Review Module 24. Review PowerPoint on Module 24. There were

advertisement

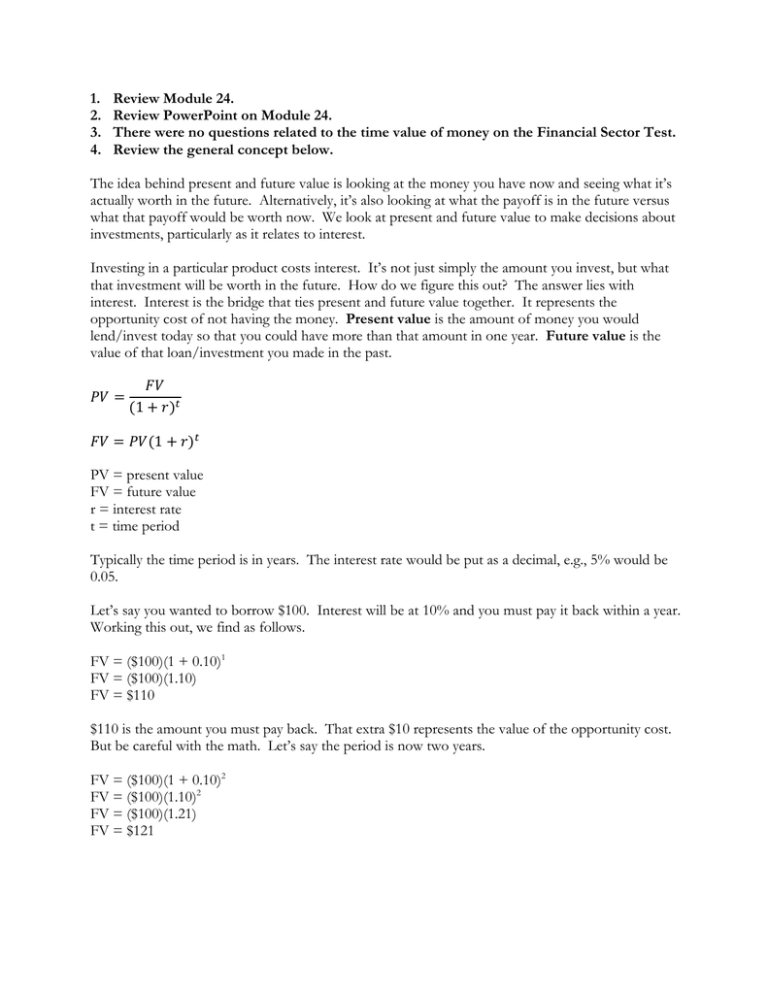

1. 2. 3. 4. Review Module 24. Review PowerPoint on Module 24. There were no questions related to the time value of money on the Financial Sector Test. Review the general concept below. The idea behind present and future value is looking at the money you have now and seeing what it’s actually worth in the future. Alternatively, it’s also looking at what the payoff is in the future versus what that payoff would be worth now. We look at present and future value to make decisions about investments, particularly as it relates to interest. Investing in a particular product costs interest. It’s not just simply the amount you invest, but what that investment will be worth in the future. How do we figure this out? The answer lies with interest. Interest is the bridge that ties present and future value together. It represents the opportunity cost of not having the money. Present value is the amount of money you would lend/invest today so that you could have more than that amount in one year. Future value is the value of that loan/investment you made in the past. 𝑃𝑉 = 𝐹𝑉 (1 + 𝑟)𝑡 𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑡 PV = present value FV = future value r = interest rate t = time period Typically the time period is in years. The interest rate would be put as a decimal, e.g., 5% would be 0.05. Let’s say you wanted to borrow $100. Interest will be at 10% and you must pay it back within a year. Working this out, we find as follows. FV = ($100)(1 + 0.10)1 FV = ($100)(1.10) FV = $110 $110 is the amount you must pay back. That extra $10 represents the value of the opportunity cost. But be careful with the math. Let’s say the period is now two years. FV = ($100)(1 + 0.10)2 FV = ($100)(1.10)2 FV = ($100)(1.21) FV = $121 We should look at interest another way also, as a matter of real life. When considering an interest rate for a loan, we look at the real interest rate. In other words, we take into account inflation when we look at interest rates. That being said, on the AP exam, when you see problems dealing with future and present value, the prompt will likely include something along the lines of “assuming zero inflation.” It’s a mathematical assumption designed to simplify the math. Take a look at the problems provided as examples in the PowerPoint. 5. Practice Problems a. Review Multiple Choice on p. 242. b. Review FRQ 1 and 2 on p. 242. c. Review the following problems. You may use a calculator. 1. For figuring out the basic terms of interest rates for the PV and FV formulas, complete the following table. For example, at 3% over 1 year, this would be (1 + 0.03)1, which would be 1.03. 2% 5% 10% 1 year 2 years 3 years 2. Joseph’s mother promises to give him $10,000 if he completes his Bachelor’s degree in 3 years. The current interest rate is 5%. Assuming no inflation, how much does Joseph’s mother have to invest to earn $10,000? Round to the nearest hundredth. a. $8,324.70 b. $9,776.81 c. $7,250.53 d. $8,620.69 e. $8,944.05 3. Eisa has been given a chance to invest $10,000 now to receive a guaranteed $20,000 in two years. The current interest rate is 10%. Assuming no inflation, what is the present value of Eisa’s guaranteed investment reward? a. $15,397.00 b. $16,024.34 c. $16,528.93 d. $17,837.66 e. $15,988.46 4. Eisa has been given a chance to invest $10,000 now to receive a guaranteed $20,000 in two years. The current interest rate is 10%. Assuming no inflation, what is the future value of Eisa’s initial investment? a. $12,988.07 b. $12,100.00 c. $13,166.24 d. $11,902.38 e. $11,503.34 5. Given your answers in numbers 3 and 4, should Eisa take this deal, yes or no? 6. What if the interest rate was lower, say at 5%? Doing no calculations, do you think Eisa should take this deal? Answer Key 1. The table is as follows: 2% 5% 10% 1 year 1.02 1.05 1.10 2 years 1.04 1.10 1.21 3 years 1.06 1.16 1.33 2. Answer: D. We’re figuring out present value. We know that the $10,000 is the reward at the end of 3 years. $10,000 is the future value, 3 years is the term, and we know 5% is the interest. PV = FV/(1 + r)t PV = $10,000/(1 + 0.05)3 PV = $10,000/1.16 PV = $8,620.69 3. Answer: C. We’re figuring out present value, with $20,000 as the reward at the end of 2 years, at 10% interest. PV = FV/(1 + r)t PV = $20,000/(1 + 0.10)2 PV = $20,000/1.21 PV = $16,528.93 4. Answer: B. We’re figuring out future value, with $10,000 as the reward at the end of 2 years, at 10% interest. FV = PV(1 + r)t FV = $10,000(1 + 0.10)2 FV = $10,000(1.21) FV = $12,100.00 5. Answer: Yes. To get the $20,000, Eisa would have to invest $16,528.93. If he were to decline the investment and say put it an interest bearing account, he would get only $12,100.00. Since $16,528.93 is greater than $12,100.00, Eisa’s getting a hell of a deal. 6. Answer: Probably not. Generally, the interest rate is what matters. The higher the interest rate, the greater return on investment. The lower the interest rate, the lesser return on investment.