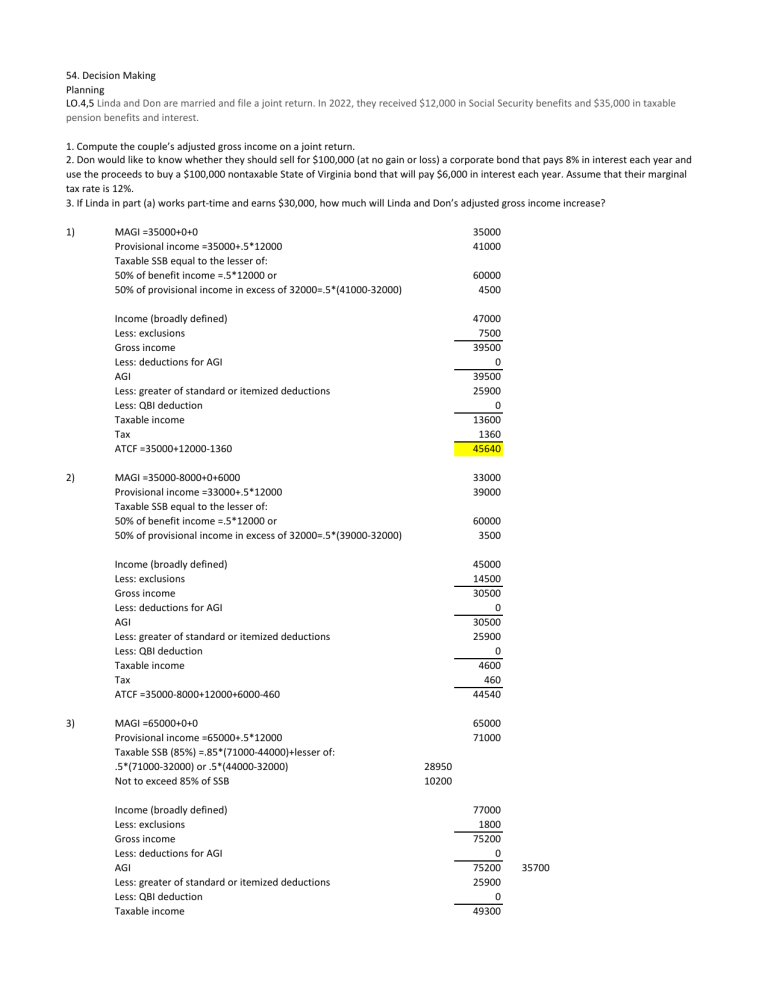

54. Decision Making Planning LO.4,5 Linda and Don are married and file a joint return. In 2022, they received $12,000 in Social Security benefits and $35,000 in taxable pension benefits and interest. 1. Compute the couple’s adjusted gross income on a joint return. 2. Don would like to know whether they should sell for $100,000 (at no gain or loss) a corporate bond that pays 8% in interest each year and use the proceeds to buy a $100,000 nontaxable State of Virginia bond that will pay $6,000 in interest each year. Assume that their marginal tax rate is 12%. 3. If Linda in part (a) works part-time and earns $30,000, how much will Linda and Don’s adjusted gross income increase? 1) 2) 3) MAGI =35000+0+0 Provisional income =35000+.5*12000 Taxable SSB equal to the lesser of: 50% of benefit income =.5*12000 or 50% of provisional income in excess of 32000=.5*(41000-32000) 35000 41000 Income (broadly defined) Less: exclusions Gross income Less: deductions for AGI AGI Less: greater of standard or itemized deductions Less: QBI deduction Taxable income Tax ATCF =35000+12000-1360 47000 7500 39500 0 39500 25900 0 13600 1360 45640 MAGI =35000-8000+0+6000 Provisional income =33000+.5*12000 Taxable SSB equal to the lesser of: 50% of benefit income =.5*12000 or 50% of provisional income in excess of 32000=.5*(39000-32000) 33000 39000 Income (broadly defined) Less: exclusions Gross income Less: deductions for AGI AGI Less: greater of standard or itemized deductions Less: QBI deduction Taxable income Tax ATCF =35000-8000+12000+6000-460 45000 14500 30500 0 30500 25900 0 4600 460 44540 MAGI =65000+0+0 Provisional income =65000+.5*12000 Taxable SSB (85%) =.85*(71000-44000)+lesser of: .5*(71000-32000) or .5*(44000-32000) Not to exceed 85% of SSB 65000 71000 Income (broadly defined) Less: exclusions Gross income Less: deductions for AGI AGI Less: greater of standard or itemized deductions Less: QBI deduction Taxable income 60000 4500 60000 3500 28950 10200 77000 1800 75200 0 75200 25900 0 49300 35700 Tax ATCF =65000+12000-5505 5505 71495 25855