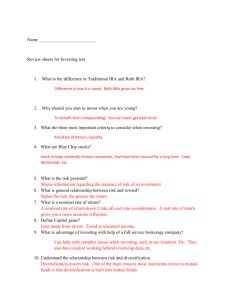

Financial Goals and the Investment Process

advertisement

BM410: Investments Personal Investing I Objectives A. Understand the ten principles of successful investing B. Understand the Investment Hourglass C. Understand the Importance of Your Investment Policy Statement A. Understand the 10 Principles of Successful Investing Is there one right way to invest? • No. There are multiple ways and multiple methods depending on your personal goals and budget • The key is for you to know yourself and what you are trying to accomplish Is there one right way to teach investing? • No. But while there are many different ways, the principles should be the same. 3 Principles for Successful Investing (continued) Elder Dallin H. Oaks commented: We live in a complex society, where even the simplest principle can be exquisitely difficult to apply. I admire investors who are determined not to obtain income or investment profits from transactions that add to the sum total of sin and misery in the world. But they will have difficulty finding investments that meet this high standard. Such complexities make it difficult to prescribe firm rules. We must rely on teaching correct principles, which each member should personally apply to govern his or her own circumstances. (Dallin H. Oaks, “Brother’s Keeper,” Ensign, Nov. 1986, 20 ) 4 Principles for Successful Investing (continued) Whatever you invest in, and at whatever phase of your investment you are in, these principles are critical. • While there may be discussion as to the number of principles, the importance of the principles are not disputed! • If you build your portfolio in line with these principles, you will have a successful portfolio 5 Principles for Successful Investing (continued) 1. Know yourself • Know your goals • Have well-written and thought-out goals • Know your budget • Live within your means, and save and invest • Know your ability to tolerate risk • Know what kind of investor you are • Invest accordingly • Develop a sleep-well portfolio – based on principles you can depend on for a lifetime so that you can “sleep6well” at night Principles for Successful Investing (continued) Watch overconfidence • Men trade 45% more than women • Their annualized returns were 2.7% less • Single men trade 67% more than single women • Their annualized returns were 1.4% less Watch on-line trading • Before on-line, investors beat the market by 1.9% • Afterwards, they underperformed by 3.6% Carla Fried, “The Problem with your Investment Approach,” Business 2.0, November 2003, p. 146 7 Principles for Successful Investing (continued) 2. Understand Risk • Risk is inherent in all investing activities • There are lots of different types of risk • Inflation, business, interest rate, financial, market, political and regulatory, exchange rate, call, and liquidity risk • Invest at a risk level you are comfortable with • Find that risk level • Taking a risk tolerance test may help. Take TT16 – A Risk Tolerance Test to get a sense on how much risk you can tolerate 8 Principles for Successful Investing (continued) 3. Stay diversified • Always invest in different asset classes and assets • Diversification is your key defense against risk • Make sure you understand the risks of each and every asset class you invest in • It’s a risky place out there. Be prepared! • Remember that the numbers you see for specific asset class performance are from diversified portfolios, not single assets! • Use TT23 – Return Simulation Worksheet to see the effects of diversification 9 Principles for Successful Investing (continued) 4. Invest low cost and tax-efficiently • Watch all your costs very carefully: taxes, transaction costs, management fees, etc. • A $1 saved is more than a $1 earned because: • You must pay taxes on every new dollar earned • The dollar saved can earn income and income on income (compound interest) • Realize that frequent trading incurs significant costs, both in terms of taxes and transaction costs 10 Source: Jason Karceski, Miles Livingston, Edward O’Neal, “Mutual Fund Brokerage Commissions, January 2004, p. 12. 11 Source: Jason Karceski, Miles Livingston, Edward O’Neal, “Mutual Fund Brokerage Commissions, January 2004, p. 12. 12 Source: Jason Karceski, Miles Livingston, Edward O’Neal, “Mutual Fund Brokerage Commissions, January 2004, p. 12. Principles for Successful Investing (continued) Defer or eliminate taxes as much as possible • Remember, mutual funds distribute 90% of all capital gains and dividends each year that you must pay taxes on • Invest tax-efficiently so you don’t have to pay more taxes each April • It’s not what you make, but what you keep after taxes and inflation that makes you wealthy 13 Principles for Successful Investing (continued) 5. Invest long-term • Avoid short-term trading • Its expensive and generates transactions costs and taxes • Invest wisely • There are no get-rich-quick schemes that work. • Stay at least partly in the market • Taking money out of the market or not continuing to save and invest stops your progress 14 Trading Costs and Returns 15 Principles for Successful Investing (continued) 6. If you invest in individual assets, know what you invest in and who you invest with • When