Goldman Sachs Growth Opportunities Fund - Institutional Shares

Release Date

12-31-11

....................................................................................................................................................................................................................................................................................................................................................

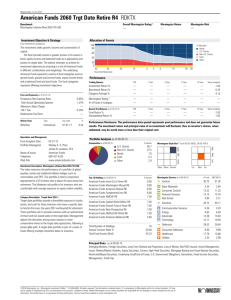

Category

Mid-Cap Growth

Investment Strategy from investment's prospectus

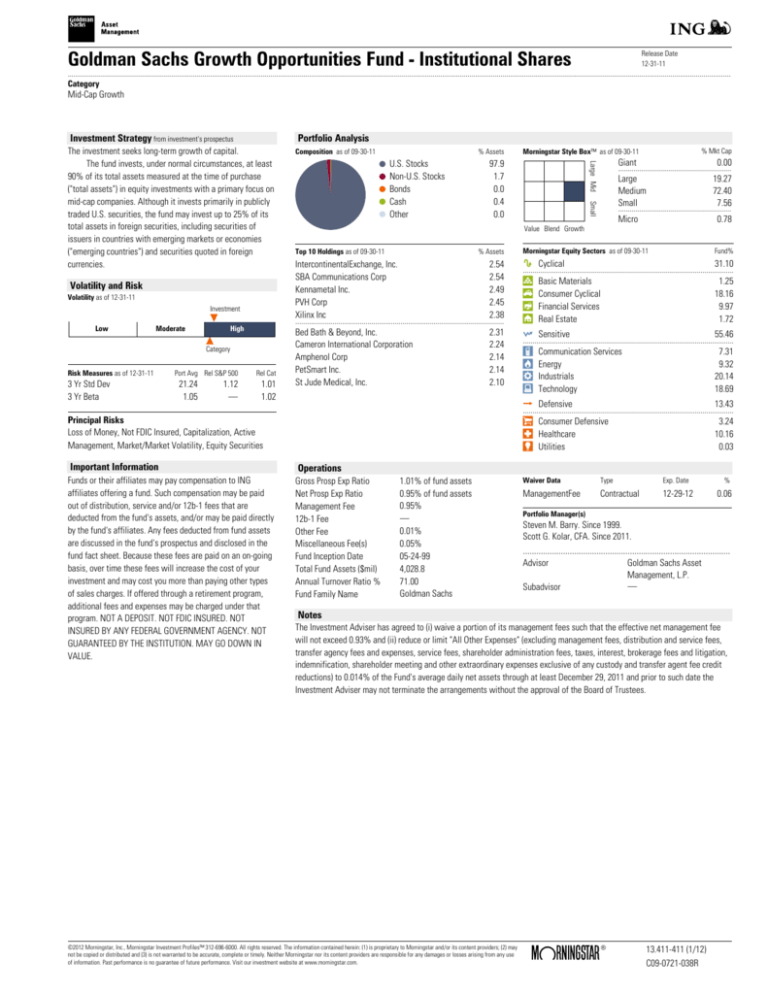

Portfolio Analysis

Investment

Low

Moderate

3 Yr Std Dev

3 Yr Beta

Port Avg Rel S&P 500

21.24

1.05

1.12

.

