Sustaining Quality Curriculum

advertisement

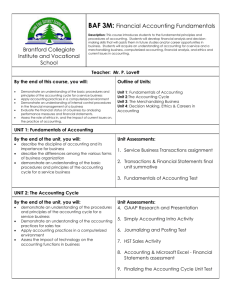

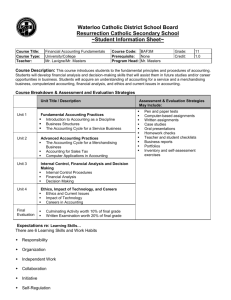

Curriculum Review Business Studies: Accounting The Big Picture • • • • • • • • • Descriptive course titles Fewer expectations Increased emphasis on ethics “demonstrate an understanding of” only in overall expectations Plain language, e.g., “record transactions in journals and ledgers” Greater use of examples Management accounting is out in BAT4M Cash Flow statement is in All courses require computer software use Course Titles • BAF3M Introduction to Financial Accounting • Financial Accounting Fundamentals • BAT4M Principles of Financial Accounting • Financial Accounting Principles • BAI3E Introduction to Accounting • Accounting Essentials • BAN4E Accounting for a Small Business • Accounting for a Small Business BAF3M Financial Accounting Fundamentals STRANDS Original: 1. The Objectives of Accounting 2. Accounting Fundamentals 3. Financial Analysis, Control, and Decision Making Revised: 1. Accounting Fundamentals 2. Accounting Practices 3. Internal Control, Financial Analysis, and Decision Making 4. Ethics, Impact of Technology, and Careers BAF3M – Accounting Fundamentals • Discipline of accounting • Different forms of business organization • Procedures and principles for a service business • Explain different equity sections, e.g., capital versus shareholder’s equity • Describe impact of adjusting entries on financial statements BAF3M – Accounting Practices • Accounting cycle for merchandising business • Perpetual and periodic inventory systems remain • Use accounting software or application software for service, merchandising business and financial statements • Sales taxes • Describe alternative accounting systems such as special journals and ledgers BAF3M - Internal Control, Financial Analysis, and Decision Making • • • • • Petty cash, bank reconciliation procedures Budgeted financial statements Role of an auditor Analysis of liquidity, solvency, profitability “simple” financial ratios, e.g. – Current, debt ratios – Comparative statements, trend analysis BAF3M – Ethics, Impact of Technology, and Careers • Role of ethics and code of conduct • Impact of current issues on accounting, e.g., fraud, globalization of transactions • Impact of technology on accounting functions • Research educational paths for accounting career paths BAT4M Financial Accounting Principles STRANDS Original: 1. The Accounting Cycle 2. Advanced Accounting Practices for Assets 3. Financing 4. Financial Analysis and Decision Making Revised: 1. The Accounting Cycle 2. Accounting Practices for Assets 3. Partnerships and Corporations 4. Financial Analysis and Decision Making BAT4M – The Accounting Cycle • emphasis on the computerized environment (go beyond BAF3M) • Include year end procedures using software • Roles of agencies, e.g., OSC • Relate GAAP and practices, e.g., matching principle and cash vs. accrual basis) • More ethics and issues, e.g., off balance sheet activities BAT4M – Accounting Practices for Assets • • • • • Short term assets, inventories, capital assets Notes receivable procedures included Relate technology to inventory control Capital vs. revenue expenditures Record and analyze methods of amortization BAT4M – Partnerships & Corporations • New strand • Limited vs. general partnerships • Various partnership transactions, e.g., formation, admission, dissolution, etc. • Common and preferred transactions and dividends • Impact of dividends on shareholder equity • Prepare financial statements including shareholders equity section BAT4M – Financial Analysis and Decision Making • Compare debt and equity financing • Investigate alternative sources, e.g., government loans • Describe and analyze annual report as a means of communication • Use annual report to prepare financial analysis of a company • Higher level ratios, e.g., turnovers, earning per share, times interest earned, etc. • Use info technology in financial analysis (spreadsheets?) • Prepare and analyze cash flow statement! BAI3E – Accounting Essentials STRANDS Original: 1. The World Accounting Cycle 2. The Accounting Cycle 3. Cash Management in a Service Business 4. The Use of Accounting Information in Decision Making Revised: 1. Fundamentals of Accounting for Business 2. The Accounting Cycle 3. Internal Control, Banking and Computerized Accounting 4. Decision Making, Ethics, and Careers BAI3E - Fundamentals of Accounting for Business • Describe differences in sources of financing, e.g. equity vs. loans • Identify elements of accounting system, e.g., journals, ledgers, etc. • Adv. and disadvantages of business ownership forms • Differentiate service and merchandising BAI3E - The Accounting Cycle • Focus on service business only • Explain relationships, e.g. assets to liabilities and equity • Complete the cycle for a service business • Complete sales tax remittance forms BAI3E - Internal Control, Banking and Computerized Accounting • Petty cash procedures, reconcile daily sales with point of sales records • Describe bank account features • Complete Bank reconciliation • Accounting software through closing, adjusting entries and financial statements – Service business only BAI3E - Decision Making, Ethics, and Careers • How is information used to make decisions, e.g. by managers • Identify costs beyond our control, e.g., taxes, minimum wage • Ethics related to a small business – Handling of cash, hiring relatives – Consequences, e.g., job loss, fines – Investigate code of ethics • Investigate a variety of accounting careers, e.g., accounting clerks, payroll, etc. BAN4E – Accounting for a Small Business STRANDS Original: 1. The Service and Merchandising Businesses 2. Accounting Practices 3. The GST, Retail Sales Taxes, and Cash-Flow Statements 4. Financial Analysis and Accounting Careers Revised: 1. Service and Merchandising Businesses 2. Accounting Practices 3. Plant & Equipment, Payroll, and Income Taxes 4. Ethics and Decision Making BAN4E - Service and Merchandising Businesses • Complete accounting cycle for a service business using accounting software • Timing for taking inventory and safeguarding inventory • Complete manual cycle for merchandising using periodic and perpetual systems • Repeat using accounting software BAN4E - Accounting Practices • Procedures for A/R and A/P sub ledgers • Use multi-column journal • Use multi-journal system BAN4E - Plant & Equipment, Payroll, and Income Taxes • Calculate cost of an fixed asset • Record depreciation • Methods of paying employees, e.g., hourly wage, salary, piecework, etc. • Record payroll transactions using accounting software • Prepare personal income tax return using software • Prepare a small business tax return BAN4E - Ethics and Decision Making • Ethical challenges for a small business, e.g., not reporting revenue, manipulating inventory, etc. • Report on a current issue • Compare budgeted and actual data to evaluate performance • Create a simple cash budget • Relate need for accounting personnel to an expanding business, e.g., specialization versus one person • Summarize steps to incorporate a business Resources • Ethics Case Studies http://ba.gsia.cmu.edu/ethics/AA/arthurandersen.htm • Misleading Annual Reports http://www.canadianbusiness.com/markets/stocks/article.jsp?content= 20050314_66053_66053 • Capital Cost Allowance http://www.cra-arc.gc.ca/E/pub/tp/it128r/it128r-e.html • BAT4M Files (can be used for other courses also) http://samsa.biz/BAT4M/