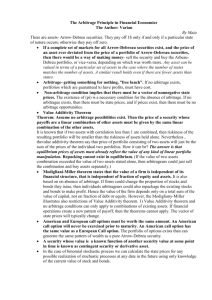

Chapter 7: Principles of Asset Valuation

advertisement

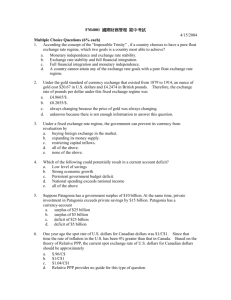

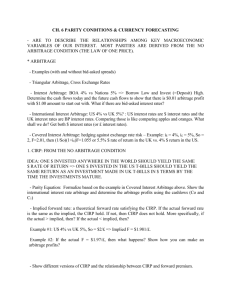

Finance School of Management Chapter 7: Principles of Asset Valuation Objective Explain the principles of asset evaluation 1 School of Management Finance Chapter 7 Contents The relationship between an asset’s value & price Value maximization & financial decisions Accounting measures of value How information is reflected in security prices The efficient markets hypothesis The law of one price & arbitrage Interest rates & the law of one price Exchange rates & triangular arbitrage Valuation using comparables Valuation Models 2 School of Management Finance The Role of Asset Valuation The process of estimating how much an asset is worth. At the heart of much of financial decision making: – – – – – – – Investing in securities Investing in real estate Wealth (value) maximization Venture capital Financing Mergers and acquisition (M&A) Others 3 Finance School of Management The Principle of Asset Valuation Arbitrage & Law of One Price: The prices of equivalent assets must be the same. Use information about one or more comparables whose market prices we know. Market price & fundamental value: The price of well-informed investors must pay for it in a free and competitive market. Value maximization and irrelevance of risk preference, consumption and expectations. 4 School of Management Finance Market Value & Book Value You buy a house for $100,000 on January 1, 19X0 and rent it out to make a profit. You finance the purchase with $20,000 of your own money (equity financing) and an $80,000 mortgage loan from a bank (debt financing). On January 2, someone makes you a bona fide offer of $150,000, which is the market value. ABC Realty Balance Sheet January 1, 19X0 Assets Land $25,000 Building 75,000 Liabilities Mortagage Loan 80,000 Owner’s Equity (Net Worth) 20,000 ABC Realty Market-Value Balance Sheet January 2, 19X0 Assets Land & Building $150,000 Liabilities Mortagage Loan 80,000 Owner’s Equity (Net Worth) 70,000 5 Finance School of Management Market Price & Fundamental Value — QRS Pharmaceuticals Corporation How is the stock market reacting to the information? – Announcements of good news: QRS’ research scientists have just discovered a drug that can cure the common cold. – Announcements of bad news: A judge has just ruled against QRS Pharmaceuticals in a lawsuit involving the payment of millions of dollars in compensation to customers who bought one of its products. 6 Finance School of Management Efficient Market Hypothesis (EMH) An asset’s current price fully reflects all publicly available information about future economic fundamentals affecting the asset’s value. 7 School of Management Finance How Does the Market Pool the Information Pieces — A typical analyst-investor’s decision making – Collecting the information or ‘facts’ – Determining the best estimate (expectation) P (1) r 1 P(0) – Determining the extent of dispersion around the estimate (risk) – Risk-return trade-off, budget limitation and investment decision or recommendation 8 Finance School of Management How Does the Market Pool the Information Pieces — Aggregation of all analysts’ estimates – Differing abilities to access and process the information – The total demand for shares of a company – The ‘votes’ cast with dollars: The market price of the stock will reflect the weighted average of analysts’ opinions with heavier weights on the opinions of those analysts with control of more than the average amount of money and with better than average amounts of information. 9 Finance School of Management How Does the Market Price Approach the Fundamental Value – The consequences of consistently overestimating the accuracy of one’s estimates – The enormous rewards to anyone who can consistently beat the average – The relative ease of entry into the analyst business Precisely because professional analysts compete with each other, the market price becomes a better and better estimate of “fair value”, and it becomes more difficult to find profit opportunities. 10 Finance School of Management Arbitrage: The Price of Gold The price of gold in New York City is $300 per ounce. Suppose that the price of gold in Los Angeles was only $250. It takes a day to ship the gold by air from Los Angels to New York. The transaction costs of buying gold in Los Angels and selling it in New York include the costs of shipping, handling, insuring, and broker fees, which account for $2 per ounce. 