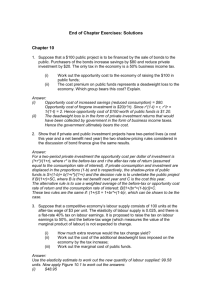

Chapter 13

advertisement

Exam Review II Soln. Chapter 12 1. Kennedy air services is now in the final year of a project. The equipment originally cost $20 million, of which 80% has been depreciated. Kennedy can sell the used equipment today for $5 mil and its TR is 40%. What is the equipment’s after-tax net salvage value? 2. Eisenhower communications is trying to estimate the first-year net operating cash flow (at year 1) for a proposed project. The financial staff has collected the following information on the project: Sales revenue $10 million Operating costs (excluding depreciation) $ 7 million Depreciation $ 2 million Interest expense $ 2 million The company has a 40 percent tax rate, and its WACC is 10 percent a. What is the project’s operating cash flow for the first year? Chapter 13 1. Martin Development Co. is deciding whether to proceed with Project X. The cost would be $9 million in Year 0. There is a 50% chance that X would be hugely successful and would generate annual after-tax CF of $6 million per year during years 1, 2 & 3. However, there is a 50% chance that X would be less successful and would generate only $1 million per year for the 3 years. If project X would be less successful and would generate only $1 million per year for the 3 years. If Project X is successful, it would open the door to another investment, Project Y, that would require a $10 million outlay at the end of Year 2. Project Y would then be sold to another company at a price of $20 million at the end of Year 3. Martin’s WAAC is 11%. a. If the company does not consider real options, what is Project X’s NPV? b. What is X’s NPV considering the growth option? c. How valuable is the growth option? 2. Hayley’s Graphic Designs Inc. is considering two mutually exclusive projects. Both require an initial investment of $10,000, and their risks are average for the firm. Project A has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of Year 1 & 2, respectively. Project B has an expected life of 4 years with after-tax cash inflows of $4,000 at the end of each of the next 4 years. The firm’s WAAC is 10%. a. If the projects cannot be repeated, which project should be selected if Hayley uses NPV as its criterion for project selection? b. Assume the projects can be repeated and that there are no anticipated changes in the cash flows. Use the replacements chain analysis to determine the NPV of the project selected. c. Make the same assumptions in part b. Use the equivalent annual method to determine the annuity of the project selected. 2. Cotner Clothers Inc. is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000 a 6-year life, and after taxcash flows of $98,300 per year. Assume that both projects can be repeated. Knitting machines prices are not expected to rise, because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Cotner’s WACC is 14%. Should the firm replace its old knitting machine, and, if so, which new machine should it use? 3. Corocoran Consulting is deciding which of two computer systems to purchase. They can purchase state-of-the-art equipment (System A) for $20,000, which will generate cash flows of $16,000 at the end of each of the next 6 years. Alternatively, they can spend $12,000 for equipment that an be used for 3 years and generates cash flows of $6,000 at the end of each year (System B). If the company’s WACC is 10% and both “projects” can be repeated indefinitely, which system should be chosen and what is its EAA? Chapter 14 1. A company’s fixed operating costs are $500,000, its variable costs are $3.00 per unit, and the product’s sales price is $4.00. What is the company’s breakeven point; that is, at what unit sales would its income equal its costs? 2. Harley Motors has $10 milion in assets, which were financed with $2 million of debt and $8 million in equity. Harley’s beta is currently 1.2 and its tax rate is 40%. Use the Hamada equation to find Harley’s unlevered beta, Bu. 3. The Weaver Watch Company sells watches for $25; the fixed costs are $140,000; and variable costs are $15 per watch. a. What is the firm’s gain or loss at sales of 8,000 watches? At 18,000 watches? b. What is the breakeven point? c. What would happen to the breakeven point if the selling price were raised to $31? d. What would happen to the breakeven point if the selling price were raised to $31, but variable costs rose to $23 a unit?