investing in individual assets, do your homework • Know what you are investing in • Be aware of the environment in which the company operates • Be very careful and invest wisely 16 Principles for Successful Investing (continued) 7. Monitor portfolio performance • President Thomas S. Monson stated: "Where performance is measured, performance improves. Where performance is measured and reported, the rate of improvement accelerates." • How can you know how you are doing if you don’t check your performance against some standard? • Set portfolio benchmarks and then monitor performance monthly 17 Principles for Successful Investing (continued) 8. Don’t waste too much time and energy trying to beat the market unless you have the time and energy • It is very difficult, expensive, and time consuming to try and beat the market • If you want to trade, trade tax-efficiently and in tax-deferred accounts • If your actively managed funds underperform, look to index funds as inexpensive, tax efficient and very viable alternatives to actively managed funds 18 Principles for Successful Investing (continued) 9. Invest only with high quality, licensed, and reputable people and institutions • When help is needed, don’t be afraid to get help. • But get good help from good licensed people consistent with the principles discussed • Use the best resources available • Know how those resources are compensated • Work only with licensed and registered advisors • Get references for any resources 19 Principles for Successful Investing (continued) 10. Develop a good investment plan consistent with your goals, budget, and these principles, and follow it closely • Think it through and write it wisely • It’s your roadmap to success • If you write it wisely and invest accordingly, it will save you much heartache in the future • And you will likely achieve your personal goals 20 Questions: Do you understand the ten principles of successful investing and why they are important? 21 B. Understand the Investment Hourglass What should you do before you start investing? • Is there a priority to paying bills? • Who/which bills should we pay first? • Are there certain things you should never do without? • What about health and life insurance? • Are their other bills more important than investing? • What about high-interest items such as credit cards and consumer loans? • Is there a purpose to investing? 22 • What are your personal goals? Before You Invest: The Hourglass Top 1. Have your priorities in order and are “square” with the Lord 2. Have adequate life and health insurance 3. Be out of credit card and consumer debt 4. Know your personal goals, budget, and have an investment plan 23 If you can answer these affirmatively, you are ready to invest! Before you Invest (continued) What does the top of the hourglass do? • It helps you keep your priorities in order And what should those priorities be? • God • Family • Personal responsibility • Your goals, budget, and a well-written Investment Plan 24 The Hourglass (continued) What does the hourglass top do? • It helps keep your priorities in order And what should those priorities be? • God • Family • Personal responsibility 25 The Investment Hourglass (continued) Retirement Assets Taxable Assets 4. Opportunistic: Individual Stocks and Sector Funds 3. Diversify: Broaden and Deepen your Asset Classes 2. Core: Broad Market Exposure: Core Mutual Funds 1. Basics: Emergency Fund and Food Storage 26 The Investment Hourglass (continued) The hourglass bottom teaches 3 important lessons: • 1. It helps keep risk in perspective • It starts from lowest risk to highest risk • 2. It teaches the “how to” about investing? • You invest first in lower-risk assets, and then move up to more risk as your assets increase • 3. It separates out taxable and retirement assets • Retirement and taxable assets should be managed differently 27 Question Do you know what you should do before you invest? 28 C. Understand the Importance of your Investment Policy Statement What is the most important document you will prepare in regards to your investing activities? • Your Investment Plan (also called an Investment Policy Statement) Why is it so important? • Your Investment Plan sets the framework on every investing activity. It states: • What you will invest in, how you will invest, why you will invest, what percentages you will invest, etc. 29 Your Investment Plan What will it help you do? • It is a detailed description of all the key areas of your investment framework. It will help you: 1. Represent yourself, your risk tolerance, and your personal constraints 2. Articulate what you will and will not invest in, how you will invest, and any investment guidelines to help you invest wisely 3. Keep you from making rash or poor investment choices which could have a major impact on future financial goals and retirement 30 Your Investment Plan (continued) I. Risk and Return Objectives A. What are your expectations for returns? • Your return expectations will drive your asset allocation decisions. A return of: • 4-6%: a diversified, low-risk portfolio • 7-8%: a diversified, moderate-risk portfolio • 9-10%: a diversified, high-risk portfolio • 11+%: an undiversified, very high-risk portfolio heavily involved in high-risk assets • Look to the long-term history of your asset classes as rough estimates of future performance (see TT 23 31 Historical Return Simulation) Your Investment Plan (continued) B. What are your expectations for risk? • What is your risk tolerance? • Where you are in the life cycle will have an impact on how much risk you can take • Balance your risk and return requirements • Where are you in the life-cycle process? • Younger: may be willing to take more risk • Older: may be willing to bear less risk • Are you a conservative, a moderate, or an aggressive investor? • This should show in your asset allocation. 