chp.06 net present value and other investment criteria

advertisement

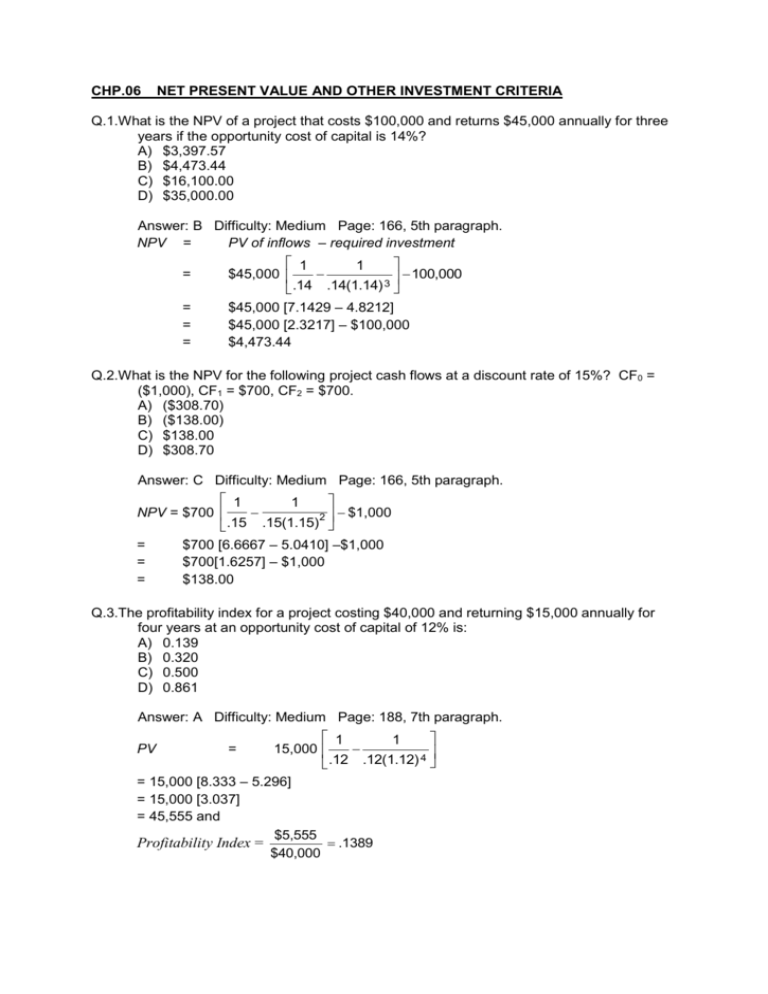

CHP.06 NET PRESENT VALUE AND OTHER INVESTMENT CRITERIA Q.1.What is the NPV of a project that costs $100,000 and returns $45,000 annually for three years if the opportunity cost of capital is 14%? A) $3,397.57 B) $4,473.44 C) $16,100.00 D) $35,000.00 Answer: B Difficulty: Medium Page: 166, 5th paragraph. NPV = PV of inflows – required investment 1 1 100,000 = $45,000 = = = $45,000 [7.1429 – 4.8212] $45,000 [2.3217] – $100,000 $4,473.44 .14 .14(1.14) 3 Q.2.What is the NPV for the following project cash flows at a discount rate of 15%? CF0 = ($1,000), CF1 = $700, CF2 = $700. A) ($308.70) B) ($138.00) C) $138.00 D) $308.70 Answer: C Difficulty: Medium Page: 166, 5th paragraph. 1 NPV = $700 1 2 .15 .15(1.15) = = = $1,000 $700 [6.6667 – 5.0410] –$1,000 $700[1.6257] – $1,000 $138.00 Q.3.The profitability index for a project costing $40,000 and returning $15,000 annually for four years at an opportunity cost of capital of 12% is: A) 0.139 B) 0.320 C) 0.500 D) 0.861 Answer: A Difficulty: Medium Page: 188, 7th paragraph. PV = 1 .12 .12(1.12) 4 15,000 = 15,000 [8.333 – 5.296] = 15,000 [3.037] = 45,555 and $5,555 .1389 Profitability Index = $40,000 1 Q.4.If a project's IRR is 13% and the project provides annual cash flows of $15,000 for four years, how much did the project cost? A) $44,617 B) $52,200 C) $60,000 D) $72,747 Answer: A Difficulty: Medium Page: 173, 3rd paragraph. PV = 15,000 1 1 4 .13 .13(1.13) = 15,000 [7.6923 – 4.7178] = 15,000 [2.9745] = 44,616.95 Q.5.ABC Corporation is experiencing hard capital rationing and will not be able to invest more than $1,000,000 this year. Develop a profitability index for the following four projects and state that would be selected: All four projects will last three years and the firm uses a 10% discount rate. Project A B C D Cost $300,000 $500,000 $125,000 $250,000 Annual Inflows $130,000 $220,000 $ 60,000 $100,000 Answer: Project Index A B C D Investment $300,000 500,000 135,000 250,000 PV @ 10% 323,291 547,107 149,211 248,685 Profitability 0.078 0.094 0.194 -0.005 Select projects C, B, and A for a total capital budget of $925,000. Project D does not meet the NPV criterion. Difficulty: Medium Pages: 188-189