11 School of Management Finance Arbitrage: The Price of Gold If you can – Lock in the selling price of $300 at the same time that you buy the gold (by short selling). – Delay paying for the gold you purchase until you receive payments from selling it (by buying on margin). You will have engaged in a “pure”, riskless arbitrage transaction. Gold dealers, arbitrageurs will also discover the discrepancy and buy as large as possible in Los Angels. The force of arbitrage maintains a relatively narrow band around the price difference between the gold market in Los Angels and the one in New York. The lower the transaction costs, the narrower the band. 12 School of Management Finance Arbitrage: The Price of GM Shares Shares of GM are traded on both the New York Stock Exchange (NYSE) and on the London Stock Exchange. If shares of GM stock were selling for $54 a share on the NYSE at the same time they were selling for $56 on the London Stock Exchange, what would happy? The transaction costs in the market for financial assets are much lower than those for gold. The arbitrage opportunities can not persist for very long. 13 School of Management Finance Arbitrage: Interest Rates Competition in financial markets ensure that not only the prices of equivalent assets are the same but also interest rates on equivalent assets are the same. Interest rates on the U.S. treasure Bonds & World Bank dollar-denominated debt (both are free of default risk). Interest-rate arbitrage: borrowing at the lower rate and lending at the higher rate. The arbitrageurs’ attempts to expand their activity will bring about an equalization of interest rates. 14 School of Management Finance Arbitrage: Exchange Rates You walk into a bank and observe three exchange rates—$0.01/ ¥, ¥200/£, and $2.1/£. Arbitrage ensures that for any three What should you do? currencies that are – At the $/¥ window, convert $200 into freely convertible ¥20,000. in competitive – At the ¥/£ window, convert ¥20,000 into markets, it is £100. enough to know – At the $/£ window, convert £100 into the exchange rates $210. between any two Professional arbitrageurs can execute large in order to arbitrage transactions at “windows” on their determine the computer screens via an electronic hookup to third. other banks located almost anywhere in the world. 15 School of Management Finance Triangular Arbitrage ¥100/$ or $0.01/¥ USA Japan UK $2/£ or £0.5/$ £0.005/¥ or ¥200/£ 16 School of Management Finance Triangular Arbitrage More generally, RA/C = RA/B * RB/C RA/B = 1/RB/A 17 Finance School of Management Triangular Arbitrage More specifically, in the example R£/¥ = R£/$ * R$/¥ = 0.5 * 0.01 = 0.005 R¥/£ = 1/R£/¥ = 1/0.005 = 200 The other two pair follow the same form. 18 School of Management Finance Seemly Violation to the Law of One Price If seemly identical assets were selling at different prices, we would suspect – Something was interfering with the normal operation of the competitive market. – There was some (perhaps undetected) difference between the two assets. Illustrations: A dollar bill / four quarters – Doing your laundry using washer & dryer. – Paying for drinking at a beverage vending machine. 19 School of Management Finance Valuation Using Comparables No two distinct assets are identical in all aspects. Valuation: Finding comparable assets and making judgments about which differences have a bearing on their value to investors. Example: Valuing your parents’ house. Even when the force of arbitrage cannot be relied upon to enforce the Law of One Price, we still rely on its logic to value assets. 20 School of Management Finance Valuation Models The difficulties of finding equivalent assets Valuation models: The quantitative methods used to infer an asset’s value from information about the prices of other comparable assets and market interest rates. 21 Finance School of Management Example: Valuing Shares of Stock The Value of a Share of a Firm’s Stock = (its most recent) Earnings Per Share (EPS) * Price/Earnings Multiple (derived from comparable firms). XYZ’s earnings per share are $2, and comparable firms in the same line of business have an average price/earnings multiple of 10. Thus Estimated Value of a Share of XYZ Stock = XYZ’s EPS * Industrial Average P/E Multiple = $2*10 = $20 Further notes on ‘Comparable’: debt/equity ratios, growth opportunities… 22