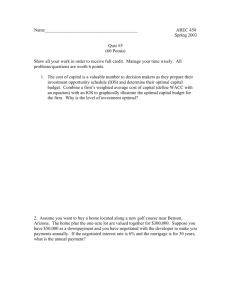

MBA 602 Taxes and Business Strategy Ron Worsham 534 TNRB Ron_Worsham@byu.edu My Philosophy of Learning I hear and I forget; I see and I remember; I do and I understand. Old Confucian Proverb Quiz 1. The owner of a municipal bond incurs tax on its earnings. True or False? 2. If you were the president of a company, you would want the company to always minimize its tax bill. True or False? 3. Consider EVERY tax planning technique (simple or sophisticated). Would you believe that there are really only three tax planning strategies in the universe? Yes or No? Why should MBA students study tax planning? Tax planning has come to be recognized as a significant value adding enterprise among executives and managers because…. • Management is more focused on reducing effective tax rates as reported in financial statements. • Globalization and disruptive technologies such as the Internet require as well as facilitate tax planning. • Many securities and investments have significant tax implications. Greater Focus on Effective Tax Rates • Effective tax rates have recently been benchmarked. – CFO Magazine began publishing comparative effective tax rates by industry in the fall of 1999 and continues to do so. – Managers now feel more pressure to reduce effective tax rates. • “You don’t want to be the one paying the highest effective tax in your business” (Business Week, April 12, 1999, p.47) Greater Focus on Effective Tax Rates • The use of equity as a form of management compensation. Compensation tied to stock prices. – Executives now view effective tax rate reduction as a means of increasing share price. – Do lower ETR firms have higher P/E ratios? • – Empirical research seems to suggest yes! “A long-term sustainable reduction in a company’s effective tax rate can have a significant impact on market capitalization and shareholder value”, according to Michael Burke, KPMG’s global managing partner of total tax minimization services. Greater Focus on Effective Tax Rates • More managers are compensated based upon after-tax earnings. – “Were pre-tax income to govern incentives, then employees with bonuses on their minds would pay far less attention to favorable tax implications…It’s a very high priority. Managing taxes is a job for everyone at Colgate”. Stephen Patrick Chief Financial Officer, Colgate-Palmolive Co. Globalization and the Internet •As companies restructure their operations in response to these forces, tax considerations play an important role. •Frictions that normally impede tax planning are disappearing. •“Electronic Commerce Transformation: An Unprecedented Tax Planning Opportunity” (Taxes, March 2001). Investment Bankers Create Tax Motivated Securities • $70 Billion in contingent convertible debt (coco’s) issued in 2001. • ETF’s are gaining ground on traditional mutual funds. • ARP’s and other forms of preferred stock designed to create tax benefits. Benefits of Tax Planning for Entrepreneurs • Entity Selection • Tax considerations of starting, buying and selling businesses • Integrate family and business tax planning Individual Benefits of Understanding Tax Planning • Maximize retirement savings • Increase after-tax returns in your investments portfolio • Negotiate compensation considering tax implications • Increased awareness of general individual tax planning strategies Investing and Tax Planning • Suppose you had to choose between tax planning knowledge and stock investment expertise. Which would you choose? Investing and Tax Planning Assume the following: 1. You have $5,000 of cash. 2. You wish to invest that money for the long-term, say 30 years. 3. Your individual tax rate is 40%. 4. You can invest the $5,000 in a stock index fund which mirrors the overall stock market providing an average annual 12% return on investment and requires no investment expertise. (passive 30 year investment). What happens if you choose to learn tax planning and implement the use of a 401(k) plan for investment in an index fund which requires no investment expertise? The after-tax value of the $5,000 investment after 30 years would be $149,000. - What would happen if you choose to become an investment expert but do not use a 401(k) for the investment? - You would have to pick stocks that would generate a 20% average annual return in order to achieve a similar after tax value of $149,000 - Beating the market (an index fund) by 8% consistently over a 30-year period would be highly unlikely. If you failed to beat the market in picking stocks and only achieved a 12% average annual return on investment, the after-tax value of your investment at the end of 30 years without the use of a 401(k) plan would be only about $40,000 as opposed to the $149,000 with a 401(k). Of course, tax planning and investing expertise are not mutually exclusive. What if you can beat the market by 8% per year and be a good tax planner utilizing a 401(k) plan? In this instance, the after-tax value of your $5,000 investment would be $1,186,882!