SULI's IDX Filing

advertisement

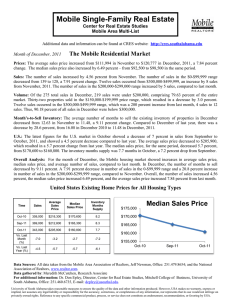

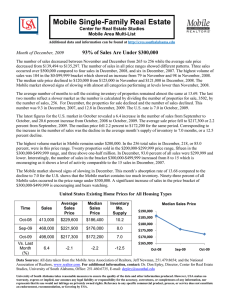

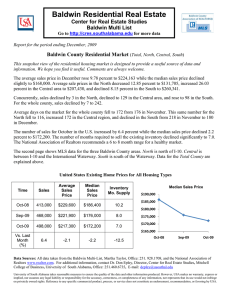

SULI Sumalindo Lestari Jaya Tbk. COMPANY REPORT : JULY 2012 Main Board Industry Sector : Basic Industry And Chemicals (3) Industry Sub Sector : Wood Industries (37) COMPANY HISTORY Established Date : 14-Apr-1980 Listing Date : 21-Mar-1994 Under Writer IPO : PT W.I. Carr Dharmala Securities Administration Bureau : PT Ficomindo Buana Registrar Mayapada Tower 10th Fl. Suite 02 B Jln. Jend. Sudirman Kav. 28 Jakarta 12920 Phone : 521-2316, 521-2317 Fax : 521-2320 BOARD OF COMMISSIONERS 1. Wijiasih Cahyasasi 2. Amiruddin Arris *) 3. Husni Heron *) 4. Kadaryanto 5. Trenggono Purwosuprodjo *) Independent Commissioners BOARD OF DIRECTORS 1. Amir Sunarko 2. David 3. Rudy Gunawan AUDIT COMMITTEE 1. Husni Heron 2. Amiruddin Arris 3. Sri Danarto CORPORATE SECRETARY Hasnawiyah Kono HEAD OFFICE Menara Bank Danamon, 19th Fl. Jln. Prof. DR. Satrio Kav. EIV/6, Mega Kuningan, Jakarta Selatan 12950 Phone : (021) 576-1188, 576-1199 Fax : (021) 577-1818 Homepage Email : www.sumalindo.com : hasnawiyah.kono@sumalindo.com; public.Relations@sumalindo.com As of 31 July 2012 : Individual Index : Listed Shares Market Capitalization : SHAREHOLDERS (July 2012) 1. PT Sumber Graha Sejahtera 2 2. Gem Treasury Investments Limited - 873384000 3. Deddy Hartawan Jamin 4. Deutsche Bank AG SG A/C Imani United Pte Limited 5. Public ( <5% ) DIVIDEND ANNOUNCEMENT Bonus Cash Year Shares Dividend Cum Date 1994 100.00 14-Jul-95 1995 50.00 25-Jun-96 1996 25.00 11-Jul-97 1999 1.00 02-Aug-00 1.400 2,472,044,622 242,260,372,956 766,275,582 407,475,000 372,456,000 130,000,000 795,838,040 Recording Date 25-Jul-95 04-Jul-96 23-Jul-97 11-Aug-00 Ex Date 17-Jul-95 26-Jun-96 14-Jul-97 03-Aug-00 : : : : : 31.00% 16.48% 15.07% 5.26% 32.19% Payment Date 16-Aug-95 02-Aug-96 21-Aug-97 25-Aug-00 F/I F F F F ISSUED HISTORY No. 1. 2. 3. 4. 5. Type of Listing First Issue Company Listing Right Issue Shares 25,000,000 100,000,000 1,735,485,759 Additional Listing without Right Issue 465,530,686 Warrant I 146,028,177 T: T: T: T: Listing Date 21-Mar-94 21-Mar-94 16-Jan-98 29-Dec-04 18-Jan-07 : : : : Trading Date 21-Mar-94 14-Feb-95 07-Apr-10 16-Jun-06 10-Aug-09 SULI Sumalindo Lestari Jaya Tbk. Closing Price Volume (Mill. Sh) 2,400 480 2,100 420 1,800 360 1,500 300 1,200 240 900 180 600 120 300 60 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Change of Closing Price, Basic Index and Jakarta Composite Index January 2008 - July 2012 100% Close 2,875 2,625 1,820 1,800 1,700 1,380 1,080 820 570 240 99 185 4,021 2,124 2,040 2,851 2,440 2,716 2,744 1,386 4,258 2,955 1,455 3,596 117,304 77,685 41,651 38,381 57,160 28,902 46,928 111,708 72,069 123,181 63,686 138,560 375,306 174,596 97,958 68,640 111,326 49,498 56,957 89,801 51,641 38,754 10,212 