32 Your Investment Plan (continued) How do you define risk? • Instead of stating “an annual standard deviation of 18%,” stating your risk in terms of your chosen benchmark risk may be easier. For example, I am willing to accept the risk of a portfolio that is: • 50% US stocks, as measured by the S&P 500 Index • 20% international stocks, as measured by MSCI EAFE Index • 25% bonds, as measured by the Lehman Aggregate Index, and • 5% real estate, as measure 33 by the S&P REIT Index Your Investment Plan (continued) II. Investment Guidelines and Constraints A. What are Your Investment Guidelines? What are the different phases in your life in regards to investing? • e.g., Accumulation, Growth, Capital Preservation, Income Generation, etc. • Your Investment Guidelines are the general road map on how you will be investing your assets over your life cycle • It integrates your personal goals and your financial goals into a complete financial perspective 34 Your Investment Plan (continued) B. What are your Investment Constraints? • Liquidity • The speed and ease with which an asset can be converted into cash • How much money will you need and when? • Examples: Graduate school, vacation • Investment Horizon • When will you sell the investment? • How soon will you need money? • Example: Down payment on a house in 3 years? 35 Your Investment Plan (continued) • Tax Considerations • What is your tax position, your marginal tax rate? • Are tax-free investments more advantageous than taxable? • Example: Government bonds versus corporate bonds • Unique Needs • What are your special needs? • Do you have diversification requirements related to employment? • Do you have special family needs? • Examples: Employee Stock Ownership Plans 36 Your Investment Plan (continued) III. Investment Policy • What will you and will you not invest in, how will those investments will be evaluated, how will the assets be invested, how will your portfolio will be funded, and any guidelines for new investments • a. Acceptable and Unacceptable Asset Classes • b. Investment Benchmarks • c. Asset Allocation • d. Investment Strategy • e. Funding Strategy • f. New Investment Strategy 37 Your Investment Plan (continued) a. Acceptable/Unacceptable Asset Classes • Which asset classes will you invest in? • Invest where you have a favorable risk-return tradeoff, i.e., mutual funds and stocks (large cap, small cap, mid cap, value, growth, mixed, international, emerging market, regional); bonds (short-term, long-term, government); and money market (CDs, commercial paper, government paper, etc.) • Which assets will you not invest in? • Do not invest where you do not have a favorable risk-return tradeoff,38 i.e., foreign currencies, commodities, precious metals, art, etc. Your Investment Plan (continued) b. Investment Benchmarks • How will you know if you are doing well? • Unless you have an investment benchmark (or standard by which to judge your performance), you cannot know how you are doing • Pick appropriate benchmarks for each asset class, i.e., the S&P500 for equities, Lehman Aggregate for bonds, etc. • Measure your performance regularly (e.g., monthly, quarterly, or annually) • Measure it on an after-fees after-taxes basis! 39 Your Investment Plan (continued) c. Asset Allocation • How much will you invest in each asset class? • Percentages should include your minimum, maximum and target • The first decision is between bonds and stocks • A good starting point is to invest your age as your percentage in bonds • The logic is the older you are, the less willing you are to accept risk • Next, you can add other asset classes (broaden), or separate the stocks or bonds components into 40 deeper asset classes (deepen) Your Investment Plan (continued) Set up a minimum, maximum and target allocation • Minimum: the minimum invested in an asset class • Maximum: the maximum invested in an asset class • Target: Your ideal allocation based on current conditions Min Target Max Younger Higher risk assets/equities 50% 75% 95% Lower safe assets/bonds 0% 25% 50% Older Lower risk assets/equities 20% 40% 60% Higher safe assets/bonds 50% 60% 80% Plan for your entire life, which will necessitate 41 different allocations based on different periods Your Investment Plan (continued) Major Asset Classes Fixed Income: Low Risk • Cash • Money Market • Government Bonds • Short, medium, and long-term • Corporate Bonds • Short, medium, and long-term, international • Junk Bonds High Risk 42 Equities: • • • • • • Large Capitalization Mid Capitalization Small Capitalization International Emerging Markets Hedge Funds Real Estate • REITs (Real