Introduction to Financial Accounting

advertisement

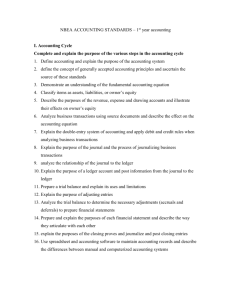

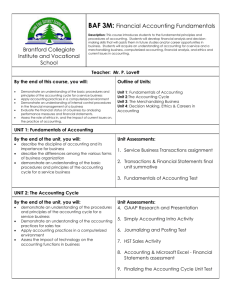

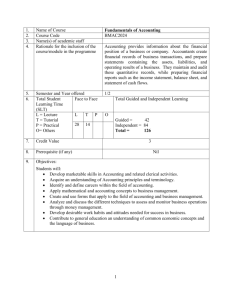

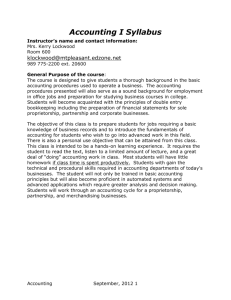

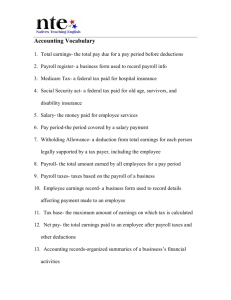

Santa Monica College Course Outline For ACCOUNTING 1, Introduction to Financial Accounting Course Title: Introduction to Financial Accounting Total Instructional Hours (usually 18 per unit): 90 Hours per week (full semester equivalent) in 5.00 Lecture: Date Submitted: Date Updated: C-ID: Transferability: Units: 5.00 In-Class Lab: 0 Arranged: May 2011 May 2014 ACCT 110 Transfers to UC Transfers to CSU IGETC Area: CSU GE Area: SMC GE Area: Degree Applicability: Prerequisite(s): Pre/Corequisite(s): Corequisite(s): Skills Advisory(s): I. II. III. Credit - Degree Applicable None None None MATH 18 or MATH 20 Catalog Description This course introduces the student to the sole proprietorship, partnership, and corporate forms of ownership. This course also familiarizes the student with recording, classifying and interpreting financial data for service and merchandising businesses. It includes a study of the journals, ledgers and financial statements used by these entities. Also covered are computerized accounting systems, internal control, ethics, cash, accounts and notes receivable, merchandise inventory, plant assets and intangible assets, liabilities, and equity accounts. Basic managerial accounting topics are also introduced. Examples of Appropriate Text or Other Required Reading: (include all publication dates; for transferable courses at least one text should have been published within the last five years) 1. Fundamental Accounting Principles , 21, Wild, J; Shaw, K; Chiappetta, B., McGraw-Hill Companies, Inc © 2013, ISBN: 0-07-802558-3 Course Objectives Upon completion of this course, the student will be able to: 1. Describe the nature and purpose of generally accepted accounting principles (GAAP) and international rules, such as International Financial Reporting Standards (IFRS); explain the conceptual framework for financial accounting and reporting, including basic principles of financial accounting, the assumptions underlying these principles, how accounting principles were developed and the constraints and limitations on accounting information. 2. Define, use and understand accounting and business terminology, and apply it to transactions, reporting and analysis. 3. Explain what an accounting system is and how it is designed to satisfy the needs of various internal and external users of the statements. Explain the purpose of and use journals and ledgers. 4. Apply transaction analysis, input transactions into the accounting system using journal entries, post and summarize this input, prepare and interpret the Income Statement, the Statement of Owner?s Equity and the Balance Sheet, and complete the accounting cycle through the beginning of the following fiscal year. 5. Distinguish between cash basis and accrual basis accounting and the principles underlying these approaches (matching principle, revenue recognition principle); explain the impact of each approach on the financial statements. 6. Distinguish the activities of a service business from those of a merchandising business; journalize the entries for merchandising transactions; prepare a chart of accounts and an income statement for a merchandising business; describe the accounting cycle for a merchandising business. 7. Identify and explain how the principles of internal control are used to minimize risk, protect business assets, and enhance accounting integrity; apply the principles of internal control to the accounting for cash, receivables, inventory, and plant assets. 8. Describe and explain the content, form and purpose of the basic financial statements, including the notes to the financial statements and the components of an annual report; describe how they satisfy the information needs of various users: investors, creditors, government bodies, directors, managers and other users. 9. Describe, explain and apply principles relating to current assets (cash and cash equivalents, receivables and bad debts, marketable securities, inventory and cost of goods sold, and prepaid expenses), including measurement, recording, changes in valuation, adjustments, errors, and reporting. 10. Identify and illustrate issues and transactions relating to long-term assets including acquisition, valuation, use, cost allocation, depreciation, disposal and reporting. 11. Distinguish between capital and revenue expenditures and demonstrate the recording and reporting of each. 12. Define and give examples of current liabilities and long term liabilities; journalize and explain the valuation and reporting of all current liabilities, including notes and payroll accounts; explain the valuation and reporting of estimated liabilities and other contingencies. 