Presentation

advertisement

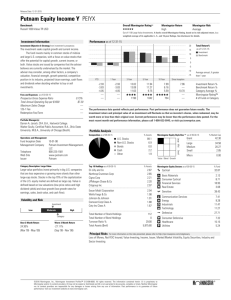

Morningstar Direct 3.1

Enhancements to:

•Navigation and Usability

•Functionality

•Data

Released on Friday, Feb. 2, 2007

Morningstar Direct Team

Navigation and Usability

Fund Analysis, Equity Analysis are the New Menu

Choices

As Noted in Nov. 2006 Press Release, Given the New

Focus on Collective Investment Trusts, the Databases

were Re-named

Previously called

just “Separate

Accounts”

Previously called

“Composites”

Previously called

“Commingled

Funds”

Morningstar Enhancing Coverage of Collective

Investment Trusts

CHICAGO, Nov. 29, 2006—Morningstar, Inc. (NASDAQ: MORN) today announced

plans to enhance its coverage of collective investment trusts, investment vehicles

similar to mutual funds available only in qualified retirement plans, such as 401(k)

plans.

Beginning in early 2007, Morningstar will collect net returns, in addition to gross

returns, for these pooled investment vehicles, and will provide monthly rankings and

Morningstar Ratings™ against a peer group of mutual funds. Morningstar currently

compares collective investment trusts to separately managed accounts, using gross

returns to provide a quarterly rating. Under this new framework, investors and

advisors will be able to more accurately compare collective investment trusts to

mutual fund offerings in retirement plans and will have access to timelier, more

transparent information.

“Because these investments are direct competitors with mutual funds in retirement

plans, however, we think it’s more appropriate to give them more prominence and put

them on a level playing field with mutual funds,” said John Rekenthaler, vice president

of research for Morningstar.

“Going forward, investors will be able to directly compare the star ratings of a

collective investment trust with those of a mutual fund. We hope not only to provide a

more timely, meaningful point of comparison for investors, but also to set a higher

reporting standard within the collective investment trust space.”With its recent

acquisition of the database division of InvestorForce, Morningstar now has data on

approximately 650 collective investment trusts. In addition to both gross- and net-offee performance data, Morningstar collects other data points such as risk and return

Regional Training Information Available in “Learning

Center”

Users Can Now Set Their Preferences for Summary

Statistics

With “Move To”, Users Can Now Easily Move their Rows

of Investment Vehicles in Their Investment Lists

Select rows to move, choose “Move To” under “Action”

Change Settings for Multiple Custom Calculations at

Once

Simultaneously Change Date Range for Sharpe and

Treynor Ratios, for Example, as Shown in Previous

Screen

New Functionality

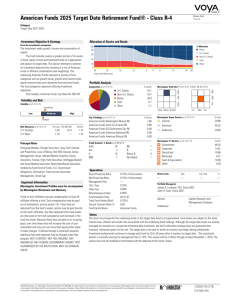

Portfolio Aggregation Report – How to Generate

Portfolio Aggregation Report – The Result

Not equal-weighted, weighted as per the Aggregate weighting

More than one page of analysis,

including detailed common holdings

Peer Investor Holding Analysis, from “View Holdings”

An institutional

investor, such as

Madison Mosaic in

this case, may want

to see what its peers

– maybe its

competitors – own

in terms of stocks,

bonds, options, etc.

The comparison of

what investments

are similar or

different against a

peer or group of

peers begins here.

Peer Investor Holding Analysis from “Ownership-Portfolio”

database

You can

insert up to

15

investment

vehicles

into the

peer

analysis

Peer Security Owner Analysis from “OwnershipSecurity” Universe

You want to

find out who

owns a stock

and other

similar types of

stocks. The

analysis begins

here.

Peer Security Owner Analysis Output – see if, in this

case, Prominent Japanese Stocks are Owned by the

same Mutual Fund

Now Able to Display “Multiple” Manager Teams

And same functionality for multiple “countries available for sale,” “custodian,” “distributor,” and

other data points. The multiple data points are included in Excel downloads.

Active Share Calculation Added to Holdings Similarity

Chart

The holdings similarity chart

can be adjusted to overlap or

similarity scores as well in

“Chart Settings.”

Active Share Calculation

To calculate Active Share, just calculate the Overlap with the index of choice

and subtract from 1.

Overlap = Sum{min(w1i,w2i)}

Where

w1i = weight of stock i on portfolio 1

w2i = weight of stock i on portfolio 2

For example:

Stock

A

Port 1

0.10

Port 2

0.05

Min

0.05

B

0.03

0.20

0.03

C

0.30

0.20

0.20

D

0.25

0.10

0.10

E

0.12

0.00

0.00

F

0.20

0.35

0.20

G

0.00

0.10

0.00

Total

1.00

1.00

0.58

Overlap = 58%

Active Share = 100% - 58% = 42%

Some Background on Active Share Calculation –

Announced Last Year

•Competitive

positioning

•Screening for manager

value-add

•Fund of funds

screening for good

active managers

Find more information on “Active Shares” at:

•http://mba.yale.edu/news_events/CMS/Articles/5727.shtml

•http://www.som.yale.edu/Faculty/petajisto/active54.pdf

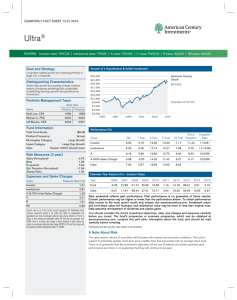

Hedge Fund Quicktake PDF Added

Hedge Fund Quicktake PDF – The Result

Hedge Fund Summary PDF – Contact Information Added

Insurance Product Funds - Quicktake and QT PDF

Enabled

Data Added

A complete list of new data points in Morningstar Direct 3.1 is also

available

Multiple New Data Points Added to Hedge Funds, in this

case, How the Fund is Regulated or Overseen (Altvest data

brought into Direct from InvestorForce)

Hedge Funds – New Data Points Include Entire Pull-Down of

“Hedging Techniques” – What they Hedge and How (Altvest data

brought into Direct from InvestorForce)

More Information on the Investor Type for a Collective

Investment Trust

“Traditional” data brought into Direct from InvestorForce

New Data Points Added to U.S. OE MF

Detailed Holdings Data Added to “View Holdings” and

Now Available for Many Closed End Mutual Funds and

ETFs as well

Net Returns (in addition to Gross Returns) for Separate

Accounts and Collective Investment Trusts

See when Analyst Reports have been Updated or Most

Recently Written for U.S. Stocks, OE and CE Mutual

Funds, and ETFs

By clicking on

the date, you

get the

Quicktake.

Look under

“Analysis”

Fund-of-Funds Indicator

New Closed End Fund Data points

•UNII: Undistributed Net Investment Income

•EPS

•UNII/EPS Date

Data from central Morningstar database to populate these fields this month (February 2007)