Name Review sheets for Investing test What is the difference in

advertisement

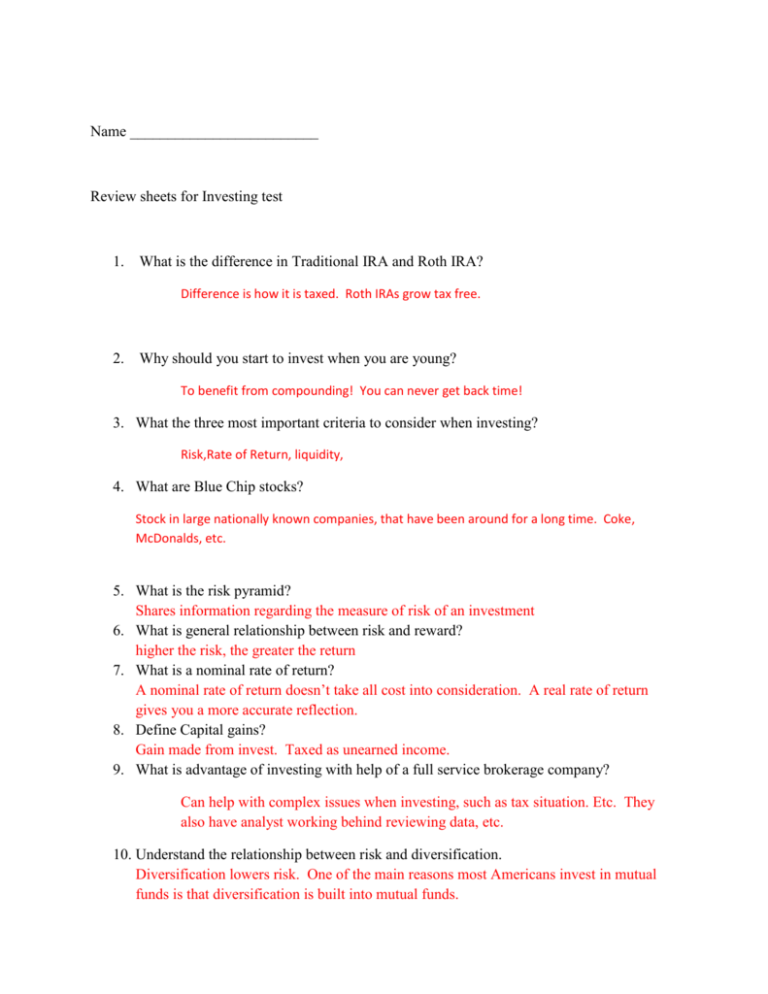

Name _________________________ Review sheets for Investing test 1. What is the difference in Traditional IRA and Roth IRA? Difference is how it is taxed. Roth IRAs grow tax free. 2. Why should you start to invest when you are young? To benefit from compounding! You can never get back time! 3. What the three most important criteria to consider when investing? Risk,Rate of Return, liquidity, 4. What are Blue Chip stocks? Stock in large nationally known companies, that have been around for a long time. Coke, McDonalds, etc. 5. What is the risk pyramid? Shares information regarding the measure of risk of an investment 6. What is general relationship between risk and reward? higher the risk, the greater the return 7. What is a nominal rate of return? A nominal rate of return doesn’t take all cost into consideration. A real rate of return gives you a more accurate reflection. 8. Define Capital gains? Gain made from invest. Taxed as unearned income. 9. What is advantage of investing with help of a full service brokerage company? Can help with complex issues when investing, such as tax situation. Etc. They also have analyst working behind reviewing data, etc. 10. Understand the relationship between risk and diversification. Diversification lowers risk. One of the main reasons most Americans invest in mutual funds is that diversification is built into mutual funds. 11. Explain purpose of 529, 401(k) and 403(b). 529-saving for higher education 401(k)-offered by private companies as a way to save for retirement, (typically have a match) 403(b)-way for individuals working for non-profit organizations to save for retirement – typically doesn’t have a match 12. Define stock: Share of ownership in a company. 13. What is inflation risk? What is market risk? Inflation risk – the risk that an investment won’t keep up with inflation Market risk- not guarantee that you will make money 14. Explain bear market. Bear market – doesn’t have consumers’ confidence and investors tend not invest 15. Explain bull market. Bull market – has consumers’ confidence and consumers tend to invest in this type of market 16. What is compound interest? Compound interest – is when your previous earned interest can earn interest 17. What is Principal? Principal – original amount of money invested 18. How are the prices for stock and bond determined? Supply and demand 19. What is the difference in corporate and government/municipal bond? Tax situation 20. Liquidity is most difficult for which type of investment? Real estate 21. Understand how to read a stock table? (Example: what is 52 week high and low provides what type of information?) Refer to your notes 22. Why the average investor does invest in mutual funds? Diversification is built into this type of investing 23. What are market indicators? Dow, S&P 500, Nasdaq 24. What is an IPO and who can purchase at the IPO? Initial public offering – investment bankers - we purchase off the secondary market 25. What are round and odd stock purchases? Number of stocks purchase – round lot means in lots of 100 – example 200, 300, etc. odd lot is 102, 103, 104, 201, etc. 26. What is rollover mean in the investment world? The average American changes employee 7 times in their lifetime – a rollover allows them to move investments by following the outlined rules and avoid tax consequences.