Shell Gas LPG (Pakistan) Limited

advertisement

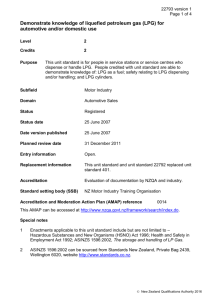

Shell Gas LPG (Pakistan) Limited Growing Energy Gap Case 1(Worst case): 4% GDP growth projections Case II(Best case): 5.8% GDP growth projections Demand (Million TOEs) Case – I (worst case) Case – II (best case) 2009-10 65.99 71.04 2014-15 79.84 94.10 2019-20 98.93 127.02 Deficits (Million TOEs) Case – I Case – II (19.31) (24.37) (33.32) (47.58) (57.55) (85.64) Conversion Rate For TOE to LPG MT = TOE*1.08 -Forecasts prepared by Petroleum Industry of Pakistan (PIP) for the oil marketing & producing companies 2007 Domestic Packed : Demand • Number of households = 24 Million •LPG penetration = 7% •Current estimated segment volume = 160 Kt/annum • Impact of increasing The shaded spots represent 80%+ of current genuine domestic volume penetration by 1% : 24K ! (4% Of LPG industry Approx. 6K POS (FMCG POS Universe 200K+) Volume) • Impact of increasing per capita consumption by 1 kg/month : 21K ! •Current per month usage = 8 Kg Coverage : key for domestic business development Commercial Potential • Current estimated commercial volume is 100K Mt/annum Main segments include; Hotels Bakery Restaurants Sweets Metal cutting Catering Available Potential: •Currently these applications are using wood & coal •To make the conversions conservative, 100% dry coal usage has been assumed Application Estimated LPG Equivalent Sweets (Khoya & Gur) 800 K Mt Tobacco Curing 100 K Mt Social ceremonies (catering 150 K Mt Rural bakeries, ovens & 30 K Mt Water Heating 12 K Mt Total 1,092 Mt Issues & Challenges • Cross- Filling • Decanting • Pricing caps & Subsidies • Penetration into rural areas • Inland freight infrastructure