SBP IPF

advertisement

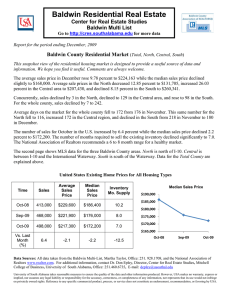

INFRASTRUCTURE PROJECT FINANCE Infrastructure, Housing & SME Finance Department Infrastructure Financing – SBP Efforts Revision in Guidelines Infrastructure Finance Task Force Facilitation in establishment of IDFI Capacity Building Consultative Group Infrastructure Finance Review Development Finance Review Project & Structured Finance 2 SBP Guidelines/Regulatory Framework - History Relaxation in Prudential Regulations for Infrastructure Project Financing (IPF) vide BPD Circular No.25 dated July 04, 2003 (http://www.sbp.org.pk/bpd/2003/C25.htm). Debt equity relaxed to 80:20 for the Infrastructure projects “Concession Agreement/License/Right of Way” issued by Government accepted as a collateral Guidelines For Infrastructure Project Financing (IPF) shared for consultation purposes vide BPD Circular No.25 of July 23, 2005 (http://www.sbp.org.pk/bpd/2005/C23.htm) Updated IPF Guidelines in August 31, 2010 vide No. IHFD/11 /191/ 2010. The salient features of the revised guidelines: Includes the requirement for establishing a mechanism for generating feasibility reports and assessing risk mitigation means in the development, construction, start-up and operation stages of the project. Banks and DFIs to establish a proper process for the continuous monitoring of project implementation to ensure proper utilization of the credit while relevant bank accounts will be subject to audit by the SBP. Banks and DFIs encouraged to accept Concession Agreement/Licence issued by a government agency as collateral. The institutions to ensure adequate insurance coverage against all potential risks applicable to the project. 3 At no point shall the bank’s exposure to the risk exceed the bank’s equity, and the exposure availed by any borrower shall also not exceed 10 times the borrower’s equity. SBP GUIDELINES- WHAT IS AN INFRASTRUCTURE? Infrastructure Project means one of the followings: a) A road, including toll road, fly over, bridge project. b) A mass transit, urban bus, urban rail project. c) A rail-bed, stations system, rail freight, passenger services project. d) A telecommunication local services, long distance and value added project. e) A power generation project. f) A power transmission or distribution project by laying a network of new transmission or distribution lines. g) A natural gas exploration and distribution project. h) An LPG extraction, distribution and marketing project. i) An LPG import terminal, distribution and marketing project. j) An LNG (Liquefied Natural Gas) terminal, distribution and marketing project. k) A water supply, irrigation, water treatment system, sanitation and sewerage system or solid waste management system project. l) A dam, barrage, canal project. m) A primary and secondary irrigation, tertiary (on-farm) irrigation project. n) A port, channel dredging, shipping, inland waterway, container terminals project. o) An airport. 4 p) A petroleum extraction, refinery, pipeline project. q) Any other infrastructure project of similar nature, notified by SBP. INFRASTRUCTURE PROJECT FINANCING PROFILE- TRENDS (AMOUNT IN RS. BILLIONS) Infrastructure Project Financing Profile- Trends (Amount in Rs. Billions) Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Total Sanctioned Amount 459.6 496.5 520.3 482.6 493.5 Amount Disbursed (Cumulative) 203.2 251.1 349.0 356.2 356.3 Amount Outstanding 234.4 275.9 298.5 265.5 289.3 No of Projects (Cumulative) 291 311 338 337 364 NPLs 1.3 8.2 10.4 17.1 17.5 Project & Structured Finance Description *Cumulative Number of projects is the total number of projects less the matured ones. 5 TOTAL NUMBER OF INFRASTRUCTURE PROJECTS- SECTOR WISE Sectors Dec-09 Dec-10 Dec-11 Dec-12 Telecom 55 54 56 56 56 Power Generation 99 118 145 154 178 Power Transmission 28 36 32 29 20 Petroleum 21 21 25 24 24 LPG Extract. Dist. 9 6 5 4 7 LPG Import & Dist 6 5 5 3 Oil & Gas Exploration/Distr. 27 25 23 19 11 Road, Bridge, Flyover 19 18 18 20 36 Water Supply, Sanitation 2 2 2 2 2 Any other 25 26 27 26 28 291 311 338 337 364 Total Project & Structured Finance Dec-08 2 6 AMOUNT OUTSTANDING- SECTOR WISE ( IN BILLIONS) Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Telecom 47.9 48.3 50.3 42.0 48.2 Power Generation 95.3 136.4 180.4 160.7 176.2 Power Transmission 33.5 46.3 30.5 26.4 21.5 Petroleum 29.0 16.8 10.8 12.6 12.9 LPG Extraction/Dist. 1.3 0.9 0.7 0.5 0.9 LPG Import & Dist 0.3 0.2 0.2 0.1 0.5 Oil & Gas Exploration/Distr. 9.3 8.8 6.1 4.8 4.4 Road, Bridge, Flyover 8.6 7.0 6.3 6.3 6.2 Water Supply, Sanitation 0.4 0.4 0.4 0.4 0.4 Any other 8.9 10.8 12.9 11.7 18.0 234.4 275.9 298.5 265.5 289.3 Total Project & Structured Finance Sectors 7 IIPF Sectoral Trends - Outstanding Finance (Rs. Millions) Sectors Dec-12 Power Generation Dec-11 4,350 Dec-09 Dec-08 4,668 4,630 2,688 1,361 3 200 500 500 10 10 10 4,840 3,198 1,871 Shipping/Container Terminals Total 4,350 4,671 Project & Structured Finance Oil & Gas Exploration and Distr. Dec-10 Banking Sector wise Trends - Outstanding Finance (Rs. Millions) Category Dec-12 Dec-11 Dec-10 Dec-09 Dec-08 Private 616.8 692.4 695.0 635.0 350.0 Islamic 2,979.6 3,182.6 3,177.1 1,744.8 1,011.0 753.2 795.8 967.7 818.0 510.0 4,350 4,671 4,840 3,198 1,871 DFIs Total 8 PROGRAM DETAILS Group Photo: Ground Floor ) Tea Break: Lunch +Prayer Break: Evening Tea: 11:00 (Near Lift Lobby 11:15-11:30 1:30 to 2:30 3:30 to 03:45 THANK YOU 10