Testimony of Armond Dinverno

advertisement

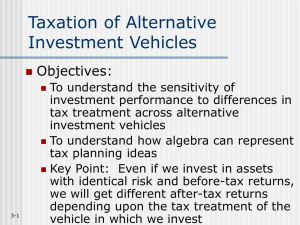

How the Tax Code Affects Planning for Individual Taxpayers Armond Dinverno, JD, CPA, CFP Co-President Balasa Dinverno & Foltz LLC Itasca, IL President’s Advisory Panel on Federal Tax Reform March 16, 2005 Chicago, Illinois Introduction • Balasa Dinverno & Foltz LLC started business in 1986 • Financial Management firm for individuals, business owners, and pension plans • 20 employees: 8 Certified Public Accountants, 2 Attorneys, 2 MBAs, and 8 Certified Financial Planners • Approximately $830 Million in assets under management How Do We Keep up With Tax Law Changes? • Constant amount of reading and research • Specialists in our firm follow tax rules – it is too difficult for generalists to maintain a tax knowledge base • We purchase specialized tax research and software • 2 of every 3 professionals in our firm are CPAs as a result of our desire to be experts at how income taxes affect our clients The Tax Code Makes Achieving a Simple Objective a Difficult Task • Our Objective Is Simple → Maximize after-tax dollars • Unfortunately, the complexity of the tax code makes our job very difficult • Because of the complexity, we must address numerous issues before we advise clients on the best investment alternatives. These issues include the following– Family tax filing status (and number of exemptions) – Amount and sources of income – Nature and amount of current financial assets • Investments in taxable accounts vs. tax deferred accounts – Real Estate • Mortgage debt • Home equity loans • Rental property Additional Planning Considerations • Asset Placement – The right investments in the right accounts to minimize the effect of income taxes – Can we maximize tax-deferred growth by using 401(k) plans, IRAs, Roth IRAs, profit sharing plans, ageweighted plans or defined benefit plans? – Place capital gain assets in taxable accounts and high-income assets in tax-deferred accounts. • Tax Loss Harvesting – Utilization of losses associated with investments that have not performed well – Match losses with gains on investments that have performed well Differing Tax Treatment for Investment Alternatives Type of Investment Taxable Bonds (held to maturity) After-tax Current Returns Tax Zero-Dividend Stocks After-tax No Tax Tax at Capital Gains Rate Dividend-Paying Stocks After-tax Tax at Dividend Rate Tax at Capital Gains Rate Municipal Bonds (held to maturity) After-tax No Tax No Tax After-tax (int. deduction) No Tax No Tax (up to $500K) Roth IRA After-tax No Tax No Tax IRA Pre-tax No Tax Tax at Ordinary Rate 401(k) Pre-tax No Tax Tax at Ordinary Rate Housing Contributions Sales/ Withdrawals No Tax Tax-Advantaged Accounts Navigating Complexity • • • Because of differing tax rates, tax treatment and favored tax status, it is difficult for taxpayers to choose the investment alternative that would maximize after-tax returns Due to the various sunsets of tax provisions, taxpayers are challenged to plan for the future, i.e., whether the current tax treatment will stay in effect For example, a simple decision of what to do with an additional $250 of savings creates the following dilemma driven by the tax code: – – – – – – – – Apply it to the mortgage Apply it to credit card debt Save it in a 401(k) plan Contribute it to an IRA Contribute it to a Roth IRA Save it for college in a 529 plan Invest it in a taxable account The easiest solution but maybe not the best – spend it Common Mistakes Taxpayers Make • Due to the complexity of the tax law, taxpayers have difficulty navigating through the rules to determine the best investment alternative – Not saving enough for retirement because they don’t know whether to save in a 401(k) plan or other contributory plan – Using municipal bonds in taxable accounts – There are approximately 100 different college savings plans Common Mistakes Taxpayers Make • Taxpayers let the tax tail wag the dog instead of making good economic decisions (the complexity of the tax law leads to poor decisions) – For example, not selling assets for fear of paying taxes when sound economics encourage a sale Other Common Mistakes • Failing to compute after-tax performance due to the complexity of that calculation • Paying additional taxes by not increasing the cost basis by mutual fund dividend reinvestments • Forgetting about carry-over items from previous years • Not meeting deadlines for setting up qualified retirement plans • Failing to name (or naming the wrong) beneficiary to an IRA, 401(k) or other retirement plan • Converting short-term debt into long-term debt with a Home Equity Loan • Not planning for the Alternative Minimum Tax (AMT) • Failing to claim deductions or tax benefits due to not knowing what is deductible Conclusions • The time and money spent on figuring out the tax code could be more productively used by taxpayers thereby making their lives simpler. • Simpler taxes and an easier application of the tax law will help taxpayers make better economic decisions. • Better economic decisions will help maintain the economic growth engine of the United States. Appendix Tax Treatment of Income and Investments Also Creates Compliance Burdens • If a professional firm prepares a client’s return, the client must complete a 15-page data questionnaire with 150 questions. • There are at least 14 possible tax forms to collect in the preparation of a tax return: W2, W-2 G, 1099-MISC, 1098, 1099-S, 1099INT, 1099-OID, 1099-DIV, 1099-B, 1099-G, 1099R, 1099-E, 1099 RRB, 1042S RRB. • Even taxpayers who use a return preparer face complexity.