Estate Investment Trusts) Currencies Commodities Your Investment Plan (continued) d. Investment Strategy • How will you invest your assets, i.e., via what strategy? • Active management, passive or both? • Active management: • Trying to beat market returns by the active buying and selling of funds/stocks • Passive management: • Accepting average returns rather than trying to beat the market—much cheaper and more tax efficient • Combination 43 • A combination of active in tax-deferred Your Investment Plan (continued) Will you invest in mutual funds or individual assets? • Individual stocks and bonds: • The individual development of portfolios which give the opportunity to selectively choose which assets to include in the portfolio. It is more time consuming and expensive, with the potential for greater risk and volatility • Mutual Funds/Exchange Traded Funds: • Professionally managed portfolios of similar instruments which offer the benefits of economies of scale and diversification • Mix: 44 • Combinations of funds and individual stocks Your Investment Plan (continued) Will you use leverage (i.e. debt) to invest? • President Joseph F. Smith stated: • If there is any one here intending to go into debt for speculation, … I would advise him to hesitate, pray over it, and carefully consider it before he obligates himself by borrowing money and going into debt. In other words, keep out of debt if you can. Pay your debts as soon as you can. (Conference Report, Oct. 1911, 128–29.) 45 Your Investment Plan (continued) • Will you buy on margin? • Buying on margin—borrowing to invest: • There is a stock you are positive will go up. You put down $10,000 of your own money and borrow $10,000 from your friendly broker (it is borrowing!) • If the stock goes up, you make a profit due to leverage. • If the stock goes down, you may be forced to continue to put more money with the broker until you close out your position. • Key risks: you can lose much much more than your original investment—don’t take the chance!! 46 Your Investment Plan (continued) Will you borrow to invest, i.e. short-sell? • Short-selling—borrowing shares to invest • There is a stock you are positive will go down. You borrow 100 shares from your broker, and sell those shares (you are borrowing!) • If the stock goes down, you make a profit due to selling the shares at a higher price, and replacing them later at a lower price. • If the stock goes up, you may be forced to continue to put more money with the broker until you close out your position. • Key risks: You can lose 47 much much more than your original investment. Don’t risk it!!!!!!!!!!!! Your Investment Plan (continued) e. Funding Strategy • How will you fund your investments? • Set up different portfolios for each goal, i.e., 401K, Roth IRA: retirement and missions; 529 Funds/Custodial: kids education and missions; Investment account: house down-payment fund • Recommendations: • Pay the Lord first (10% tithing plus other offerings), and pay yourself second (10% minimum) • Balance that 10% among your goals, i.e., 5% to 401K match, 1% to a 529/Custodial 48 account, and 4% to investment fund Your Investment Plan (continued) f. New Investment Strategy • What about new investments? • Decide the maximum percentage you will invest in any new investment, i.e., not more than 10% of my assets • Too many times people have made bad investments by putting all of their assets with one “sure thing” and have lost it all. • Decide the maximum you are willing to invest (or lose) with a single investment • Also decide the maximum percentage of your company’s stock you 49 will have in your 401k/retirement account, i.e., no more than 10%. Your Investment Plan (continued) IV. Monitor your Portfolio, Reevaluate and Rebalance as Necessary • Monitor your performance • Compare your performance to your benchmarks. • How did you do? How versus benchmarks? • Re-evaluate • Re-evaluate your goals and performance over 23 year periods. • Rebalance • Rebalance back to your asset allocation targets through inflows of new money and taxminimizing selling50 Your Investment Plan (continued) Thoughts on performance and monitoring • Develop a good asset allocation plan and stick to it • Beware of last year’s best performers—winners rotate. Do not chase them • Remember the tax consequences of selling • Re-evaluate your investments as necessary • Rebalance annually or less often 51 Investment Plan Note Because of the importance of this Plan, I have created an example with TT05 - Investment Plan Example (or Investment Policy Statement) • Please feel free to copy this plan, and then change it to represent your personal views on risk and return, constraints, investment policy, etc. • Starting from a copy will help to make sure you have all the important sections of the Plan • While this plan contains the areas I deem important, you can add any additional areas to your plan 52 Questions Do you understand the investment process and how to write your investment plan (i.e., your investment policy statement)? 53 Review of Objectives A. Do you Understand the ten principles of successful investing? B. Do you Understand the Investment Hourglass? C. Do you Understand the Importance of Your Investment Policy Statement/ 54