Net Present Profiles and the TI-83 Calculator - it

advertisement

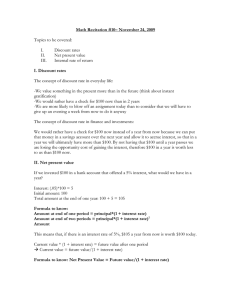

Net Present Profiles and the TI-83 Calculator Prepared by Pamela Parrish Peterson Consider the following mutually exclusive projects: End of period 0 1 2 3 4 1. Project X Project Y -$100,000 -$140,000 $40,000 $0 $40,000 $0 $40,000 $0 $40,000 $240,000 Creating a plot of the net present value profiles To plot the NPV Profile for these two projects, do the following: STAT 1:Edit ENTER Enter in the cash flows for periods 1 through 4 for each, with Project X in L1 and Project Y in L2: L1 L2 40000 0 40000 0 40000 0 40000 240000 --------- ----------Then Y= for Y1, enter in the NPV function: APPS 1:FINANCE ENTER 7 and then complete the arguments, hitting the key X,T,汈,n for X in the following: npv(X,-100000,L1) Hit ENTER to move on. The first line in the screen should look like this:1 \Y1=npv(X,-100000,L1) Then complete the same for Y2= 1 In the Y= screen, the Plot1 Plot2 Plot3 at the top of the screen should not be highlighted. If they are, use the cursor to go to the highlighted item and hit ENTER to toggle off the item. npv(X,-140000,L2) Then set up the X variable by depressing WINDOW. Xmin=0 Xmax=30 Xsc1=5 Ymin=-80000 Ymax=100000 Ysc1=20000 Xres=1 The Xmin and Xmax are the maximum discount rates that are using in the npv function. The Ymin and Ymax are the maximum and minimum of the Y variables (that is, the NPVs). The “sc1” are the grid lines and these can be set to zero for a cleaner graph. Depress GRAPH. The graph will show slowly. If you want different lines used for the two projects, in the Y= screen, use the cursor to go to the left of the “Y1=” or “Y1=2” and hit ENTER; the choices of plot lines will be shown. 2. Calculating the cross-over discount rate Using the lists L1 and L2 created for the profiles, calculate the difference in the lists: 2nd L1 – 2nd L2 STO 2nd ENTER L3 Checking the lists with STAT 1:Edit ENTER L3 L1 L2 40000 40000 0 40000 40000 0 40000 40000 0 -200000 40000 240000 --------- ----------Then calculate the internal rate of return of the differences. The initial cash flow in the first argument is the difference in the initial cash flows (that is, -$100,000 - -$140,000 = +$40,000). APPS 1: FINANCE ENTER 8 irr(40000,L3) The answer is 9.128%. This is the discount rate at which the NPV profiles of the two projects intersect. This is the point of indifference between the two projects.