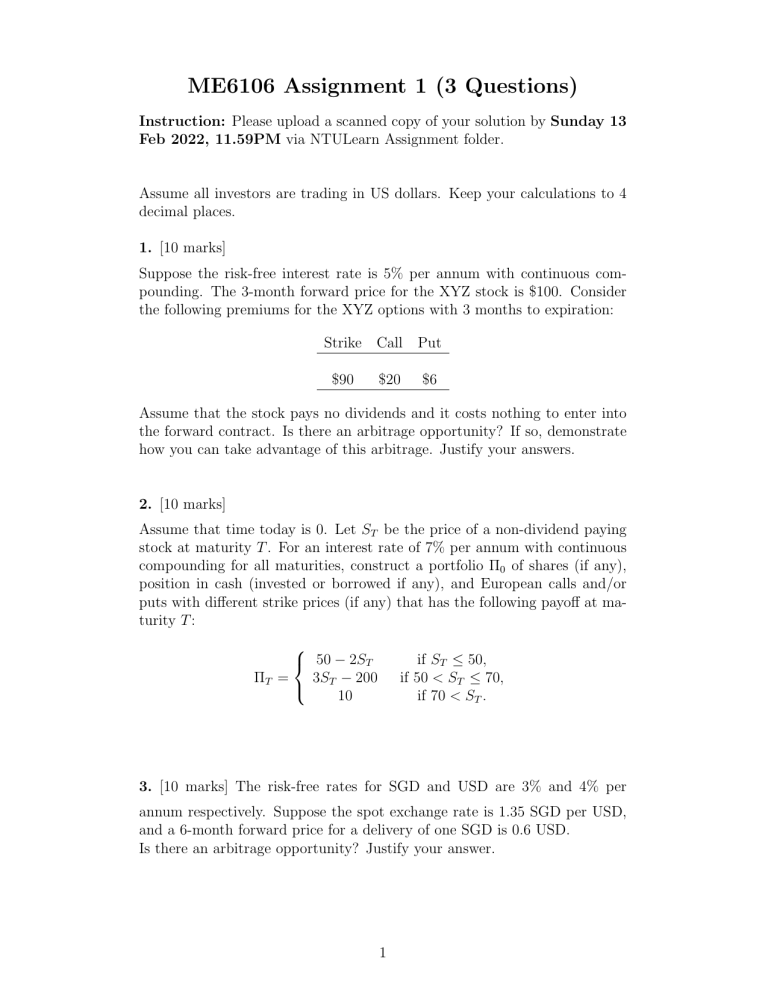

ME6106 Assignment 1 (3 Questions) Instruction: Please upload a scanned copy of your solution by Sunday 13 Feb 2022, 11.59PM via NTULearn Assignment folder. Assume all investors are trading in US dollars. Keep your calculations to 4 decimal places. 1. [10 marks] Suppose the risk-free interest rate is 5% per annum with continuous compounding. The 3-month forward price for the XYZ stock is $100. Consider the following premiums for the XYZ options with 3 months to expiration: Strike Call Put $90 $20 $6 Assume that the stock pays no dividends and it costs nothing to enter into the forward contract. Is there an arbitrage opportunity? If so, demonstrate how you can take advantage of this arbitrage. Justify your answers. 2. [10 marks] Assume that time today is 0. Let ST be the price of a non-dividend paying stock at maturity T . For an interest rate of 7% per annum with continuous compounding for all maturities, construct a portfolio Π0 of shares (if any), position in cash (invested or borrowed if any), and European calls and/or puts with different strike prices (if any) that has the following payoff at maturity T : 50 − 2ST 3ST − 200 ΠT = 10 if ST ≤ 50, if 50 < ST ≤ 70, if 70 < ST . 3. [10 marks] The risk-free rates for SGD and USD are 3% and 4% per annum respectively. Suppose the spot exchange rate is 1.35 SGD per USD, and a 6-month forward price for a delivery of one SGD is 0.6 USD. Is there an arbitrage opportunity? Justify your answer. 1