Capital Budgeting In Practice

advertisement

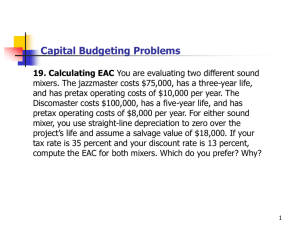

Capital Budgeting In Practice 11 Corporate Financial Management 3e Emery Finnerty Stowe © Prentice Hall, 2004 Examples of Capital Budgeting Options Option to replace an asset. Option to change selling prices. Future investment opportunities. The abandonment option. The postponement option. Capital Budgeting Options A project’s NPV = Discounted Cash Flow NPV (DCF-NPV) + Value of Options – Cost of Options While it is difficult to place a value on all capital budgeting options, they should not be ignored. The Price-Setting Option Suregrip Leather Co. (SLC) currently manufactures and sells 8 million leather belts per year, and is operating at capacity. Demand is expected to increase for at least the next five years. SLC could invest $6 million now in additional manufacturing facilities. The NPV of this expansion is $850,000. SureGrip (cont’d) Alternative, the current price of a belt ($2.10) could be increased. The demand curve has been estimated to be: D=$82 million / (Price)3 (given by consultant) Variable cost per unit is $1.20, the cost of capital is 15% and the current tax rate is 40%. The Price-Setting Option The two alternatives faced by the SureGrip Leather Co. (SLC) are: 1. Expand capacity, NPV = $850,000. 2. Increase unit wholesale price. SLC should choose the alternative that has the highest positive NPV. The Price-Setting Option The maximum unit price which the market will support can be obtained by setting the quantity demanded equal to current capacity in the demand equation and then solving for the market-clearing price. $82million Q Demanded 8,000,000 units 3 Price So Price $2.17 The Price-Setting Option This new price of $2.17 is $0.07 higher than the current wholesale price. By selling 8 million units per year, SLC’s revenues will increase by (8 million)($0.07) or $560,000 per year for 5 years, without any additional investment! The after-tax revenues will increase by $560,000×(1 – 0.40) or $336,000 per year for 5 years. NPV of this (at 15%) is $1,126,324. The Price-Setting Option Adding additional production capacity has an NPV of $850,000 after an investment of $6 million today. Increasing the wholesale price has an NPV of $1,126,324 without any additional investment. SLC should go with the latter alternative. The Price-Setting Option Since SLC’s current price of $2.10 is below the maximum price the market will pay per unit and demand 8 million units, SLC has the option to increase its unit price. The expansion proposal increases the operating leverage of SLC. If demand declines in the future, the expansion would be costly to reverse. price could be cut back to stimulate demand. Future Investment Opportunities These are options to identify future, more valuable investment possibilities resulting from current opportunities. Manufacturing and distributing a new product now puts a marketing/distribution network in place for future use. Money spent on research and development of a new idea gives the option to develop the product later on. Not all future investment possibilities can be accurately measured in terms of their value. The Abandonment Option The abandonment option is the option to stop the project earlier than originally planned. The abandonment value of assets is enhanced by the presence of active usedequipment markets. Generic assets versus special purpose assets. The Abandonment Option Venda-A-Cart, Inc. is considering a new project that is expected to last for 4 years. The cost of capital is 15% and the project’s aftertax cash flows and abandonment values are given in the table on the next slide. Should Vend-A-Cart invest in this project? The Abandonment Option Year CFAT 0 1 2 3 4 ($40,000) $13,600 $13,600 $13,600 $13,600 Abandonment Value $40,000 $30,000 $15,000 $14,000 $1,500 Abandon in Year 4 –$40,000 $13,600 $13,600 $13,600 $13,600 +$1,500 t=0 t =1 t=2 t=3 t=4 $13,600 $13,600 $13,600 $15,100 NPV $40,000 2 3 4 (1.15) (1.15) (1.15) (1.15) NPV $314.66 Abandon in Year 3 –$40,000 $13,600 $13,600 $13,600 + $14,000 t=0 t =1 t=2 t=3 $13,600 $13,600 $27,600 NPV $40,000 2 (1.15) (1.15) (1.15) 3 NPV $257.09 t=4 Abandon in Year 2 –$40,000 $13,600 $13,600 + $15,000 t=0 t =1 t=2 $13,600 $28,600 NPV $40,000 (1.15) (1.15) 2 NPV $6,548.20 t=3 t=4 Abandon in Year 1 –$40,000 $13,600 + $30,000 t=0 t =1 t=2 $43,600 NPV $40,000 (1.15) NPV $40,000 $37,913.04 NPV $2,086.96 t=3 t=4 The Abandonment Option The NPV of the project, if kept for 4 years is ($315). If abandoned after 3 years, the NPV is $257. Thus, the value of the abandonment option is $257 - ($315) or $572. The Postponement Option Suppose that your firm owns a forest. If you were to open a logging camp, the start-up costs would be $50,000. The amount of lumber that could be logged would result in a $75,000 after-tax inflow at the end of one year. Then the project is over. The discount rate is 10% The forest is growing such that for each year we wait to start, the after-tax cash inflow grows by 5 percent per year. This growth will stop after 3 years. When should they start the project? The Postponement Option Evaluate three mutually exclusive projects: 1. Start the project today. 