BAF3M Course Outline

advertisement

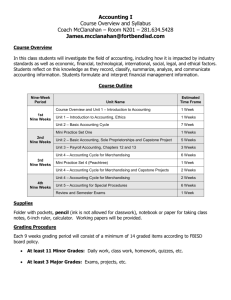

BAF 3M: Financial Accounting Fundamentals Brantford Collegiate Institute and Vocational School Description: This course introduces students to the fundamental principles and procedures of accounting. Students will develop financial analysis and decisionmaking skills that will assists them in future studies and/or career opportunities in business. Students will acquire an understanding of accounting for a service and a merchandising business, computerized accounting, financial analysis, and ethics and current issues in accounting. Teacher: Mr. P. Lovett By the end of this course, you will: Demonstrate an understanding of the basic procedures and principles of the accounting cycle for a service business Apply accounting practices in a computerized environment Demonstrate an understanding of internal control procedures in the financial management of a business Evaluate the financial status of a business by analyzing performance measures and financial statements. Assess the role of ethics in, and the impact of current issues on, the practice of accounting. Outline of Units: Unit 1: Fundamentals of Accounting Unit 2:The Accounting Cycle Unit 3: The Merchandising Business Unit 4: Decision Making, Ethics & Careers in Accounting UNIT 1: Fundamentals of Accounting By the end of the unit, you will: describe the discipline of accounting and its importance for business describe the differences among the various forms of business organization demonstrate an understanding of the basic procedures and principles of the accounting cycle for a service business Unit Assessments: 1. Service Business Transactions assignment 2. Transactions & Financial Statements final unit summative 3. Fundamentals of Accounting Test UNIT 2: The Accounting Cycle By the end of the unit, you will: demonstrate an understanding of the procedures and principles of the accounting cycle for a service business Demonstrate an understanding of the accounting practices for sales tax Apply accounting practices in a computerized environment Assess the impact of technology on the accounting functions in business Unit Assessments: 4. GAAP Research and Presentation 5. Simply Accounting Intro Activity 6. Journalizing and Posting Test 7. HST Sales Activity 8. Accounting & Microsoft Excel - Financial Statements assessment 9. Finalizing the Accounting Cycle Unit Test UNIT 3: The Merchandising Business By the end of the unit, you will: demonstrate an understanding of the procedures and principles of the accounting cycle for a merchandising business Demonstrate an understanding of internal control procedures in the financial management of a business. Apply accounting practices in a computerized environment Unit Assessments: 10. Shoes Outlet Merchandising assignment 11. Simply Accounting for a Merchandising business 12. Merchandising Business unit test UNIT 4: Decision Making, Ethics & Careers in Accounting By the end of the unit, you will: evaluate the financial status of a business by analyzing performance measures and financial statements explain how accounting information is used in decision making asses the role of ethics in, and the impact of current issues on, the practice of accounting describe professional accounting designations and career opportunities Unit Assessments: 13. ENRON Video reflection 14. Accounting Designations research assignment 15. Financial analysis and ratios QUEST FINAL GRADE: Course Work will count for 70% of the final mark in the course. You will complete ten (10) assignments and five (5) tests throughout this course. The Final Evaluation will count for 30% of the final mark in the course. This evaluation will include a final examination (20%) and a final MONOPOLY assessment of your bookkeeping and decision making skills for a service business (10%), which will be completed during class time.