PowerPoint Slides 6

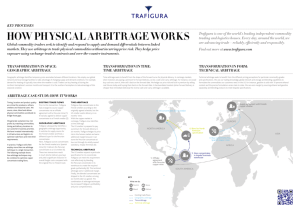

advertisement

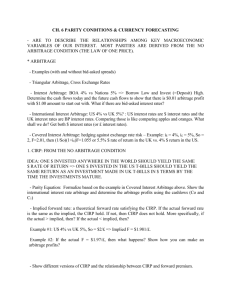

IBUS 302: International Finance Topic 6–Interest Rate Parity I Lawrence Schrenk, Instructor 1 (of 20) Learning Objectives 1. 2. 3. Define arbitrage.▪ Explain interest rate parity. Describe and calculate covered interest arbitrage.▪ 2 (of 20) Arbitrage 3 (of 20) Arbitrage Definition The practice of taking advantage of the price differential between two markets by buying and selling assets. Three Requirements 1. 2. 3. Positive Profit No Risk No Investment Note: (3) implies (2). 4 (of 20) Arbitrage Characteristics The Law of One Price Other Considerations Simultaneous Positions Long and Short Positions 5 (of 20) Self-Financing Strategies No Investment Strategy Short Positions Short Selling Borrowing How to Capture Arbitrage Long in Higher Priced Portfolio (lend) Short in Lower Priced Portfolio (borrow) 6 (of 20) A Simple Example Asset Cash Cash Cash Flow 1 Flow 2 Flow 3 Price A $10 $25 $15 $45 B $15 -$10 $10 $10 C $25 $15 $25 $50 7 (of 20) Arbitrage versus Equilibrium What happens when investors take advantage of arbitrage? ▪ What should happen to the prices in the example? Of Asset A and B? Of Asset C? Arbitrage is ‘Self-Eliminating’–Equilibrium is restored. ▪ 8 (of 20) Non Arbitrage Pricing If markets are efficient and in equilibrium… This can either There is no arbitrage. Set a limit on prices, or Determine prices exactly. Applications Determining FX Rates Pricing Derivative Securities 9 (of 20) Notation We need to distinguish: The simple no arbitrage example: Real (empirical or market) data, and Values predicted by a theory The actual price of asset C is $50.00 The predicted, no arbitrage value is $55.00 Subscripts will distinguish theoretical values: P = $50.00 PNA = $55.00 (NA for no arbitrage) 10 (of 20) Interest Rate Parity (IRP) 11 (of 20) Spot and Forward Rates What is the relationship between spot and forward rates? Could… S($/£) = 1.7700, and F6($/£) = 1.7720 ▪ Would this allow arbitrage? Depends! ▪ 12 (of 20) FX Rates and Interest Rates Any spot rate can exist with any forward rate, but… There will be arbitrage if the risk free rates of interest are not correct. 13 (of 20) Interest Rate Parity A ‘parity’ relationship holds if arbitrage is not possible. Interest rate parity (IRP) is a relationship between The domestic risk free rate The foreign risk free rate The spot rate The forward rate 14 (of 20) Two Strategies/Same Investment Dollar Strategy... 1. Make a risk free investment with dollars. Non-Dollar Strategy simultaneously... 1. 2. 3. Convert dollars into pounds. Make a risk free investment with the pounds. Sell the proceeds from (2) forward for dollars Same investment In both strategies, you... Begin with dollars Make only risk free investments End with dollars 15 (of 20) Example 1: An Arbitrage Opportunity Data S(£/$) = 0.6000 F12(£/$) = 0.5800 (→ F12($/£) = 1.7241) i£ = 9% i$ = 10% i = annual, risk free rate of interest 16 (of 20) Example 1: An Arbitrage Opportunity Dollar Strategy 1 $1.10 Non-Dollar Strategy ≠ $1.13 ▪ £0.6540 F12($/£) = 1.7241 i$ = 10% i£ = 9% $1.00 ▪ S(£/$) = 0.6000 $1.00 £0.6000 17 (of 20) Example 2: No Arbitrage Data S(£/$) = 0.6000 F12(£/$) = 0.5945 (→ F12($/£) = 1.6821) i£ = 9% i$ = 10% i = annual, risk free rate of interest 18 (of 20) Example 2: No Arbitrage Strategy 1 $1.10 Strategy 2 = $1.10 ▪ £0.6540 F12 ($/£) = 1.6821 i$ = 10% i£ = 9% $1.00 ▪ S(£/$) = 0.6000 $1.00 £0.6000 19 (of 20) Interest Rate Parity (IRP) If both strategies yield the same amount, then there is no arbitrage. Note: buying/selling forward required to eliminate FX risk! For this to occur, the following relationship must hold: 1 i$ FIRP $/x S $/x 1 i x Both in American Terms▪ This is the interest rate parity (IRP) requirement. FIRP is the forward rate predicted by IRP. ▪ 20 (of 20) Example 2 (cont’d) So for our second example, the interest rate parity condition 1 i$ 1 1 i$ FIRP $/£ S $/£ 1 i £ S £/$ 1 i £ Holds because the actual value 1 1.10 F $/£ 1.6820 0.6000 1.09 Note: Small rounding error 1.6820 ≠ 1.6821 21 (of 20)