Topic 2 Interest Rates and Foreign Exchange: Spot Markets FX Markets

advertisement

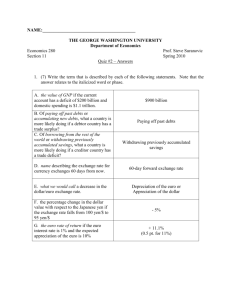

Topic 2 Interest Rates and Foreign Exchange: Spot Markets Staying Competitive in a Floating Rate Environment FX Markets • • • • • Spot Market (Today’s Topic) Forward Market (Next Topic) Futures and Options Swaps Other Derivatives Alternative Exchange Rate Systems • Pegged Rates • Floating Rates – Free Float – Managed Float Functions of Money • Medium of Exchange • Store of Value • Unit of Accounting Better Money, Worse Money • What makes some money better? – – – – Swiss Franc Euro Yen U.S. Dollar • What makes some money worse? – – – – Ruble Cruziero Peso Rupia Examples of Exchange Rates (9/10/13) Direct Quotes (U.S. Perspective) • Swiss Franc 1.07 Indirect Quotes • Swiss Franc CHF 1 = $ 1.07 • Euro 1.3260 € 1 = $ 1.3260 • British Pound • Euro • 1.5735 £ 1 = $ 1.5735 • Japanese Yen 0.9346 $1 = CHF 0.9346 0.7542 $1 = € 0.7542 • British Pound 0.6355 $1 = £ 0.6355 0.010031 ¥ 1 = $ 0.010031 http://finance.yahoo.com/currency?u • Japanese Yen $1 = ¥ 100.305 100.305 Examples of Exchange Rates (1/29/13) Direct Quotes (U.S. Perspective) • Swiss Franc 1.0852 Indirect Quotes • Swiss Franc CHF 1 = $ 1.0852 • Euro 1.3491 € 1 = $ 1.3491 • British Pound • Euro • 0.7412 $1 = € 0.7412 1.5759 • British Pound 0.01103 • Japanese Yen £ 1 = $ 1.5759 • Japanese Yen 0.9215 $1 = CHF 0.9215 0.6346 $1 = £ 0.6346 ¥ 1 = $ 0.01103 90.6545 $1 = ¥ 90.6545 http://finance.yahoo.com/currency?u Cross Rate Example: $1,200,000 - $1,000,000 $1,000,000 = $200,000 New York Dollar Weakens Dollar Strengthens Brussels London £ 1 = Euro 1.50 £ 600,000 Pound Weakens Euro 900,000 Second Example: $1,111,111 - $1,000,000 $1,000,000 = $111,111 New York Dollar Strengthens Dollar Weakens Tokyo London £ 1 = ¥ 135 £666,667 Yen Weakens The Determination of Exchange Rates • Equilibrium Spot Exchange Rate – Supply and Demand for Exchange • Asset Market Model of Exchange Rates – Supply and Demand for Financial Assets • Central Bank Intervention – Unsterilized no domestic offset – Sterilized domestic money supply adjusted to compensate ¥ 90,000,000 The Basic Relationship (FA is a financial asset; RA is a real asset) MU money MU FA 1 MU FA 2 MU FA n = = = ! = P money P FA 1 P FA 2 P FA n MU RA 1 MU RA 2 MU RA n = = = ! = P RA 1 P RA 2 P RA n ! A Helpful Concept: Arrow-Debreu Securities MU money MU FA 1 MU FA 2 MU FA n = = = ! = P money P FA 1 P FA 2 P FA n MU RA 1 MU RA 2 MU RA n = = = ! = P RA 1 P RA 2 P RA n ! • Arrow-Debreau securities: – One of these pays a dollar if a specific state of the world occurs at a specific time, – but pays nothing otherwise – (a lottery ticket also works this way, but covers a very limited span of events) Questions for discussion: • • • • • • What is the marginal utility of money? What is the price of money? What is the marginal utility of a financial asset? What is the marginal utility of a real asset? What does the price of an Arrow-Debreau security reflect? Consider the ratio of marginal utility to price. What does it mean for this ratio to be the same for all financial assets and real assets in the world?