Slides

advertisement

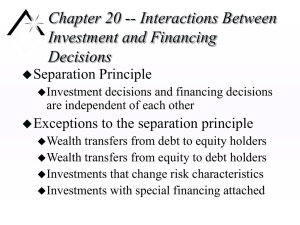

Plan for Today 1. 2. 3. 4. 5. 6. 7. Hand in case Administration & Questions Review of last class Case: Tartempion: The incremental approach Tax shields -- Capital Cost Allowance (CCA) Case: Fonderia Di Torino S.P.A. Conclusion and preparation for next week Review of Last Week • We study the long-term decisions of a financial manager: – How to use funds: • What projects to undertake to maximize firm value • How much dividends to pay – Where to get funds: equity and debt • Key concepts in financial decision making: – Time value of money – Risk and return • Use NPV to value investments: – Use cash flows, not accounting numbers – Focus on incremental cash flows Course in a Nutshell The Market The Firm Capital Structure Capital Budgeting Stockholders Dividends Equity Debt Bondholders Personal Taxes Cash flow Financial Manager Projects Investments Interest Corporate Taxes Government What we know now • Capital investments generate tax effects over time – Use PVCCATS formula to account for tax shields • Challenges in NPV analysis – Finding the relevant incremental cash flows • Include all effects of a project and compare with the status quo – Dealing with inflation • Match real CFs with real rates and nominal CFs with nominal rates – Comparing equipment with different lives • Use Equivalent Annual Cost or extend to same life • NPV analysis incorporates most of Buffet’s investment principals Next Week • • • Quiz – Start of class – Material from weeks 1 and 2 Readings: Chapters 9 and 11 Case: The Investment Detective – Read through only