22,197 20 19 18 22 20 21 22 20 21 18 20 19 Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 285 270 240 415 830 820 670 590 640 580 500 450 130 210 183 215 410 550 500 510 500 360 405 365 240 215 220 415 720 640 560 530 540 440 430 375 14,384 10,414 5,172 6,310 13,759 6,759 4,805 4,271 7,123 4,749 1,781 1,336 264,912 242,901 109,354 168,092 226,864 95,532 66,242 73,348 127,751 85,123 16,682 23,975 56,727 56,611 23,742 48,588 150,780 67,898 36,979 40,734 74,034 45,956 7,329 24,221 19 20 20 20 17 22 21 20 18 22 20 19 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 440 365 345 182 164 127 111 127 114 148 176 143 360 142 118 146 80 108 90 88 100 102 123 125 365 146 168 162 112 111 95 99 108 147 128 131 4,458 5,996 36,795 24,926 8,990 9,289 3,853 12,037 7,033 10,215 13,626 6,371 57,437 73,651 1,259,963 861,724 212,120 261,496 115,189 415,455 219,588 449,758 460,822 144,832 23,353 13,743 227,392 145,532 28,014 30,854 11,699 44,931 23,904 55,861 68,935 19,288 20 19 22 21 19 22 22 21 17 21 21 20 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 133 117 130 142 156 150 156 140 148 162 143 140 112 102 103 119 131 128 134 120 116 122 135 132 114 108 119 136 138 138 136 134 135 142 136 134 2,771 1,138 7,699 5,502 7,140 2,900 3,499 1,746 1,737 2,790 726 879 41,578 12,654 157,856 121,081 164,145 149,732 429,909 68,718 34,061 109,945 11,645 24,545 5,124 1,381 18,953 15,577 23,490 20,913 60,075 9,636 4,475 16,068 1,541 3,613 21 18 23 20 21 20 21 19 20 21 22 21 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 140 138 132 142 125 116 117 132 121 120 114 109 95 92 133 128 122 121 117 106 98 1,722 1,063 1,902 4,319 1,263 489 873 34,763 18,868 40,706 121,267 28,778 5,067 8,946 4,454 2,488 5,127 15,294 3,424 541 906 21 21 21 20 21 20 22 Month 95.6% Jakarta Composite Index Basic Index Closing Price 75% 51.7% 50% 25% -25% -50% -75% -95.6% -100% Jan 08 Low 2,625 2,425 1,780 1,580 1,650 1,380 1,060 790 560 210 97 59 Volume Value Freq. (X) (Thou. Sh.) (Million Rp) Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 High 3,575 2,875 2,700 2,200 2,040 1,970 1,440 1,060 930 480 275 320 Day Closing Price* TRADING ACTIVITIES Closing Price* and Trading Volume Sumalindo Lestari Jaya Tbk. January 2008 - July 2012 Jan 09 Jan 10 Jan 11 Jan 12 SHARES TRADED 2008 2009 2010 2011 Jul-12 Volume (Million Sh.) Value (Billion Rp) Frequency (Thou. X) Days 917 1,147 33 240 1,501 634 81 238 4,532 694 144 245 1,326 181 39 247 258 32 12 146 Price (Rupiah) High Low Close Close* 3,575 59 185 127 830 130 375 258 440 80 131 131 162 102 134 134 142 92 98 98 -0.91 -4.46 PER (X) 10.41 6.15 PER Industry (X) 0.70 2.10 PBV (X) * Adjusted price after corporate action 71.18 12.86 0.91 -1.05 6.17 8.09 -1.18 12.07 -22.98 SULI Sumalindo Lestari Jaya Tbk. Financial Data and Ratios Public Accountant : Purwantono, Suherman & Surja (Member of Ernst & Young Global