2. Start the project in one year. 3. Start the project in two years. Calculate the NPV at time zero for each one and pick the highest $75,000 NPV $50,000 1.10 Start t = 0 $18,181.82 Start t = 1 $50,000 $75,000 1.05 NPV 1.10 1.10 2 $19,628.10 wait Start t = 2 $50,000 $75,000 1.052 NPV 2 1.10 1.103 $20,802.03 Problems in Defining Incremental Cash Flows If two alternative manufacturing processes differ only in their levels of operating leverage, sales revenues are not affected by the choice of the process. This does not imply that sales revenues can be ignored in the analysis. The high-risk project’s total cash flows are riskier than the low-risk project’s: With lower sales, the project with the lower operating leverage will also have lower cost. Capital Rationing Capital rationing limits the firm’s capital expenditures during a given time period. Capital rationing can be imposed by: using a discount rate that is higher than the project’s cost of capital, or setting an explicit upper limit on the total dollar investment. The first method reflects managerial desire to be conservative: It understates the true NPV of the project. Capital Rationing In a perfect capital market, a firm can always obtain the necessary funds for a positive NPV project. In practice, obtaining necessary funds may be difficult due to: asymmetric information (about the true value of the project) between the investors and the firm. the adverse selection problem. transaction costs associated with raising funds. These costs reduce the NPV of the project. Hard versus Soft Capital Rationing With hard capital rationing, the limit on total capital spending is strictly enforced. With soft capital rationing, the firm sets a target limit on capital expenditures. Exceptions may be made if a particularly desirable project becomes available. Alternatively, the firm might under-spend if conditions warrant. Project Choice Under Capital Rationing The objective is to select the set of projects that maximize the total NPV of the capital budget, subject to the constraints on the invested capital. The Profitability Index (PI) can help in this process. PI measures the NPV per dollar invested. Project Choice Under Capital Rationing The Venda-A-Cart Co. has the following projects available. Total investment is limited to $3.4 million. Which projects should it select? Project Cost NPV A B C D E F $1,200,000 $900,000 $700,000 $600,000 $600,000 $300,000 $864,000 $360,000 $784,000 $570,000 $270,000 $60,000 Project Choice Under Capital Rationing Projects ranked by their Profitability Index Project C D A E B F Cost NPV PI $700,000 $600,000 $1,200,000 $600,000 $900,000 $300,000 $784,000 $570,000 $864,000 $270,000 $360,000 $60,000 2.12 1.95 1.72 1.45 1.40 1.20 Project Choice Under Capital Rationing If the firm chooses projects C, D, A, E, and F (in descending order of their PI values): the total investment is $3.4 million. the total NPV is $2,548,000. Suppose the firm chooses B instead of both E and F. The total investment is $3.4 million. The total NPV is $2,578,000. Managing the Firm’s Capital Budget Capital rationing can be used as a planning tool for capital expenditures. Managerial authority and responsibility: A divisional manager must have some leeway in approving capital projects. Managers from different functional areas must work cooperatively for the good of the firm. Managing the Firm’s Capital Budget Managerial Incentives and Performance Evaluation If managers are evaluated and rewarded for their performance, self-interested behavior leads to optimal performance for the good of the firm. Post-Audits A post-audit is a procedure for evaluating the performance of a capital budgeting decision after its implementation. Abandonment option. Advantage of hindsight. Applying the Principles of Finance Valuable New Ideas Pursuing valuable investment ideas is the best way to achieve extraordinary returns. New ideas are not limited to new products. Comparative Advantage Make use of current expertise. Market Efficiency There is useful information in a physical asset’s markettraded price. You should think long and hard before you conclude that a market price is “wrong.”