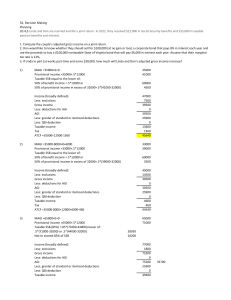

discuss1

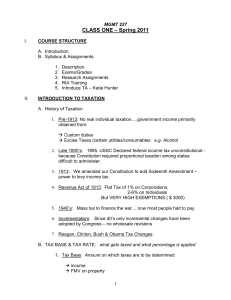

advertisement

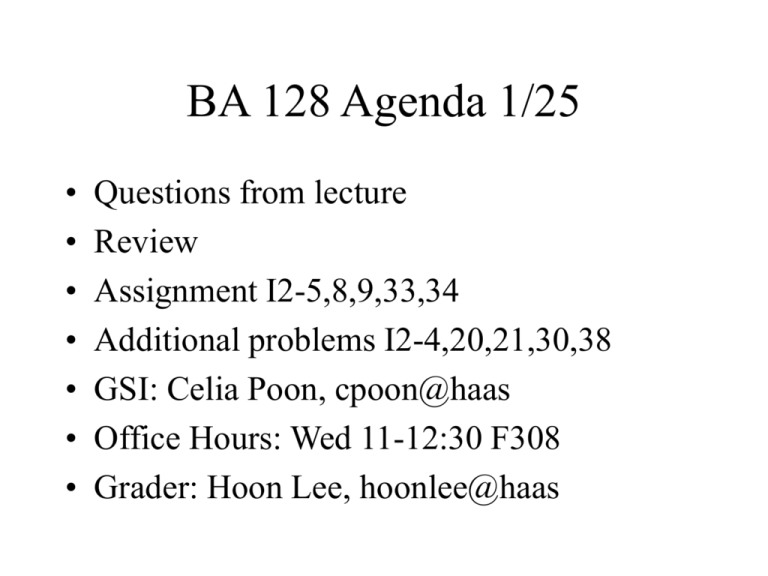

BA 128 Agenda 1/25 • • • • • • • Questions from lecture Review Assignment I2-5,8,9,33,34 Additional problems I2-4,20,21,30,38 GSI: Celia Poon, cpoon@haas Office Hours: Wed 11-12:30 F308 Grader: Hoon Lee, hoonlee@haas Purpose of Taxes • Government to collect revenues • Influence personal and business decisions for social and economic reasons • Fiscal policy to stimulate investment, reduce unemployment and inflation • Help small business and specialized industries Tax system and structure in the US • Pay as you go system • Tax law changes - incremental • Largest source of federal tax revenue – Individual, Social Security, Corporate income taxes • Tax Base = Taxable Income • Tax Rate = % rate applied to tax base Tax Rate Structure • • • • • • Progressive Regressive Proportional Average tax rate Effective tax rate Marginal tax rate Types of taxes • • • • • • State and franchise taxes Wealth transfer taxes (estate and gift taxes) Property Taxes Federal excise taxes/customs duties Sales Taxes Employment Taxes (social security taxes, cap at $68,400) Individual Tax Formula Income from whatever source derived - exclusions = Gross Income - deductions for AGI (business related and IRA deduction) = Adjusted Gross Income (AGI) - greater of standard deduction or itemized - personal exemption = Taxable Income * applicable tax rate (from tax table or tax rate schedule based on filing status) = Gross Tax - credits and prepayments = Net taxes payable/refund due Examples of Exclusions • • • • • Interest on municipal bonds Gifts and inheritances Foreign earned income Employee fringe benefits Exclusions besides interest on muni bonds are not reported in tax form • PI2-3 Deductions for AGI • • • • • IRA contributions Alimony Interest on educational loans Trade and business deductions PI2-5 Itemized Deductions • • • • • • Medical expenses (>7.5% of AGI) State, local and property taxes Mortgage interest Charitable contributions (limited) Casualty and theft losses (>10% of AGI) Misc deductions (>2% of AGI) -e.g. tax preparation fees Standard deduction • Depends on filing status - e.g. Single $4250 • Blind - legally blind (not = completely blind) • Dependents - S.D. limited to greater of earned income + $250 or $700 • Loss standard deduction if married file separately and the other spouse itemizes Personal Exemption • 1 exemption per person • A dependent cannot claim its personal exemption in his/her tax return • Dependency exemption – – – – – Gross income test (< exemption or exception) Support test Relationship test Cannot file a joint return US citizen/resident or Canadian/Mexican residents Phase out provisions • Threshold for personal exemption, lose 2% for each $2500 • Threshold for itemized deduction, lose 3% • Threshold for child care credit, reduce $50 for each $1000 (base on MAGI) Tax credits • Refundable – earned income credit – income withholding - prepayments • Nonrefundable – child income credit – low income housing credit – foreign tax credit Corporate Taxation • Different types of corporations • C-corp • S-corp (flow through entity, < 35 shareholders, file information return) Corporate Tax formula Income from whatever source derived - exclusions = Gross Income - deductions = Taxable Income * applicable tax rate = Gross Tax - credits and prepayments = Net taxes payable/refund due Capital gains and losses • Sale and exchange of capital asset • What is not a capital asset - inventory, trade receivables, business property • What is usually? Stocks and bonds • Capital gain tax - new rule 1998 • Long term and short term • Short term taxed at ordinary income amounts • Long term (taxed at 20% max) • Capital loss ($3000 deduction and the rest can carryforward) Tax planning • Shift income to family members • For corporations, establish entities to absorb gains • Doubling up - defer payment or pay sooner, cash basis vs. accrual basis Who must file a tax return • PI2-30, for single $6950 • Self employment must file if income >$400 • Dependents with unearned income >$700 must file • Filing date - before the 15th day of the fourth month after the close of tax year • Extension • Tax forms - 1040, 1040EZ, 1040A