Limited) Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Cash & Cash Equivalents 65,558 24,951 37,717 11,527 7,403 Receivable 88,483 71,463 108,063 54,868 49,385 Inventories 305,008 322,354 208,357 196,763 187,224 Current Assets 544,831 463,236 467,966 381,203 312,598 Fixed Assets 1,148,400 1,321,401 1,240,895 992,177 863,580 Other Assets 10,547 14,541 5,985 1,879 1,761 Total Assets 1,895,845 2,169,945 2,009,536 1,955,536 1,695,019 14.46% -7.39% -2.69% -13.32% 897,999 924,678 979,524 1,467,638 BALANCE SHEET (Million Rp except Par Value) Book End : December TOTAL ASSETS AND LIABILITIES (Bill. Rp) Assets Liabilities 2,250 1,800 Growth (%) 1,350 900 450 - Current Liabilities 474,088 802,959 897,920 810,786 620,191 186,411 1,277,047 1,795,919 1,735,463 1,599,715 1,654,049 40.63% -3.37% -7.82% 3.40% 38,862 49,075 52,937 9 - Authorized Capital 1,800,000 3,000,000 3,000,000 3,000,000 3,000,000 Paid up Capital 1,228,466 1,236,022 1,236,022 1,359,625 1,359,625 1,236 2,472 2,472 Long Term Liabilities Total Liabilities Growth (%) 2007 2008 2009 2010 Dec-11 TOTAL EQUITY (Billion Rupiah) 580 Minority Interest Paid up Capital (Shares) 1,228 1,236 Par Value 1,000 1,000 1000 & 100 1000 & 100 1000 & 100 580 462 356 325 343 Retained Earnings Total Equity -1,044,147 -1,204,071 -1,307,886 -1,296,812 -1,611,744 579,937 324,951 221,136 355,812 40,971 -43.97% -31.95% 60.90% -88.49% Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 1,073,890 1,097,078 667,300 592,238 408,729 2.16% -39.17% -11.25% -30.99% 1,006,637 780,090 630,230 450,910 Growth (%) INCOME STATEMENTS Total Revenues Growth (%) Expenses 884,423 Gross Profit 189,467 90,442 -112,791 -37,992 -42,181 Operating Expenses 100,390 118,554 88,424 89,328 163,946 89,077 -28,113 -201,215 -127,320 -206,128 N/A -615.74% 36.72% -61.90% 221 225 41 107 -12 2007 2008 2009 2010 Dec-11 TOTAL REVENUES (Billion Rupiah) 1,074 1,097 1,097 Operating Profit Growth (%) 873 667 649 Other Income (Expenses) Income before Tax Tax -57,409 -299,252 118,724 90,403 -100,229 31,668 -327,365 -82,491 -36,917 -306,357 -7,711 -24,067 17,462 -38,611 8,493 -11,774 - -3,862 2,856 - 27,604 -252,330 -103,815 4,550 -314,851 N/A 58.86% N/A N/A Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 114.92 51.59 50.61 38.92 21.30 - - - - - 592 409 426 202 Minority Interest Net Income Growth (%) RATIOS Current Ratio (%) Dividend (Rp) 22.47 -204.15 -83.99 1.84 -127.36 BV (Rp) 472.08 262.90 178.91 143.93 16.57 DAR (X) 0.67 0.83 0.86 0.82 0.98 DER(X) 2.20 5.53 7.85 4.50 40.37 ROA (%) 1.67 -15.09 -4.10 -1.89 -18.07 ROE (%) 5.46 -100.74 -37.30 -10.38 -747.75 GPM (%) 17.64 8.24 -16.90 -6.42 -10.32 OPM (%) 8.29 -2.56 -30.15 -21.50 -50.43 NPM (%) 2.57 -23.00 -15.56 0.77 -77.03 Payout Ratio (%) - - - - - Yield (%) - - - - - EPS (Rp) -22 2007 2008 2009 2010 Dec-11 NET INCOME (Billion Rupiah) 28 2008 28 -41 2009 2007 4.5 Dec-11 2010 -109 -104 -178 -246 -252 -315 -315