Chapter 4 Vocab

advertisement

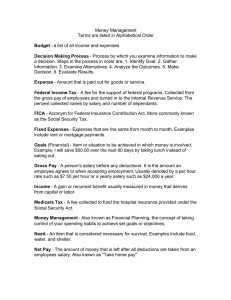

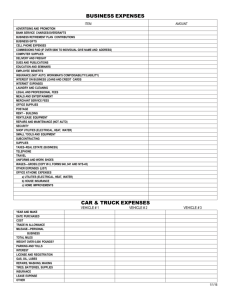

Chapter 4 Vocabulary and Notes 1. 3 % for 1st 1,000; 5% for 2nd 1,000; and 10% for anything over 2,000 Graduated Commission. 2. A deduction is another word for subtraction. 3. Amount of commission / sales = Rate of Commission. 4. An Agent is a person who legally acts for someone else. 5. FICA tax is a tax that includes Social Security (6.2%) and Medicare (1.45%). FICA tax is (7.65%). (Federal Insurance Contributions Act) 6. Fringe Benefits are any benefits beyond your regular pay such as car usage, vacation pay, etc. 7. Graduated Commission is earned by some salespersons. This is paid on a set rate of commission and increases as their sales increase. 8. Gross pay - Deductions = Net Pay. 9. Gross pay + Fringe Benefits = Total Job Benefits. 10. Gross pay is the total of all pay earned. 11. Job benefits are in addition to your wages other benefits like the use of company car, uniform, vacation, etc.. 12. Job expenses are various types of expenses in relation to your job (dues, gas, clothing, equipment, etc. 13. Percent means “per hundred.” 14. Net Proceeds is the amount of money received by the principal after subtracting the agent’s commission and expenses, if any. 15. Principal is someone who the agent legally acts to protect. 16. Quota is a fixed amount that needs to be sold in order to earn a commission. 17. Rate of Commission * Quantity sold = Commission. 18. A Decimal read as “and.” 19. Sale price – (commission + expenses) = Net Proceeds. 20. Straight Commission is when a salesperson only earns commission. 21. Take-home pay is the amount of pay you take home after all deductions. 22. Total job benefits – Job Expenses = Net Job Benefits. 23. Withholding Allowance is used to reduce the amount of tax withheld. 24. Withholding tax is a deductions held by the government.