13. Describe the characteristics and advantages and disadvantages of the partnership form of business organization; journalize partnership entries. 14. Describe the importance of business ethics, the basic principles of proper ethical conduct, and the practical application of ethical principles to various reporting issues and business situations. 15. Describe and compute various managerial ratios and concepts related to service and merchandizing businesses in the current global economic environment including liquidity, solvency, profitability and market prospect ratios, as well as whole-statement analysis. IV. V. Methods of Presentation: Lecture and Discussion , Other (Specify) Other Methods: audio and visual presentations, problem-solving, self-tests & interactive discussions Course Content % of course Topic 3% Decision making uses and purposes of accounting information and reports. 5% Financial reporting rules and disclosure, including cash and accrual based accounting, and GAAP (domestic) and IFRS (international) standards 9% Analyzing and recording transactions using accrual basis accounting (GAAP) 10% Completing the Accounting Cycle: Adjusting Accounts and Preparing Financial Statements 7% Accounting for Merchandising Operations 7% Accounting Information Systems, including computerized ledgers 7% Internal Controls 7% Accounting for Current Assets: Cash and Receivables 7% Inventories and Cost of Sales 7% Long term assets: Plant Assets, Natural Resources, and Intangibles 7% Current Liabilities; Payroll Accounting 7% Accounting for Partnerships 7% Ethical issues in Accounting 10% Basic managerial ratios for service and merchandising businesses 100% VI. Total Methods of Evaluation: (Actual point distribution will vary from instructor to instructor but approximate values are shown.) Percentage Evaluation Method 35 % Quizzes - 6-12 Chapter Quizzes 5% Projects 10 % Homework 25 % Final exam 25 % Other - Instructor discretion: midterm or re-weighting 100 % Total Additional Assessment Information: Grade Scale: 90% - 100% A 80% - 89% B 70% - 79% C 60% - 69% D 0% - 59% F VII. Sample Assignments: 1.General Ledger Software Assignment: This is a computerized accounting assignment designed to provide exposure to computerized accounting. You will complete a comprehensive problem in the textbook using a general ledger software program. The comprehensive problem features over 30 accounting transactions, including purchases, sales, cash receipts, cash payments and other transactions. You will analyze these transactions and process journal entries for each, using the general ledger software. Your work must be submitted as a general ledger software file. It cannot be substituted by any other format. 2.Financial Statement Preparation: Analyze the following accounting transactions over a month’s period provided for the Holden Graham Company and perform the required work as described below: May 1 H. Graham invested $40,000 cash in the business. 1 Rented a furnished office and paid $2,200 cash for May’s rent. 3 Purchased $1,890 of office equipment on credit. 5 Paid $750 cash for this month’s cleaning services. 8 Provided consulting services for a client and immediately collected $5,400 cash. 12 Provided $2,500 of consulting services for a client on credit. 15 Paid $750 cash for an assistant’s salary for the first half of this month. 20 Received $2,500 cash payment for the services provided on May 12. 22 Provided $3,200 of consulting services on credit. 25 Received $2,500 cash payment for the services provided on May 22. 26 Paid $1,890 cash for the office equipment purchased on May 3. 27 Purchased $80 of advertising in this month’s (May) local paper on credit; cash payment is due June 1. 28 Paid $750 cash for an assistant’s salary for the second half of this month. 30 Paid $300 cash for this month’s telephone bill. 30 Paid $280 cash for this month’s utilities. 31 Graham withdrew $1,400 cash for personal use. Required: 1. Show the effects of the transactions on the accounting equation by recording increases and decreases to the appropriate accounts. 2. Prepare an income statement, a statement of owner’s equity, a balance sheet and a statement of cash flows for the month of May. VIII. Student Learning Outcomes 1. Be able to record, classify and interpret financial data and prepare reports for service and merchandising businesses 2. Be able to complete a comprehensive accounting cycle problem. 3. Demonstrate a level of engagement in the subject matter that reveals their understanding of the value of the course content beyond the task itself, specifically as it relates to linking the relevance of course content to careers in business and accounting and their personal lives.