Financial Accounting Information

advertisement

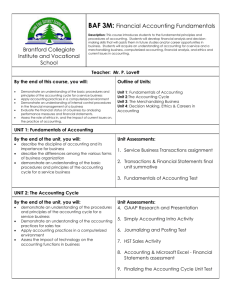

CHAPTER 1 INTRODUCTION TO BUSINESS AND ACCOUNTING 1 Chapter Overview Why is it necessary to have an understanding of business before trying to learn about accounting? What is the role of accounting information within the business environment? What is private enterprise, and what forms does it take? What types of regulations do companies face? 2 Chapter Overview What activities contribute to the operations of a company? Are there any guidelines for reporting to company managers? Are there any guidelines in the United States for reporting to people outside of a company? What role does ethics play in the business environment? 3 Reflection Will I be sufficiently informed What to will I do Will I understand the role make good business when I of graduate accounting decisions, both in in mybusiness personalso from college? that gained lifeI have and at work?financial literacy to achieve my goals? 4 Private Enterprise and Capitalism Businesses in the United States and most other countries operate in an economic system called private enterprise. In this system, individuals (people like you and me) own companies (businesses) that produce and sell services and or goods for a profit. These companies generally fall into three categories: service, merchandising, and manufacturing. 5 Service Companies Service companies perform services or activities that benefit individuals or business customers. Companies like A Great Cut, Midas Muffler Shops, Merry Maids, UPS, and many professional practices such as accounting, law, architecture, and medicine, are all service companies. 6 Merchandising Companies Merchandising companies purchase goods (sometimes referred to as merchandise or products) for resale to their customers. Some merchandising companies are wholesalers, meaning they sell their goods to retailers or other commercial users. Examples include plumbing supply stores, electrical suppliers, or beverage distributors. 7 Merchandising Companies Some merchandising companies are retailers, meaning they sell their goods directly to consumers like you and me. Most of the businesses you come in contact with are probably retailers, such as JC Penney, Toys ’R’ Us, amazon.com, and Circuit City. 8 Manufacturing Companies Manufacturing companies make their products and then sell these products to their customers. Unlike merchandisers who purchase readyto-sell merchandise, a manufacturer has no goods to sell until they are manufactured. Examples of manufacturing companies include General Motors, Black & Decker, and Dell Corporation. 9 Entrepreneurship Entrepreneurship is a combination of three factors: A company owner’s idea for a business. The willingness of the company’s owner to take a risk in starting a business. Abilities of the company’s owners and employees to use capital and to produce and sell goods or services. 10 Sources of Capital Entrepreneurs can raise capital in two ways: Investing his/her own money into the business for a greater future return or finding other investors to do the same. Borrowing money from a bank or other lending sources (creditors). Since borrowings have specific repayment schedules, they creates more risk for the business. 11 Business Organizations Business organizations or companies are a significant aspect of the U.S. and world economies. A company may be organized as a sole proprietorship, partnership, or a corporation. Each of these business forms has its advantages and disadvantages. 12 Business Organizations Exhibit 1-3 13 Regulatory Environment Many different laws and authorities regulate the business environment, covering issues from consumer protection, environmental protection, employee safety, hiring practices, and taxes. Companies must comply with different sets of regulations depending on the nature of their business. 14 Integrated Accounting System An integrated accounting system is a means by which accounting information about a company’s activities is identified, measured, recorded, and summarized so that it can be communicated to users. External users include the many diverse groups of people outside the company. Internal users include the managers and employees within the company. 15 Managerial Accounting Information Management accounting information helps managers plan, operate, and evaluate a company’s activities. This information has an internal focus and is free from the restrictions of regulatory bodies interested in how companies report to external users. 16 Financial Accounting Information Financial accounting information is organized for the use of interested people outside of the company. This information has an external focus and must follow the guidelines of generally accepted accounting principles, standards for preparing financial accounting information. 17 Basic Management Accounting Reports Budgets: A financial plan that quantifies managers’ plans and the impact on the company’s operating activities and financial position. Cost Analysis: The process of determining and evaluating costs of specific products or activities. Manufacturing Cost Reports: Cost reports that help monitor and evaluate a company's operations to determine if its plans are being achieved. 18 Generally Accepted Accounting Principles (GAAP) Accepted principles, procedures, and practices that companies use for financial accounting and reporting in the United States. These principles, or “rules” must be followed in the external reports of companies that sell stock to the public in the United States and by many other companies as well. GAAP covers a wide range of issues from how to account for inventory, buildings, income taxes, as well as specialized industry guidelines. 19 Basic Financial Statements Financial statements are accounting reports used to summarize and communicate financial information about a company. A company’s integrated accounting system produces three major statements: the income statement, the balance sheet, and the cash flow statement, as well as a supporting statement called the changes in owners’ equity. Each financial statement summarizes specific information and serves specific purposes. 20 Income Statement 21 Balance Sheet 22 Cash Flow Statement 23 Ethics in Business and Accounting A company’s financial statements are meant to convey information about the company to internal and external users in order to facilitate decisionmaking. If the information in the financial statements does not convey a realistic picture, the decisions based on this information can have disastrous consequences. 24 Code of Ethics The American Institute of Certified Public Accountants (AICPA) has a professional code of ethics that guides the professional work of CPAs. The Institute of Management Accountants (IMA) and the International Federation of Accountants (IFAC) have a code similar to the AICPA. Many companies have codes or statements of company and business ethics to guide the actions and behaviors of their employees. 25