Rel Cat

1.01

1.02

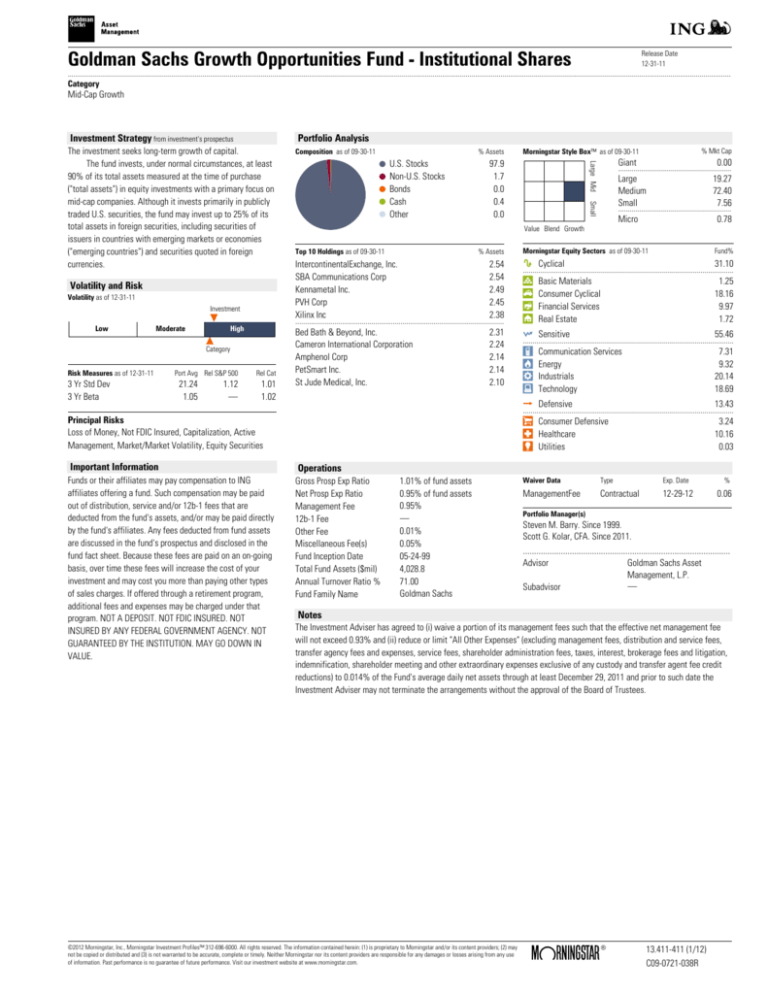

Morningstar Style Box™ as of 09-30-11

97.9

1.7

0.0

0.4

0.0

% Mkt Cap

Giant

0.00

..........................................................

Large

Medium

Small

19.27

72.40

7.56

..........................................................

Micro

Value Blend Growth

0.78

Morningstar Equity Sectors as of 09-30-11

Fund%

IntercontinentalExchange, Inc.

SBA Communications Corp

Kennametal Inc.

PVH Corp

Xilinx Inc

2.54

2.54

2.49

2.45

2.38

Cyclical

31.10

1.25

18.16

9.97

1.72

Bed Bath & Beyond, Inc.

Cameron International Corporation

Amphenol Corp

PetSmart Inc.

St Jude Medical, Inc.

2.31

2.24

2.14

2.14

2.10

Sensitive

55.46

7.31

9.32

20.14

18.69

Top 10 Holdings as of 09-30-11

% Assets

...........................................................................................................

High

Category

Risk Measures as of 12-31-11

U.S. Stocks

Non-U.S. Stocks

Bonds

Cash

Other

Small

Volatility and Risk

Volatility as of 12-31-11

% Assets

Composition as of 09-30-11

Large Mid

The investment seeks long-term growth of capital.

The fund invests, under normal circumstances, at least

90% of its total assets measured at the time of purchase

("total assets") in equity investments with a primary focus on

mid-cap companies. Although it invests primarily in publicly

traded U.S. securities, the fund may invest up to 25% of its

total assets in foreign securities, including securities of

issuers in countries with emerging markets or economies

("emerging countries") and securities quoted in foreign

currencies.

............................................................................................................

Basic Materials

Consumer Cyclical

Financial Services

Real Estate

............................................................................................................

Communication Services

Energy

Industrials

Technology

Defensive

13.43

Consumer Defensive

Healthcare

Utilities

3.24

10.16

0.03

............................................................................................................

Principal Risks

Loss of Money, Not FDIC Insured, Capitalization, Active

Management, Market/Market Volatility, Equity Securities

Important Information

Operations

Funds or their affiliates may pay compensation to ING

affiliates offering a fund. Such compensation may be paid

out of distribution, service and/or 12b-1 fees that are

deducted from the fund's assets, and/or may be paid directly

by the fund's affiliates. Any fees deducted from fund assets

are discussed in the fund's prospectus and disclosed in the

fund fact sheet. Because these fees are paid on an on-going

basis, over time these fees will increase the cost of your

investment and may cost you more than paying other types

of sales charges. If offered through a retirement program,

additional fees and expenses may be charged under that

program. NOT A DEPOSIT. NOT FDIC INSURED. NOT

INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT

GUARANTEED BY THE INSTITUTION. MAY GO DOWN IN

VALUE.

Gross Prosp Exp Ratio

Net Prosp Exp Ratio

Management Fee

12b-1 Fee

Other Fee

Miscellaneous Fee(s)

Fund Inception Date

Total Fund Assets ($mil)

Annual Turnover Ratio %

Fund Family Name

1.01% of fund assets

0.95% of fund assets

0.95%

.

0.01%

0.05%

05-24-99

4,028.8

71.00

Goldman Sachs

Waiver Data

Type

Exp. Date

ManagementFee

Contractual

12-29-12

%

0.06

Portfolio Manager(s)

Steven M. Barry. Since 1999.

Scott G. Kolar, CFA. Since 2011.

.............................................................................................

Advisor

Subadvisor

Goldman Sachs Asset

Management, L.P.

.

Notes

The Investment Adviser has agreed to (i) waive a portion of its management fees such that the effective net management fee

will not exceed 0.93% and (ii) reduce or limit "All Other Expenses" (excluding management fees, distribution and service fees,

transfer agency fees and expenses, service fees, shareholder administration fees, taxes, interest, brokerage fees and litigation,

indemnification, shareholder meeting and other extraordinary expenses exclusive of any custody and transfer agent fee credit

reductions) to 0.014% of the Fund's average daily net assets through at least December 29, 2011 and prior to such date the

Investment Adviser may not terminate the arrangements without the approval of the Board of Trustees.

©2012 Morningstar, Inc., Morningstar Investment Profiles™ 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may

not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use

of information. Past performance is no guarantee of future performance. Visit our investment website at www.morningstar.com.

13.411-411 (1/12)

C09-0721-038R