The Arbitrage Principle in Financial Economics

advertisement

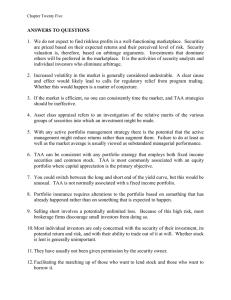

The Arbitrage Principle in Financial Economics The Author: Varian By Maia There are assets- Arrow-Debreu securities. They pay off 1$ only if and only if a particular state of nature occurs; otherwise they pay off zero. If a complete set of markets for all Arrow-Debreau securities exist, and the price of an asset ever deviated from the price of a portfolio of Arrow-Debreau securities, then there would be a way of making money- sell the security and buy the ArbeauDebreu portfolio, or vice-versa, depending on which was worth more. Any asset can be valued in terms of a particular set of assets in the case where the number of states matches the number of assets. A similar result holds even if there are fewer assets than states. Arbitrage- getting something for nothing, ”free lunch”. If no arbitrage exists, portfolios which are guaranteed to have profits, must have cost. Non-arbitrage condition implies that there must be a vector of nonnegative state prices. The existence of (pi) is a necessary condition for the absence of arbitrage. If no arbitragee exists, then there must be state prices, and if prices exist, then there must be no arbitrage opportunities. Value Additivity Theorem Theorem: Assume no arbitrage possibilities exist. Then the price of a security whose payoffs are a linear combination of other assets must be given by the same linear combination of the other assets. It is known that if two assets with correlation less than 1 are combined, then riskiness of the resulting portfolio will be smaller than the riskiness of assets held alone. Nevertheless , thevalue additivity theorem say that price of portfolio consisting of two assets will just be the sum of the prices of the individual two portfolios. How it can be? The answer is that equilibrium prices of assets must already reflect the value of any kind of linear portfolio manipulation. Repacking cannot exist in equilibrium. (If the value of two assets combination exceeded the value of two assets stated alone, then arbitrageurs could just sell the combination and buy assets separately.) Modigliani-Miller theorem states that the value of a firm is independent of its financial structure, that is independent of fraction of equity and assets. It is also based on on absence of arbitrage. If firms could change the proportion of stocks and bonds they issue, then individuals arbitrageurs could also repackage the existing stocks and bonds to make profit. Hence the value of the firm depends only on a total sum of the value of capital, not on fraction of debt or equity. However, the Modigliany-Miller illustrates also restrictions of Value Additivity theorem. 1) Value Additivity theorem and no arbitrage conditions can only apply to combinations of existing assets. If financial operations create a new pattern of payoff, then the theorems cannot apply. The vector of state prices will typically change. American and European call options must be worth the same amount. An American call option will never be exercised prior to maturity. An American call option has the same value as a European Call option. The portfolio of options exists than can generate the same pattern of wealth as a pure Arrow-Debreu security. A security whose value is a known function of another security value at some point in time is known as contingent security or derivative asset. In the case of binomial stochastic process we can calculate the state prices for any possible realization of stochastic processes at any date in the future using only knowledge of the current value of stock and bonds.